A De-SPAC Liquidation (Morning Update from SPAC Track)

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (June 13, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): DWAC -10.3%, KINZ -1.2%, CFVI -1.1%

Some De-SPAC Moves (10%+): RDBX +28.2%

ELMS -57.8%, ASTR -23.8%, DRTS, -15.6%, VLTA -14%, AVCT -12.8%, WEJO -12.7%, BKKT -11.1%, LTRY -11.5%, PEAR -10.8%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

1) Mudrick Capital Acquisition Corporation II (MUDS) & Blue Nile

Blue Nile, Inc. is the largest online retailer of high-quality, conflict-free, GIA graded diamonds and fine jewelry. The company offers a superior experience for purchasing engagement rings, wedding rings, and fine jewelry by providing expert guidance, in-depth educational materials, and unique online tools that place consumers in control of the jewelry shopping process. Blue Nile has some of the highest quality standards in the industry and offers thousands of independently graded diamonds and fine jewelry at prices significantly below traditional retail.

Valuation: $683M Pro-forma Enterprise Value

Additional Financing: $80M PIPE of which $52M “has been pre-funded”

News:

EV-Truck Startup Electric Last Mile Says It Plans to Liquidate (Bloomberg)

Electric Last Mile Solutions Inc. (ELMS) said it plans to liquidate through a Chapter 7 bankruptcy process, a decision that comes almost one year after the electric-vehicle startup went public and just four months after both its chief executive officer and chairman resigned.

The Troy, Michigan-based company said in a statement late Sunday that its board and interim CEO, Shauna McIntyre, decided to liquidate after a review of Electric Last Mile’s products and plans turned up no better option for stockholders, creditors and other interested parties.

Electric Last Mile’s stock plunged 55% in premarket trading Monday to 23 cents a share as of 7:11 a.m. in New York. It was down 93% so far this year as of the close of trading last week.

The filing will make Electric Last Mile the first of the EV startups that merged with special purpose acquisition companies to go out of business amid the recent market slump. On May 27, the company had warned it might run out of cash this month. Its shares have fallen 93% this year, closing last week at 51 cents.

Founders James Taylor and Jason Luo had planned to import electric delivery vans from China and assemble them at a former General Motors Hummer factory in Mishawaka, Indiana. Both men resigned in early February after Electric Last Mile accused them of making improper stock purchases just before the company announced the SPAC merger in December 2020. The company listed on the Nasdaq in late June 2021 in a SPAC transaction that netted it about $379 million.

Astra’s failed launch resulted in the loss of two NASA weather satellites (The Verge)

A rocket belonging to the up-and-coming Astra (ASTR) space company failed to deliver two of NASA’s weather-tracking satellites to space after its second stage engine shut down prematurely. Both satellites were lost as a result of the failure.

Astra’s Launch Vehicle 0010 (LV0010) successfully took off from Florida’s Cape Canaveral Space Force Station at 1:43PM ET, but suffered an upper stage failure about 10 minutes into its flight. The launch was part of NASA’s mission to send six TROPICS satellites into space — these small, foot-long CubeSats are supposed to help NASA keep better track of developing tropical storms. CubeSats are low-cost satellites frequently built by researchers at colleges and universities.

“The upper stage shut down early and we did not deliver the payloads to orbit,” Astra said in a statement on Twitter. “We have shared our regrets with @NASA and the payload team.” Thomas Zurbuchen, the associate administrator for NASA’s science division, acknowledged the unsuccessful launch in a thread on Twitter, but remained optimistic, noting it still “offered a great opportunity for new science and launch capabilities.”

Updates:

Merger vote set: Social Capital Suvretta Holdings Corp. III (DNAC) & ProKidney (7/6)

8i Acquisition 2 Corp. (LAX) and Euda Health amend the merger agreement to, among other things, reduce Euda’s pre-money equity valuation from $550M to $140M

PMV Consumer Acquisition Corp. (PMVC) announced that, as it has not yet filed a definitive proxy yet, it will not hold the meeting on the 6/14 date that was filed in the preliminary proxy. A date will be announced with the definitive proxy filing

Biotech Acquisition Company (BIOT) and Blade Therapeutics mutually agreed to terminate their merger

BAC intends to continue to pursue the consummation of a business combination with an appropriate target

Barclays resigned from advising EJF Acquisition Corp. (EJFA) & Pagaya ahead of their merger. The shareholder meeting to vote on the merger is scheduled for this Friday, 6/17

KINS Technology Group Inc. (KINZ) shareholders approved the deadline extension from 6/17 to 12/16

Digital World Acquisition Corp. (DWAC) received a document request and subpoena from the SEC seeking various documents and information regarding its merger with Trump Media & Technology Group

New SPACs (S-1s):

No new S-1s

Registration Withdrawals:

Freestone Acquisition Corp (FSTN)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

Prenetics Global (PRE)

S-4 Activity:

S-4/A:

Riverview Acquisition Corp. (RVAC) & Westrock Coffee Company (1st amendment)

AEA-Bridges Impact Corp. (IMPX) & LiveWire (3th amendment)

Founder SPAC (FOUN) & Rubicon Technologies (3th amendment)

Social Capital Suvretta Holdings Corp. I (DNAA) & Akili Interactive (3th amendment)

Avista Public Acquisition Corp. II (AHPA) & OmniAb (subsidiary of Ligand) (1st amendment)

CC Neuberger Principal Holdings II (PRPB) & Getty Images (3th amendment)

ITHAX Acquisition Corp. (ITHX) & Mondee (4th amendment)

Upcoming Dates:

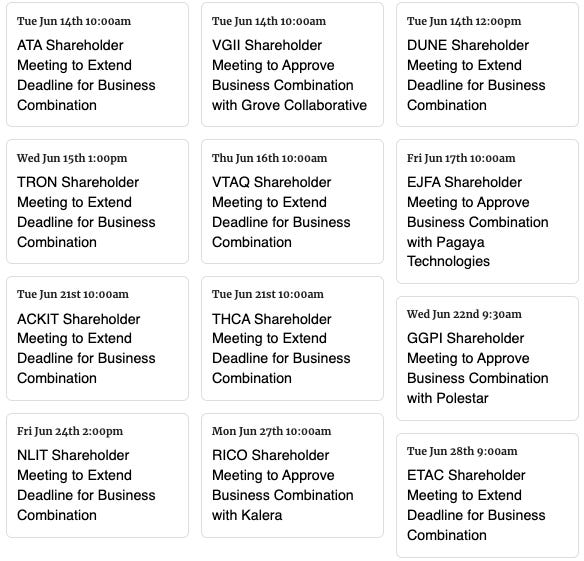

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,