Eyes on Hyzon

Turbulence at a fuel cell truck maker and back-to-back IPO days in this edition of the Morning Update, the pre-market recap for SPAC Track Pro subscribers.

Good Morning,

Are SPAC IPOs back? For EF Hutton they are!

The last 2 SPACs to file registration statements and the latest 2 SPACs to IPO count EF Hutton as underwriter.

Also, things are going downhill for a hydrogen fuel cell truck company that doesn’t end in ‘kola’: Hyzon Motors stock dropped 36% after hours yesterday. More below.

Previous Session Stats

Gainers & Losers

Volume Leaders

News & De-SPAC Updates

Hyzon Motors [$HYZN] reported yesterday that the information on its latest 10-K and 10-Q should no longer be relied upon due to issues regarding “revenue recognition timing and internal controls and procedures, primarily pertaining to its China operations”.

In addition, Hyzon reported “operational inefficiencies” in its Europe operation (a joint venture with Holthausen) “which will have a material adverse effect on the Company’s ability to produce and sell vehicles”. Hyzon will be restructuring its European operation and a “board-appointed special committee, working with external advisors” will investigate the financial reporting issues as well as “other governance and compliance issues” (SF)

In January, Hyzon disclosed it received a subpoena from the SEC in relation to Orca Capital’s (a short-seller firm) report from September alleging that some Hyzon vehicle orders were phony. In April, Hyzon announced that it was replacing its CFO effective immediately.

Trapped H2O Investors Inherit Stake in Troubled Taxi App [Gett] (BB)

Nikola [$NKLA] Sales Gain Despite Battery Crunch Pressuring Deliveries: Truck maker beats analyst expectations for revenue, loss while Deliveries to dealers in quarter fell short of prior forecast (BB)

The Deals

—

SPAC Updates

Merger Votes / Completions

Vote Set: Riverview [$RVAC] & Westrock Coffee (8/25)

Redemption Results: Brookline Capital (BCAC) & Apexigen [$APGN]

“4,618,607 out of 5,061,592 shares of BCAC’s Common Stock” or ~91% (SF)

Deal Updates

Founder SPAC [$FOUN] announced an up to $150M FPA with ACM ARRT in connection with its merger with Rubicon Technologies. The merger was approved on Tuesday, with no word on redemptions or completion date (PR)

Aries I’ [$RAM] merger partner, Infinite Assets (to be renamed InfiniteWorld upon closing), acquired Super Bit Machine, “an independent gaming studio and Armajet developer” (PR)

Extensions

Kensington V’s [$KCGI] sponsor purchased 3.68M warrants at $0.75 each for a total of $2.76M and deposited the funds in the trust account, extending its deadline by 6 months to Feb 17th, 2023 (SF)

More

Departures: Anzu I [$ANZU] reported that its Chairman, CFO, General Counsel, and another member of its Board have resigned, and unlike the typical “the resignation was not due to any disagreement with the company” statement, we have some meat:

Ms. Harris and Mr. Wulfsohn informed the Company that their resignations were due to the following considerations: their disagreement with Company decisions and process leading to the resignations of Mr. Joy and Mr. Ganz and the resulting loss to the Company of the expertise of these two key executives; their disagreement with the nature of and approach to potential acquisition candidates the Company was considering in the context of changes in market conditions (both generally and for special purpose acquisition companies) and the approaching deadline for completing a business combination; and their disagreement with the Company’s continued pursuit of a specific business combination transaction.

IPOs

Pono Capital Two [$PTWO-U]

$100M, 1 Warrant

UW: EF Hutton

Registrations

New S-1s

No new S-1s

Registration Withdrawals

Cedarlake Acquisition Corp. (CEDA)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Key Filings

SPAC S-4 Activity

Effective:

Riverview [$RVAC] & Westrock Coffee

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

—

*including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

Upcoming Dates:

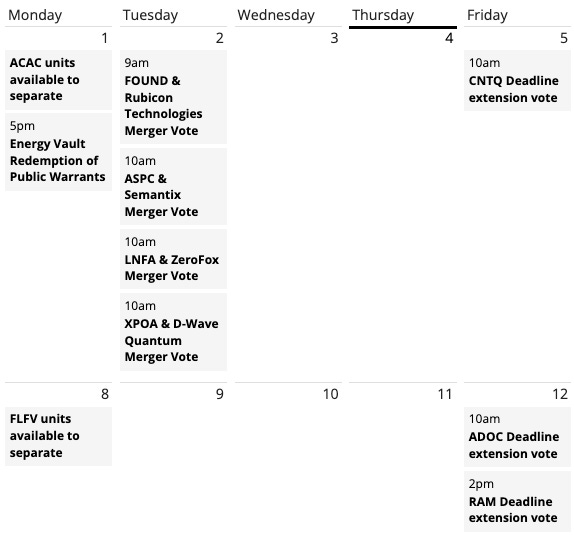

Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)