Early Fireworks with 4 Terminations, 1 Liquidation, & 1 Bankruptcy

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 1, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): NLIT -5.8%

Some De-SPAC Moves (10%+): PGY +16%, FSRD +14.4%

ENSC -21.7%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

EToro to Abandon Deal to Go Public via SPAC Merger (The Information)

Online brokerage EToro and the special purpose acquisition company [FinTech Acquisition Corp V (FTCV)] that agreed to take it public are planning to let the deadline for their merger pass without closing the deal, according to a person familiar with the matter. EToro is joining other tech and media companies that have backed off SPAC deals that would take them public amid a tech stock sell-off.

The Tel Aviv–based eToro in December set the deal’s termination date for Thursday through a merger with FinTech Acquisition Corp. V, a SPAC backed by banking entrepreneur Betsy Cohen. But the deal isn’t moving forward, the person said, meaning the SPAC merger will end automatically.

[De-]SPAC Led by Former Apple Executive [Enjoy Technology (ENJY)] Goes Bankrupt Less Than a Year After Going Public (Bloomberg)

Byju's says 500 employees laid off across the group, employees claim 1,100 retrenched at Toppr alone (The Hindu)

Bloomberg reported in February that the company was in negotiations with several SPACs and was set to announce a deal within the month.

EV motorway charging network Gridserve in M&G funding talks (Sky News)

The company was exploring the SPAC route "prior to a souring of the environment for such deals"

US Regulator to Review SPAC Audits After Restatement Wave (Bloomberg Tax)

Hyperfine (HYPR) CEO steps down after one year (Fierce Biotech)

Updates:

G3 VRM Acquisition Corp. (GGGV) announced that it will liquidate on 7/6 at a liquidation price of $10.15 per share “due to its anticipated inability to consummate an initial business combination within the time period required by its Amended and Restated Certificate of Incorporation”

Energy Vault (NRGV) announces redemption of its public warrants (cash or cashless per the press release) with the exercise deadline of 8/1 at 5PM EST

Isleworth Healthcare Acquisition Corporation (ISLE) and Cytovia Therapeutics terminated their merger agreement that was announced in April

—> “Isleworth is currently assessing whether it should extend its life and the life of the trust maintained for the benefit of its public holders of Common Stock, and seek an alternative business combination”

North Atlantic Acquisition Corp. (NAAC) and TeleSign terminate their merger agreement

—> NAAC will seek an alternative business combination

USHG Acquisition Corp. (HUGS) and Panera Brands terminate their agreement to have HUGS participate in the Panera Brands IPO, with HUGS continuing to look for a merger partner

—> Danny Meyer, Chairman of HUGS and Founder of Union Hospitality Group and Shake Shack: “Based on current capital market conditions, it is unlikely that an initial public offering for Panera will happen in the near-term, and so we have agreed not to extend our partnership beyond its existing June 30 expiration date. We are disappointed that market timing was not on our side, especially as we have such tremendous admiration and respect for Panera, its entire management team and their partners at JAB."

Polestar (PSNY) released the official redemption number for its merger with Gores Guggenheim, Inc. (GGPI)

16,265,203 shares were redeemed or an estimated ~20.3% of the public SPAC shares

Chavant Capital Acquisition Corp. (CLAY) signed a non-binding LOI with a “U.S. based technology company … developing advanced connectivity solutions with high bandwidth and low latency, targeting customers in the infrastructure, consumer electronics, satellite, automotive and other sectors”

Northern Lights Acquisition Corp. (NAAC) - which previously announced shareholder approval of its merger with Safe Harbor Financial - announces that it will accept redemption reversals, and that it is extending the outside date to 7/29 with the ability to extend to 8/31

—> The extension of the Outside Date will provide the Company with additional time to complete the Business Combination as it awaits regulatory approval [Safe Harbor Financial offers banking solutions for cannabis companies]

Kismet Acquisition Two Corp. (KAII) announces its sponsor has transferred all the membership interest to a new sponsor: Quadro IH DMCC,

—> and that Dimitri Elkin has taken over as the new CEO, with Elkin’s affiliate, Twelve Seas Management Company, and Quadro IH DMCC appointed as the managing members of the new sponsor

Merger Vote Set: CC Neuberger Principal Holdings II (PRPB) & Getty Images (7/19)

New SPACs (S-1s):

1) Trailblazer Merger Corporation I (TBMC)

$67M

1 Class 1 Warrant, 1 Class 2 Warrant, 1 Right (1/20th of a share)

Focus: Tech in the U.S.

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

MSP Recovery (MSPR)

S-4 Activity:

S-4:

KludeIn I Acquisition Corp. (INKA) & Near

S-4/A:

Brookline Capital Acquisition Corp. (BCAC) & Apexigen (4th amendment)

Alpha Capital Acquisition Co (ASPC) & Semantix (4th amendment)

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup (6th amendment)

Duddell Street Acquisition Corp. (DSAC) & FiscalNote (8th amendment)

L&F Acquisition Corp. (LNFA) & ZeroFox (4th amendment)

CHW Acquisition Corp (CHWA) & Wag Labs (4th amendment)

Venus Acquisition Corporation (VENA) & VIYI Algorithm (8th amendment)

Effective:

CC Neuberger Principal Holdings II (PRPB) & Getty Images

Upcoming Dates:

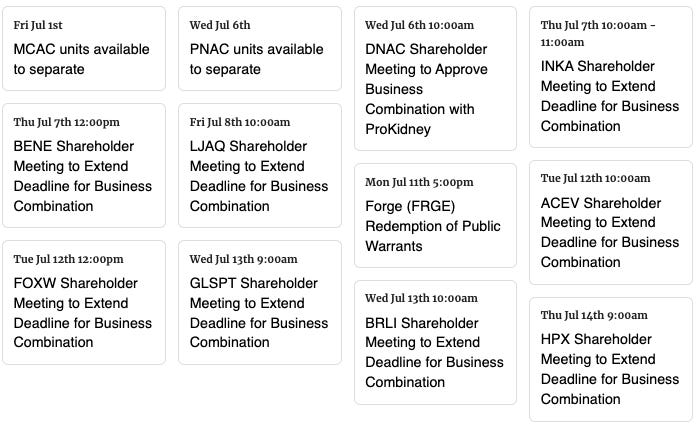

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,

UPDATED WITH REVISIONS:

- Initial publishing showed 6/31. Updated to show 7/1.

- The following Early Movers were included erroneously: DNAC -4.6%, TRON +4.9%. Now removed.