Going through withdrawals

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (January 21, 2021)

There have been 9 SPAC registrations withdrawn in 2022 to date including:

N2: led by Noam Gottesman and Martin Franklin

Modiv: a proptech-focused SPAC featuring Ray Wirta, the former Chairman & CEO of CBRE

Riverside Management’s RMG 5, 6, and 7: RMG’s previous SPACs completed mergers with RMO: $2.19 (-11%) and RNW: $5.65 (-5.8%)

Moose Pond: led by the the founder of RetailMeNot, Cotter Cunningham, and Co-founder of HomeAway, Brian Sharples

Ascendant Digital: sponsor team completed one SPAC merger: MarketWise (MKTW: $5.95) and has one other out searching (ACDI)

Quiet Plus: Tech-focused SPAC featuring the founder of Everlane, the founder of ClassPass, and the CFO of Twilio as directors

1.12: a SPAC led by Frank Martire, Jr., the Executive Chairman of NCR and partner/director of several SPACs with Bill Foley

Don’t worry about the fallen SPACs, though. SPACs are like The Immortals… when one falls there is another to take its place.

There have been 11 new SPAC registrations in 2022.

Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

1) Cohn Robbins Holdings Corp. (CRHC: warrants +8.9%) & Allwyn Entertainment

Merger Partner Description:

Allwyn Entertainment is a lottery, entertainment, and digital gaming operator, with trusted brands delivering over €16bn in wagers. Allwyn is one of Europe’s largest and fastest growing lottery companies and its strong performance across its markets is helping to fund good causes in Austria, the Czech Republic, Greece, Cyprus and Italy.

News:

KKR SPAC Said to Mull Deal for PetSmart at $14 Billion Value (Bloomberg)

PetSmart is in talks to go public through a blank-check company backed by private equity firm KKR & Co., according to people familiar with the matter.

The pet supply retailer, backed by BC Partners, would be valued in the transaction at $14 billion including debt, said one of the people, who asked not to be identified because the information was private.

KKR Acquisition Holdings I Corp. (KAHC), the special purpose acquisition company, raised $1.38 billion in its initial public offering last March to hunt for a deal in the consumer or retail industries. As with other SPAC transactions, PetSmart would become publicly traded after combining with KKR Acquisition.

The merger would add to the $1.8 trillion of transactions announced in the consumer industry over the past 12 months, according to data compiled by Bloomberg. Discussions are in early stages, and the talks could still end without an agreement, the people said.

Representatives for PetSmart and BC Partners didn’t immediately respond to requests for comment. A spokesperson for KKR declined to comment.

Private equity firms led by BC Partners bought the chain in 2015 in an $8.7 billion deal, and later added debt to PetSmart when it acquired online pet store Chewy.

Despite a rocky period that saw the buyout debt fall to distressed levels, the companies’ fortunes rebounded amid growing spending on pets and pet care. BC Partners later split PetSmart’s operations from Chewy’s and sold shares after the online retailer went public.

Merger Votes/ Completions:

Merger Vote Set:

Novus Capital Corporation II (NXU) & Energy Vault: 2/10

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

S-4 Activity:

Pro subscriber content only

Tracking De-SPAC S-1s (including PIPE resale registrations):

Pro subscriber content only

New S-1s:

1) FG Merger Corp. (Ticker not available yet)

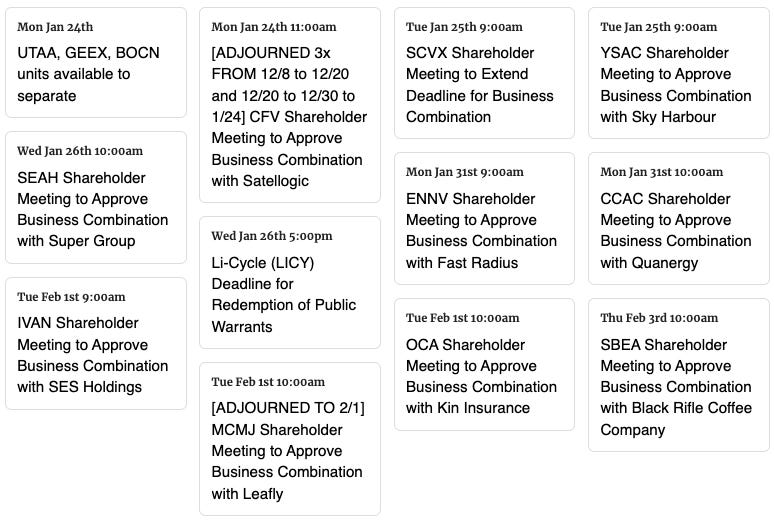

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

The Pro edition of the Nightcap newsletter is sent to SPAC Track Pro subscribers and includes: deal details, S-1 registration details, S-4 merger filing updates, post-closing S-1 updates (incl. PIPE share registrations), and quick links to investor presentations, press releases, and relevant filings.

Sign up for SPAC Track Pro with 10% off of the first month or the first year of the annual subscription with the coupon: ‘10NIGHTCAP2022’.

Thanks for reading,