Has the Quantum SPAC race begun?

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (October 6, 2021)

Discover and track all of the SPACs at spactrack.net.

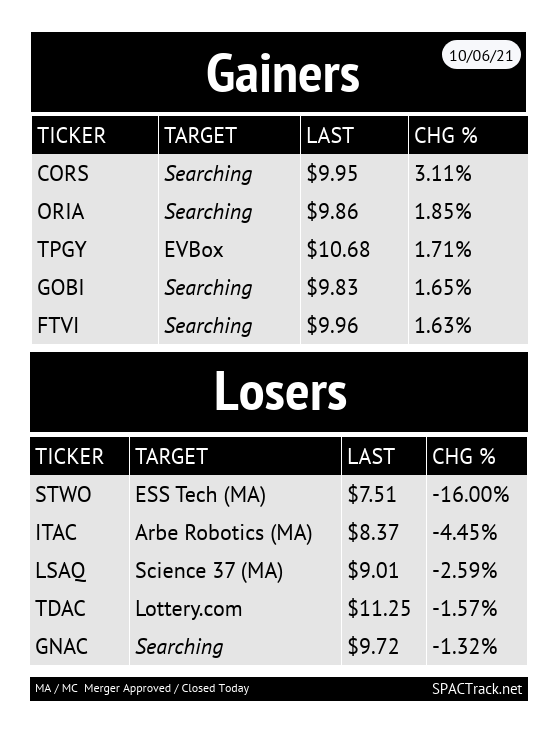

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals:

1) Supernova Partners Acquisition Company II (SNII: warrants +42.11%) & Rigetti Computing

Merger Partner Description:

Rigetti Computing is a pioneer in full-stack quantum computing. The company has operated quantum computers over the cloud since 2017 and serves global enterprise, government, and research clients through its Rigetti Quantum Cloud Services platform. The company's proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. Rigetti has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. The company designs and manufactures its chips in-house at Fab-1, the industry's only dedicated and integrated quantum device manufacturing facility. Rigetti was founded in 2013 by Chad Rigetti and today employs more than 130 people with offices in the United States, U.K., Canada, and Australia.

Valuation: $1.152B EV

PIPE: $103M including investments from T. Rowe Price Associates, Inc., Bessemer Venture Partners, Franklin Templeton, and In-Q-Tel

Merger Votes/ Completions:

LifeSci Acquisition II Corp. (LSAQ) filed an 8-K noting that its shareholders approved its merger with Science 37 (merger vote was on Monday). The filing stated that closing is expected today

Awaiting redemption data

Industrial Tech Acquisitions, Inc. (ITAC) announces that closing of the merger with Arbe Robotics, that was approved yesterday, is set for tomorrow, 10/7 with ticker change to ARBE set for 10/8

Appx 76.6% of public shares were redeemed, resulting in gross proceeds of $118M

News:

Online Brokerage TradeZero Said in Merger Talks With Dune SPAC (Bloomberg—paywalled)

TradeZero Holding Corp., an online brokerage that provides free and subscription-based software for stock trading, is in talks to merge with Dune Acquisition Corp. (DUNE), a blank-check firm, according to people with knowledge of the matter.

Terms are in flux, but if a transaction is finalized, it may be announced in coming weeks, the people added. It’s still possible talks could fall apart.

Representatives for Nassau, Bahamas-based TradeZero and West Palm Beach, Florida-based Dune declined to comment.

TradeZero, led by Chief Executive Officer Dan Pipitone, offers commission-free stock trading, short selling, free limit orders, and other services, its website shows. The company makes money in part from rebates paid for order flow by market centers including EDGX, ARCA and Nasdaq, and is planning on expanding its options offerings from single- to multi-legged trading.

Dune, led by CEO Carter Glatt, raised $172.5 million in a December initial public offering. The SPAC has said it will focus on finding a target in the technology sector, specifically companies pursuing a software-as-a-service model.

During the pandemic, retail investors stormed into financial markets, propelling the revenue of brokerages including Robinhood Markets Inc., which itself became a meme stock following its August initial public offering. Other companies with brokerage arms such as Interactive Brokers Group Inc. and Charles Schwab Corp. posted stock gains over the past 12 months that outpaced the S&P 500 Index.

Stock brokerage EToro in March agreed to go public through a blank-check firm merger, while cryptocurrency exchange Bakkt Holdings LLC inked a SPAC deal in January.

Betsy Cohen Predicts About a Third of SPACs Will Bust (Bloomberg—paywalled)

Blank-check sponsor Betsy Cohen said about 30% of all special purpose acquisition companies in the market will fail, in an interview on Wednesday at the Bloomberg Invest Global conference.

“Either they won’t be able to find companies in the time frame or they will find companies within that time frame but the public market investors will not support them,” Cohen said.

She added that traditionally a private investment in public equity (PIPE) gets raised to validate valuations in transactions but that’s now changed.

Private equity firms are increasingly showing up in deals in the PIPEs and as the sponsor, which she called an inherent conflict and “probably not a good thing.”

“Public investors are very quick to understand that the valuation hasn’t been validated by anybody except people with an interest in completing the SPAC,” Cohen said.

After having raised nine SPACs and completing deals such as taking investment bank Perella Weinberg Partners (PWP) public, Cohen is still bullish on them. She said that the market is in the middle, not end of the trend.

Wall Street Darling Ginkgo Caught in SPAC, Short-Seller Selloff (Bloomberg—paywalled)

[Ginkgo Bioworks (DNA: $10.59 -11.60%)] The Boston-based company counts Viking Global Investors LP, Baillie Gifford & Co. and Cathie Wood’s ARK Investment Management LLC among its 10 biggest holders on hopes it will lead a synthetic biology revolution.

While early investors wait for those promises to materialize, the cell programming firm has embarked on a roller-coaster ride after its debut on Sept. 17, when it completed a reverse merger with Soaring Eagle Acquisition Corp., a special purpose acquisition company. Since then, the share price has dropped more than 7%.

To be sure, SPACS have also underperformed in the same time. The De-SPAC Index, a group of 25 firms that went public through combinations with SPACs, slid 14% since late last month and is now almost 50% lower from a February peak.

Ginkgo took another blow on Wednesday, at one point dropping as much as 24% after a short report from Scorpion Capital. The day’s tumble came as more than 60 million shares changed hands.

Ginkgo CEO Jason Kelly said the company is increasing the scale of its platform so it can deliver more cell programs to customers.

It remains to be seen how much investors such as Baillie Gifford or ARK will snap up during the latest decline. The stock had slumped in five of the past six days prior to Wednesday’s selloff -- with ARK adding to positions each day it traded in the red.

For Scorpion Capital, which sent fellow ARK-favorite Berkeley Lights Inc. spiraling last month to a record low, the short call centers on questions surrounding Ginkgo’s ability to generate revenue, and drew support from fellow short-seller Citron Research.

Ginkgo’s Kelly responded to the short report’s critique that startups are using Ginkgo to launch. “We don’t think that is a problem,” he said. “We’re happy we make it easy for companies to start on Ginkgo’s platform and hopefully more entrepreneurs hear about our platform today.”

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

Cazoo Group (CZOO: $7.05 +0.28%)

eFFECTOR Therapeutics (EFTR: $11.36 -6.35%)

ReNew Energy Global (RNW: $8.79 -12.19%)

Li-Cycle (LICY: $11.37 +4.99%)

New S-1s (3):

1) Iconic Sports Acquisition Corp. (ICNC)

$250M, 1/2 Warrant

Focus: Global sports industry (focus on iconic businesses, including sports franchises)

Management:

Jamie Dinan (Founder, Chairman & CEO of York Capital Management and Co-owner of the Milwaukee Bucks)

Gianluca Vialli (Former Professional Football Player: Sampdoria, Juventus and Chelsea)

Directors:

Alex Liu (Managing Partner & Chairman of Kearney)

2) Innovative International Acquisition Corp. (IOAC)

$200M, 1/2 Warrant

Focus: Consumer technology, ecommerce, healthcare or enterprise SaaS, either in the US or Asia-Pacific (APAC) region

Management:

Mohan Ananda (Founder, Former Chairman & CEO of Stamps.com)

3) OmniLit Acquisition Corp. (OLIT)

$125M, 1/2 Warrant

Focus: Advanced manufacturing industry (focus on photonics or optics)

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,