An inspiration to all SPACs facing high redemptions

A newsletter recapping the past week's SPAC activity (Feb 20, 2022)

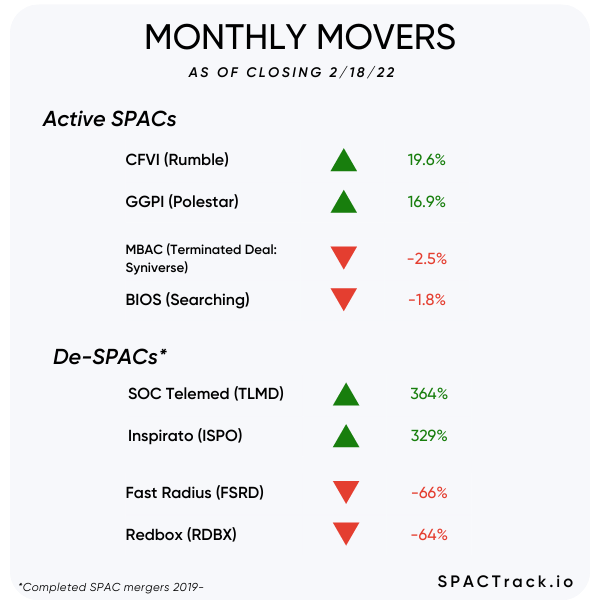

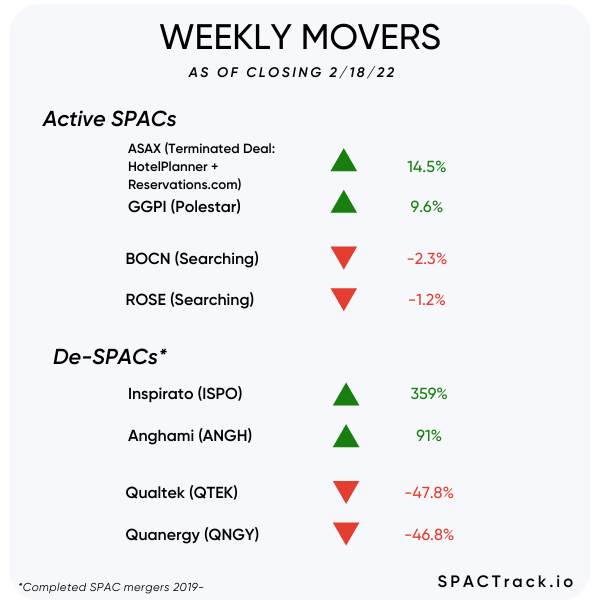

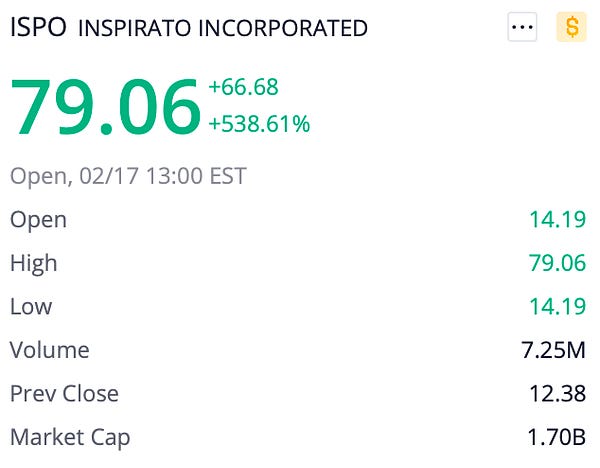

High redemption De-SPAC low float “squeezes” have returned in a big way, apparently.

Starting with Inspirato (ISPO) on Thursday with seemingly all other low float (due to very high redemptions) De-SPACs following suit:

…and the wild trading continued on Friday:

This Week’s Newsletter is brought to you by Rows

The world runs on spreadsheets, but the last time they got a major update was in 2006. It’s when Nokia 6070 was the best selling phone!

Rows has reinvented spreadsheets. All the data on stocks, crypto, and more is now right in your spreadsheet via 40+ integrations with platforms like Stripe, Google Analytics, Twitter, Salesforce, Crunchbase, and LinkedIn. Get started for free.

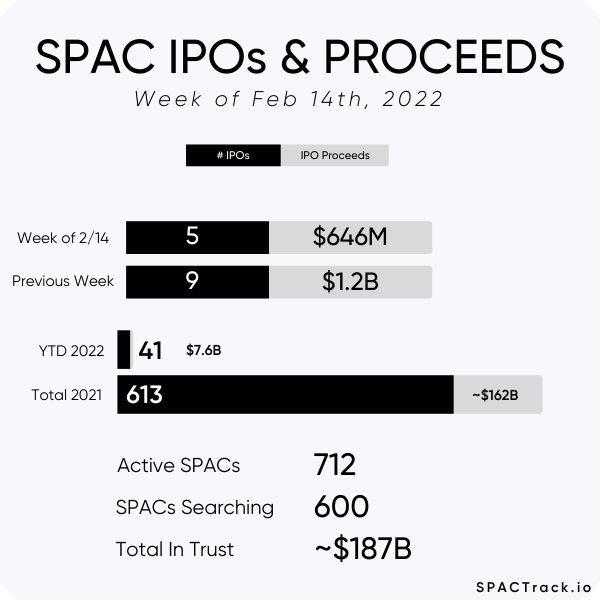

The Stats:

The Deals from the Past Week (3):

1) Software Acquisition Group Inc. III (SWAG) & Nogin

Merger Partner Description:

Nogin delivers Commerce as a Service to leading brands in the fashion, CPG, beauty, health, and wellness industries. The Company's Intelligent Commerce product is a full-stack eCommerce platform that includes R&D, sales optimization, and machine learning, along with artificial intelligence-driven marketing and fulfillment. Known for helping global brands keep pace with big retail and drive predictable profitability, Nogin partners with clients to take the eCommerce operation, team, and data from the ground up—typically in less than 90 days.

Valuation: $646M EV

2) Northern Lights Acquisition Corp. (NLIT) & Safe Harbor Financial

Merger Partner Description:

Safe Harbor is one of the first financial services providers to offer reliable access to banking solutions for cannabis, hemp, CBD, and ancillary operators, making communities safer, driving growth in local economies, and fostering long-term partnerships. Safe Harbor, through its partners, serves the regulated cannabis industry and implements the highest standard of accountability, transparency, monitoring, reporting, and risk mitigation measures while meeting BSA obligations in line with FinCEN guidance on CRBs. Over the past seven years, Safe Harbor has processed over $11 billion in transactions with operations spanning 20 states with regulated cannabis markets.

Valuation: $227.1M EV

Additional Financing: $60M PIPE

3) SPK Acquisition Corp. (SPK) & Varian Biopharmaceuticals

Merger Partner Description:

Varian Biopharmaceuticals, Inc. is private precision oncology company developing novel therapeutics for the treatment of cancer. Varian Bio is developing what has the potential to be a best-in-class high-potency, specific atypical protein kinase C iota (“aPKCi”) inhibitor for the treatment of various tumor types in multiple formulations. Recent scientific publications have characterized aPKCi as an oncogene whose activity may play a fundamental role in the regulation of cancer-associated transcription factors including GLI-1 and K-RAS. Varian Bio’s lead drug candidate, VAR-101, is being developed in a topical formulation for the treatment of basal cell carcinoma. VAR-102, an oral formulation, is being developed for the treatment of a wide variety of solid tumors where studies have shown potent aPKCi inhibition would be impactful, including non-small cell lung cancer (NSCLC), pancreatic cancer and colorectal cancer.

Valuation: $116M pro-forma equity value

News:

Trump’s social media app will reportedly go live on Presidents’ Day

Chamath Palihapitiya has resigned from his Chair position and as a member of the Board of Virgin Galactic Holdings, Inc. (SPCE)

Circle Valued at $9B in New Transaction Terms Agreed with Concord Acquisition Corp

Concord Acquisition Corp (CND) & Circle terminated the existing business combination agreement and entered into a new agreement that values Circle at an enterprise value of $9B. This is 2x the original valuation of $4.5B from back in July 2021

Warburg [Warburg Pincus Capital Corp I-A (WPCA) & Warburg Pincus Capital Corp I-B (WPCB)] and Barry Sternlicht Partnering on Jumbo, 3-Way SPAC Deal

Merger Votes/ Completions & More Updates:

Healthcare Capital Corp. (HCCC) shareholders approved the merger with Alpha Tau Medical

Astrea Acquisition Corp. (ASAX), HotelPlanner and Reservations.com Mutually Agree to Terminate Business Combination Agreement

Merger Votes Set:

MedTech Acquisition Corporation (MTAC) & Memic Innovative Surgery (3/9)

Highland Transcend Partners I Corp. (HTPA) & Packable (3/29)

Helix Acquisition Corp. (HLXA) & MoonLake Immunotherapeutics (3/31)

Bridgetown 2 Holdings Limited (BTNB) & PropertyGuru (3/15)

FirstMark Horizon Acquisition Corp. (FMAC) & Starry (3/16)

Tailwind Two Acquisition Corp. (TWNT) & Terran Orbital (3/22)

Sign up for SPAC Track Pro and get 15% off of the first month or the first year of the annual subscription with the coupon: ‘15PRECAP2022’. View all of the data points available for SPAC Track Pro users here: spactrack.io/pro

If you only wish to subscribe to the premium daily newsletter (sent each morning before market open), you can do so here:

De-SPAC S-1 Activity (including PIPE resale registrations*):

S-1 filings:

SES AI (SES)

Energy Vault (NRGV)

Anghami (ANGH)

Satellogic (SATL)

Effective:

QualTek (QTEK)

GreenLight Biosciences (GRNA)

The Oncology Institute (TOI)

*When applicable

S-4 Activity:

S-4 filings:

CHP Merger Corp (CHPM) & Accelus

InterPrivate III Financial Partners Inc. (IPVF) & Aspiration

Ackrell SPAC Partners I Co (ACKIT) & Blackstone Products

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup

Social Capital Suvretta Holdings Corp. I (DNAA) & Akili Interactive

Dynamics Special Purpose Corp. (DYNS) & Senti Bio

CF Acquisition Corp. VI (CFVI) & Rumble

Software Acquisition Group Inc. III (SWAG) & Nogin

InterPrivate III Financial Partners Inc. (IPVF) & Aspiration

CHP Merger Corp (CHPM) & Accelus

Benessere Capital Acquisition Corp. (BENE) & Ecombustible

Gores Holdings VIII, Inc. (GIIX) & Footprint

Abri SPAC I, Inc. (ASPA) & Apifiny Group

Cartesian Growth Corp (GLBL) & Tiedemann Group and Alvarium Investments

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup

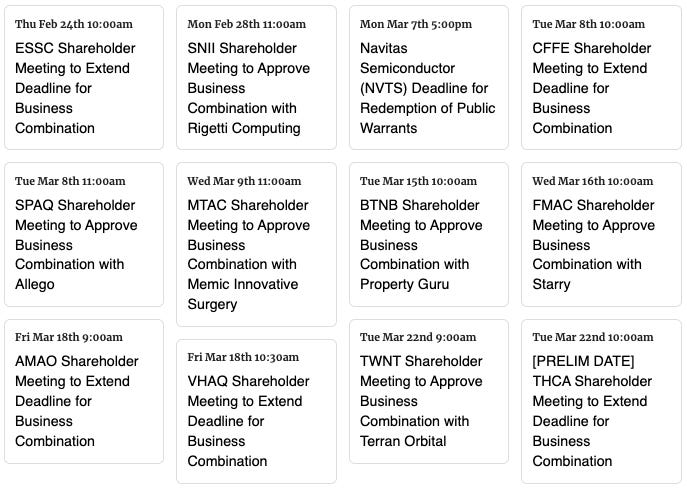

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,