4 new Industry 4.0 companies set to hit the public markets

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (September 28, 2021)

Discover and track all of the SPACs at spactrack.net.

Today, there were 7 SPAC mergers approved resulting in a suite of Industry 4.0 companies hitting the public markets, including:

1 quantum computing company (IonQ)

2 3-D manufacturing companies (Velo3D, Shapeways)

1 FoodTech/ crop genetics company (Benson Hill)

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals:

1) TradeUP Global Corporation (TUGC: warrants +22.02%) & SAITECH

Merger Partner Description:

SAITECH is a Eurasia-based energy saving mining operator that engages in the hosting of bitcoin mining machines for its clients. SAITECH uses a proprietary liquid cooling and heat exchange technology towards mining machines that enables utilization of waste heat to provide recycled energy heating for potential customers while achieving lower mining operating costs. The Company strives to become the most cost-efficient digital assets mining operation company globally while simultaneously promoting the clean transition of the bitcoin mining industry. Accordingly, SAITECH believes it is categorized as energy saving amongst other bitcoin hosting operators based on its focus on recovering and applying waste energy in its operations. SAITECH also plans to commence bitcoin mining by the end of 2021.

Valuation: $228M equity value

PIPE: No PIPE

No Investor Presentation filed

News:

Four Bloomberg pieces centered on the Gores Guggenheim (GGPI) / Polestar deal within a day of the announcement featured headlines noting Leonardo DiCaprio’s involvement. Leo is an investor in many companies with energy-transition-related missions.

Below is a snippet from one of the aforementioned pieces with a take that we noted some time ago that could become a more significant source of supply for SPAC mergers: corporate carve-outs.

DiCaprio's Soon-to-Be Meme Stock Fits Better With Another Actor (Bloomberg—paywalled)

Leo pointing at the television, Leo raising a drink in his hand or Leo smugly laughing with a drink in his hand would all make for perfectly good memes to go along with Polestar. But I humbly suggest we go with actor Steve Buscemi’s “How do you do, fellow kids?” meme, oft-used to used to poke fun at people inauthentically pretending to be part of the young, hip and “in” crowd.

…

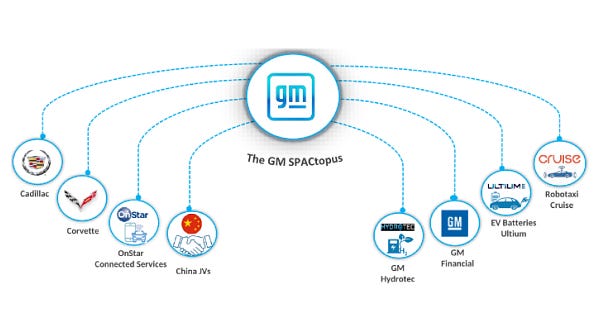

Recall that as far back as 2018, General Motors has kicked around the idea of spinning off its EV operations. When my colleague David Welch reported last year that GM was again pondering the provocative move, it sent shares soaring. An analyst at Deutsche Bank estimated doing this could make GM worth as much as $93 a share, more than triple where its stock was trading at the time. Morgan Stanley has memorably theorized that GM has a portfolio of hidden gems, including its EV battery operation, that ESG investors would be eager to fund as independent businesses. Analyst Adam Jonas has been referring to GM as a “SPACtopus” boasting eight attractive assets with high growth ahead.

So far, CEO Mary Barra’s moves to at least somewhat separate any one of those businesses so they’re able to attract outside investment has been limited to Cruise, the self-driving company GM acquired in 2016. While Cruise has yet to deploy a robotaxi service as planned, GM’s purchase has been a smash success — Cruise has been valued at more than $30 billion and raised over $9.25 billion from the likes of SoftBank, Honda, T. Rowe Price and Microsoft.

Volvo is executing something similar with Polestar. Just as Barra dispatched one of GM’s top executives, Dan Ammann, to be chief executive officer of Cruise, Polestar CEO Thomas Ingenlath is a former Volvo design chief. Cruise relies on a GM plant for its autonomous test vehicles; Polestar is sourcing its EVs from Geely and Volvo factories in China and the U.S.

Polestar’s selling point when it closes its SPAC deal and lists sometime in the first half of next year will be that, unlike current or one-time meme stocks like Lucid (LCID: $24.54 -5.21%), Lordstown Motors (RIDE: $7.19 -7.58%) or Nikola (NKLA: $10.98 -8.12%), it’s going public with actual product already bringing in revenue.

Mahindra Is Said to Weigh Electric Supercar Unit Funding Options (Bloomberg—paywalled)

Mahindra & Mahindra Ltd. is weighing options to raise funds for its Automobili Pininfarina unit as it seeks to bring a delayed $2.2 million electric hypercar into production, people with knowledge of the matter said.

The Indian carmaker’s considerations include a potential overseas listing of the EV supercar business, according to the people, who asked not to be identified because the information is private. A merger with a blank-check company is one scenario being studied for Automobili Pininfarina, the people said.

Mahindra could seek to value the unit at around $500 million in any deal, the people said. Mahindra is looking for ways to speed up development, as Automobili Pininfarina hasn’t yet begun deliveries of the 1,900-horsepower Battista it showed as a prototype in 2019.

Deliberations are at an early stage, and the structure of any potential deal hasn’t been finalized, the people said.

…

Automobili’s Battista, first unveiled at the Geneva auto show, uses battery and powertrain technology from Croatian electric-supercar maker Rimac Automobili. The unit originally planned to build 150 cars from 2020.

Mahindra set up the electric hypercar unit to cash in on the brand value of Pininfarina SpA, the iconic coach-builder famous for designing Ferrari NV’s sports cars. Mahindra took control of Pininfarina in 2015 with a plan for the company to make cars under the brand name for the Automobili unit. The design business wouldn’t be part of any transaction, the people said.

Deliveries of the Battista are now due to begin early in 2022, and production-ready Battista cars were running on road and track in North America and Europe, a spokesman for Automobili Pininfarina said. The company sold out all five of the limited-production Battista Anniversario edition vehicles it unveiled last year, and it’s very happy with its sales momentum, the spokesman said.

Merger Votes/ Completions:

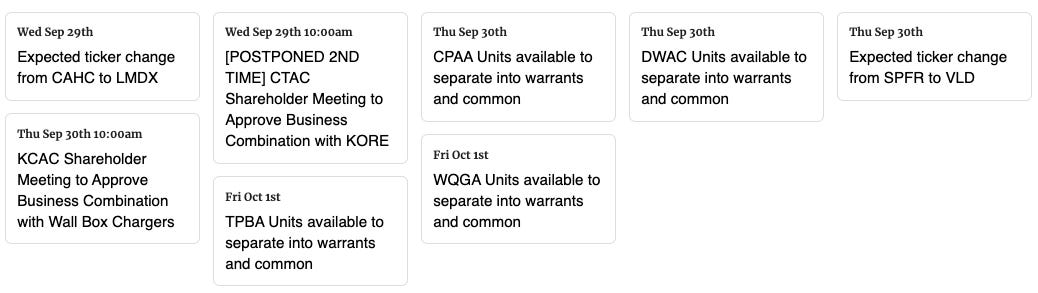

dMY Technology Group III (DMYI: $11.07 -7.29%) shareholders approved its merger with IonQ. Closing expected on 9/30.

IonQ set to receive $6340M in gross proceeds after appx. 2.5% redemptions

Jaws Spitfire Acquisition Corporation (SPFR) shareholders approved its merger with Velo3D

18.2M redemptions or an estimated ~53% of public shares, resulting in an aggregate of ~$295M in proceeds after transaction expenses

Min. cash condition of $350M was waived by Velo3D

Closing is expected on 9/29 with Ticker change to VLD expected on 9/30

PTK Acquisition (PTK) shareholders approved its merger with Valens Semiconductor

Estimated 74% redemptions

Galileo Acquisition Corp (GLEO: $10.64 +5.66%) shareholders approved its merger with Shapeways

Montes Archimedes Acquisition Corp. (MAAC) shareholders approved its merger with Roivant Sciences

Star Peak Corp II (STPC) shareholders approved its merger with Benson Hill

CA Healthcare Acquisition Corp. (CAHC) announced shareholder approval and the completion of its merger with LumiraDx

Ticker change to LMDX is set for tomorrow, 9/29

MoneyLion (ML: $8.09 -7.54%) / Fusion released redemption numbers

25.8M shares or an estimated 74% of the public shares were redeemed, resulting in ~$341M in gross proceeds to MoneyLion

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

Nexters (GDEV: $6.67 -6.97%)

AgileThought (AGIL: $11.66 -4.89%)

AEye (LIDR: $6.07 -20.24%)

OppFi (OPFI: $7.94 +0.00%)

S-1/As filed:

IronNet (IRNT: $26.36 +2.05%)

IPOs to Begin Trading Tomorrow*:

1) Hennessy Capital Investment Corp. VI Announces Pricing of $300,000,000 Initial Public Offering (HCVI-U)

*priced at the time of this writing

New S-1s (3):

1) ESGEN Acquisition Corp (ESAC)

$200M, 1/2 Warrant

Focus: Disruptive Decarbonization in North America

2) PepperLime Health Acquisition (PEPL)

$150M, 1/2 Warrant

Focus: Technology and consumer health and wellness

3) Pegasus Digital Mobility Acquisition Corp. (PGSS)

$200M, 1/2 Warrant

Focus: Next-generation transportation sector with exposure to energy transformation and digital mobility tailwinds

Management:

Ralf Speth (Former CEO of Jaguar Land Rover, Vice-Chairman of Jaguar Land Rover Automotive, and Director of Tata Sons)

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,