Ackman throws in the towel and Walmart boosts Canoo

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 12, 2022)

The Stats:

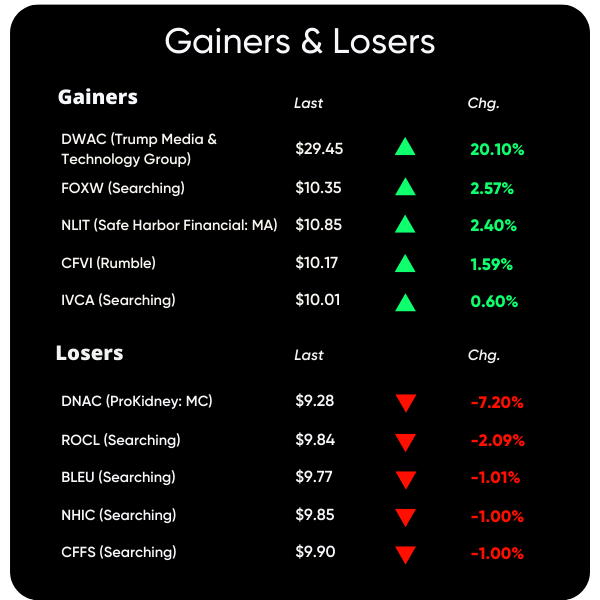

Pre-Market Movers*:

Active Moves (1%+): ITHX -4.9%, DWAC -2.7%

Some De-SPAC Moves (10%+): GOEV +96.7%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

1) FAST Acquisition Corp. II (FZT) & Falcon’s Beyond Global

Headquartered in Orlando, Florida, Falcon's Beyond is a fully integrated, top-tier experiential entertainment development enterprise focusing on a 360° IP Expander™ model. The company brings its own proprietary and partner IPs to global markets through owned and operated theme parks, resorts, attractions, patented technologies, feature films, episodic series, consumer products, licensing, and beyond. The company has won numerous design awards and provided design services in 40 countries around the world, turning imagined worlds into reality.

Valuation: $1B Pro-forma EV

Additional Financing: $60M private placement by existing investor, Katmandu Collections (of which $20M has been pre-funded)

Sweetener: “The transaction offers downside protection for FAST II stockholders through (1) the automatic conversion of 50% of FAST II’s existing public stockholders’ position into convertible preferred equity and (2) a bonus pool of common shares allocated to private placement investors and non-redeeming FAST II stockholders”

News:

Ackman’s Record SPAC to Return Funds After Deal Hunt Fizzled (Bloomberg)

Billionaire investor Bill Ackman told investors in the largest-ever blank-check company that it’s returning their $4 billion after failing to consummate a merger deal.

Pershing Square Tontine Holdings Ltd.’s (PSTH) efforts to find a target company were thwarted in part by what Ackman said was the unexpected recovery of capital markets during the coronavirus pandemic, according to a statement Monday.

“The rapid recovery of the capital markets and our economy were good for America but unfortunate for PSTH, as it made the conventional IPO market a strong competitor and a preferred alternative for high-quality businesses seeking to go public,” Ackman said, referring to the blank-check firm by its trading symbol.

Pershing Square Tontine Holdings in July 2020 helped catapult special purpose acquisition companies, or SPACs, to record levels as the pandemic took hold. Since the start of that year, more than 1,200 SPACs have raised in excess of $271 billion in initial public offerings, almost three times the volume of all previous years combined, according to data compiled by Bloomberg.

Last year, Ackman’s effort to buy a 10% stake in Universal Music Group from Vivendi SA with a portion of the SPAC’s funds was shot down by regulators. Early discussion with companies including Airbnb Inc. and Stripe Inc. also failed to yield a deal.

Ackman said in Monday’s statement that he’s still “working diligently to launch” a new type of privately funded acquisition vehicle, Pershing Square SPARC Holdings Ltd., that will issue publicly traded warrants allowing holders to acquire stock in a newly merged company.

Canoo Shares Surge 82% on Walmart Order for 4,500 Electric Vans (Bloomberg)

Canoo Inc. (GOEV) shares surged as much as 82% in early trading after the struggling electric-vehicle startup won an order for 4,500 vans from Walmart Inc.

The deal announced in a statement Tuesday is a boon to Canoo, which ended the first quarter with just $105 million in cash. The company recently moved its headquarters to Walmart’s hometown of Bentonville, Arkansas, and warned in May of substantial doubt about its ability to continue as a going concern.

Canoo shares jumped 77% to $4.19 at 8:15 a.m. in New York, before the start of regular trading. Its stock-market value, about $603 million as of Monday’s close, has plunged from about $4.8 billion since late 2020, when the startup went public by merging with a special purpose acquisition company.

Walmart will be the first to take delivery of vehicles Canoo expects to begin producing in the fourth quarter. The companies said the vans will hit the road next year and support the US retailer’s growing e-commerce business. Walmart will have the option to purchase as many as 10,000 of the vans.

The agreement with Canoo is the latest in a series of moves by Walmart into electric and autonomous vehicles. The retailer announced in January it was reserving 5,000 electric delivery vans from General Motors Co.’s BrightDrop, and it’s been working on making autonomous deliveries with the Silicon Valley startup Gatik since 2019.

Canoo will send some pre-production vehicles to Walmart in the coming weeks to “refine and finalize” a configuration for the Dallas Fort Worth area.

Updates:

Pershing Square Tontine Holdings Ltd. (PSTH) will liquidate and redeem all of the public shares at a redemption price of appx. $20.05 on 7/26. Though, Pershing still aims to launch its “SPARC”

With the SPAC and IPO market effectively shut today, now is a highly opportunistic investment environment for a public acquisition vehicle which does not suffer from the negative reputation of SPACs. With this in mind, as we have previously explained, we are working diligently to launch Pershing Square SPARC Holdings, Ltd., a privately funded acquisition vehicle which intends to issue publicly traded, long-term warrants called SPARs, which will offer SPAR owners the opportunity to acquire common stock in the newly merged company, the outcome of a business combination between SPARC and a private company. The SPARC structure has many favorable attributes compared with conventional SPACs that should increase the probability a transaction can be executed on favorable terms.

We intend to distribute SPARs to PSTH security holders who own either Class A Common Stock (ticker: PSTH) or warrants (ticker: PSTH.WS) as of the close of business on July 25, 2022 (the last date such instruments are redeemed or cancelled): ½ of a SPAR for each share of common stock and one SPAR for each warrant. The timing of the SPAR distribution will be determined by reference to the date SPARC’s registration statement becomes effective, which we would not expect to occur until Fall 2022.

Ace Global Business Acquisition Limited (ACBA) and DDC Enterprise Limited (DayDayCook) mutually terminated their merger agreement

—> “Ace shall continue to pursue the consummation of a business combination with an appropriate target”

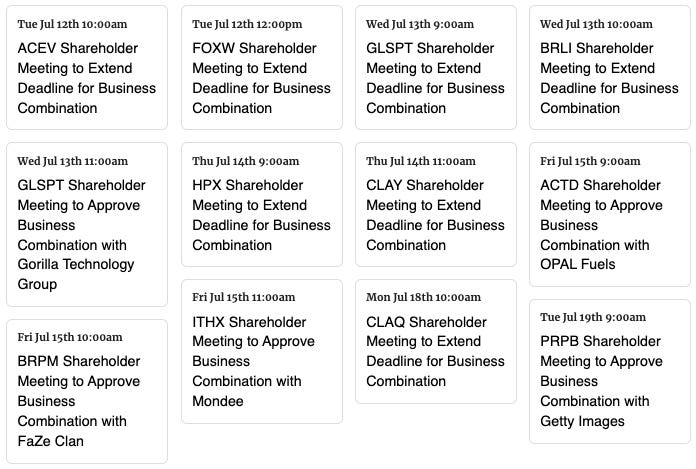

Merger Vote Set:

Alpha Capital Acquisition Co (ASPC) & Semantix (8/2)

Social Capital Suvretta Holdings Corp. III (DNAC) completed its merger with ProKidney, with the company trading as PROK starting today

—> 22,829,769 shares were redeemed or an estimated ~91.3% of the public SPAC shares

Benessere Capital Acquisition Corp. (BENE) shareholders approved the extension of its deadline from 7/7 to 1/7/23

—> BENE also extended the deadline to redeem in connection with the extension to 7/14 at 5pm

THOR Industries announced it has made a strategic $15M investment in Dragonfly, Chardan NexTech Acquisition 2 Corp. (CNTQ)’s merger partner

B. Riley Principal 150 Merger Corp. (BRPM) & FaZe Clan file an updated investor presentation

Nexters (GDEV), which was suspended from trading by Nasdaq on 2/25 earlier this year along with other Russia-based companies, announced that it plans to:

Intensify the Company’s relocation program with a goal of relocating the vast majority of critical personnel located in Russia, Ukraine, and Belarus to Cyprus, Armenia, and certain other “safe-harbor” countries.

Divest the Company of its Russia-based subsidiaries by transferring its gaming business in Russia to the local management

New SPACs (S-1s):

No new S-1s

Registration Withdrawals

Neo Technology Acquisition Corp (NFTT)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

biote (BIOT)

S-4 Activity:

S-4:

Primavera Capital Acquisition Corporation (PV) & Lanvin Group Holdings Limited

XPAC Acquisition Corp. (XPAX) & SuperBac

Adara Acquisition Corp. (ADRA) & Alliance Entertainment

S-4/A:

Chardan NexTech Acquisition 2 Corp. (CNTQ) & Dragonfly Energy (1st amendment)

LMF Acquisition Opportunities, Inc. (LMAO) & SeaStar Medical (1st amendment)

Concord Acquisition Corp (CND) & Circle (4th amendment)

Effective:

Alpha Capital Acquisition Co (ASPC) & Semantix

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,