A Rare Liquidation Appears.

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (November 19, 2021)

Discover and track all of the SPACs at spactrack.net.

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

None today.

Merger Votes/ Completions:

DD3 Acquisition Corp. II (DDMX) shareholders approve the merger with Codere Online. Set to close on 11/30 followed by ticker change to CDRO.

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

No activity

Quick News:

Yunhong International (ZGYH) will liquidate as opposed to extending. It will dissolve and return $10.31 per public share.

“On November 18, 2021, the Company’s sponsor notified the Company that it will not make additional contributions to the Company’s Trust Account. Accordingly, there will be no contribution of $0.10 per Public Share for the extension period commencing on November 18, 2021 or any subsequent extension period. Due to the Company’s inability to consummate an initial business combination within the time period required by its Memorandum and Articles of Association, it intends to dissolve and liquidate in accordance with the Memorandum and Articles of Association and will redeem all of its outstanding Class A ordinary shares that were included in the units issued in its initial public offering (the “Public Shares”), at a per-share redemption price of approximately $10.31.”

Pershing Square Tontine Holdings (PSTH) excerpt of Transcript of Pershing Square Capital’s Third Quarter 2021 Investor Call:

Bill Ackman: “…we are working hard to try to consummate a transaction for PSTH, and at the same time, we are working to get Pershing Square SPARC Holdings approved by the SEC, and to get the rule changed that the New York Stock Exchange has proposed that has been published in the Federal Register and that is up for approval or disapproval by the SEC on December 9, although the SEC can push that date out if they so choose. But our goal is to be in a position for this entity to be a registered company by hopefully at or around the end of the year.

We intend to make a public filing of the prospectus for PSTH, ideally by Wednesday of next week or the following Monday. Hopefully by Wednesday. That will provide a lot more details on the structure of Pershing Square SPARC Holdings, and we’ve made some progress in terms of the structure design to make it an even more appealing entity”

SoFi Technologies, Inc. (SOFI) Announces “Redemption Fair Market Value” in Connection With Redemption of its Outstanding Warrants

New S-1s (7):

1) APx Acquisition Corp. I (APXI)

$150M, 1/2 Warrant

Focus: Mexico, Spanish-speaking Latin America, and Hispanic businesses in the United States

2) Clean Earth Acquisitions Corp. (CLIN)

$200M, 1/2 Warrant

Focus: Clean and renewable energy industry

3) C5 Acquisition Corp (CXAC)

$250M, 1/2 Warrant

Focus: Space, Cybersecurity, Energy Transition

Management:

Rob Meyerson (Former President of Blue Origin)

4) Genesis Growth Tech Acquisition Corp. (GGAA)

$200M, 1/2 Warrant

Focus: Tech, Consumer Internet in Europe, Israel, the UAE, or the US

5) Globalink Investment Inc. (GLLI)

$100M, 1 Warrant, 1 Right (1/10th of a share)

Focus: E-commerce and payments (outside of China)

6) Healthcare AI Acquisition Corp. (HAIA)

$200M, 1/2 Warrant

Focus: Healthcare tech and pharmaceuticals

Management:

Robert Piconi (CEO & co-founder of Energy Vault)

7) Power & Digital Infrastructure Acquisition II Corp. (XPDB)

$250M, 1/2 Warrant

Focus: Electrical grid energy transition

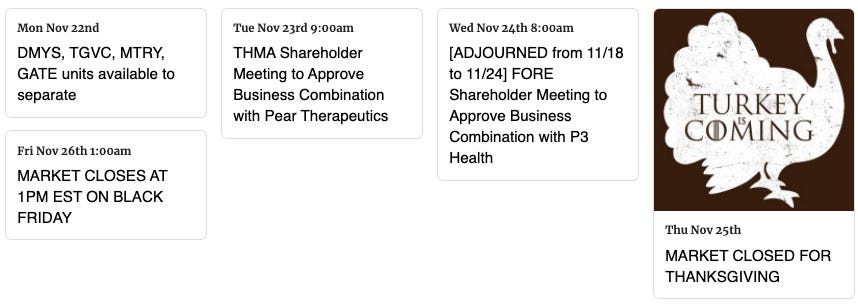

Upcoming Dates:

Next Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,