Joby and Li-Cycle sidestep the Footprints of recent SPAC mergers and rise after the merger vote

The Nightcap newsletter: SPAC Track’s nightly recap of the action in the SPAC world. (August 5, 2021)

Good evening!

Thanks for reading the Nightcap by SPAC Track. You can always discover and track all of the SPACs at spactrack.net.

The Stats:

If you find that this newsletter keeps you informed of all things SPAC, please consider sharing it with a friend or colleague and suggest they subscribe!

The Deals:

1) Growth Capital Acquisition Corp. (GCAC: $9.87) & Cepton Technologies

Cepton Technologies, Inc., an Innovator in Automotive ADAS Lidar, and Growth Capital Acquisition Corp., Enter into Business Combination Agreement (Press Release)

Merger Partner Description:

Cepton provides state-of-the-art, intelligent, lidar-based solutions for a range of markets such as automotive (ADAS/AV), smart cities, smart spaces and smart industrial applications. Cepton’s patented MMT®-based lidar technology enables reliable, scalable and cost-effective solutions that deliver long range, high resolution 3D perception for smart applications.

Valuation: $1.55B EV

PIPE: $58.5M anchored by existing Cepton investor, Japan-based KOITO MANUFACTURING CO

Cepton Technologies Investor Presentation

Deal News:

Packaging-Technology Firm Footprint Said in Gores SPAC Talks (Bloomberg— behind paywall)

Footprint, a maker of plant-based fibers that’s attempting to eliminate single-use plastics, is in talks to go public through a merger with Gores Holdings VII Inc. (GSEV: $9.92), a blank check-firm, according to people with knowledge of the matter.

A transaction is set to value the combined entity at as much as $3 billion, one of the people said. Terms aren’t finalized and it’s possible talks fall apart.

Representatives for Footprint and Gores declined to comment.

Footprint, led by co-founders former Intel Corp. engineers Troy Swope and Yoke Chung makes compostable, biodegradable and recyclable products that it has said is “on par” with the cost and performance of plastic. Customers include Conagra Brands Inc., Beyond Meat Inc., Tyson Foods Inc., McDonald’s Corp. and Sweetgreen, and the company has more than 2,400 issued and pending patent claims, its website shows. Footprint has said its efforts have “led to a redirection of 61 million pounds of plastic waste from the environment.”

Quick News Corner (not so quick today):

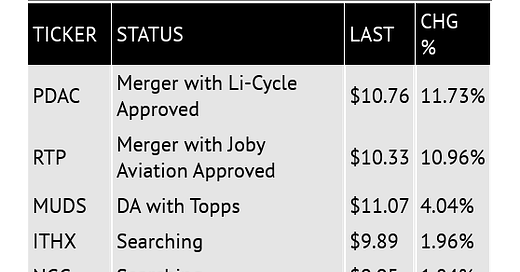

Peridot Acquisition Corp. (PDAC: $10.76) & Li-Cycle announce shareholder approval of the merger

Reinvent Technology Partners (RTP: $10.33) & Joby Aviation announce shareholder approval of the merger

Plus, merger partner of Hennessy Capital Investment Corp. V (HCIC: $9.88), Completes Driverless Level 4 Semi Truck Highway Demonstration

The driverless Level 4 truck demonstration was completed on the newly built Wufengshan highway and "the driverless truck drove safely and smoothly in typical highway traffic."

Greenrose Acquisition Corp. (GNRS: $10.01) Enters Agreements for Up to $103 Million in Additional Capital

A reminder that GNRS previously provided the deal update that only Shango Holdings and Futureworks will be a part of the DeSPAC transaction, while Theraplant and True Harvest are anticipated to close after DeSPAC, due to delays in acquiring State regulatory approvals.

Planet, merger partner of dMY Technology Group, Inc. IV (DMYQ: $9.85), Signs Multi-Year, Multi-Launch Rideshare Agreement with SpaceX

Wallbox, merger partner of Kensington Capital Acquisition Corp. II (KCAC: $9.85), Closes First Half 2021 With Over 300% YOY Revenue Growth

Astra (ASTR: $10.22) Announces Multi-Launch Contract and First Launch With Department of Defense "Space Force expected to fly demonstration launch no earlier than August 27th”

And to conclude here’s a heartwarming story of two former SPACs working together in the name of sports betting:

DraftKings (DKNG: $50.48) and Genius Sports (GENI: $16.81) Sign Transformative NFL, Official Sports Data, Single-Game Parlay, and Fan Engagement Agreement

IPOs to Begin Trading Tomorrow*:

1) Roth CH Acquisition IV Co. (ROCG-U)

$100M, 1/2 warrant

Focus: Business services, consumer, healthcare, technology, wellness or sustainability

Management:

Byron Roth (Chairman and Chief Executive Officer of Roth)

2) Nova Vision Acquisition Corp. (NOVV-U)

$50M, 1 warrant (to purchase 1/2 of a share), 1 right (to receive 1/10th of a share)

Focus: PropTech, FinTech, ConsumerTech, Supply Chain Management (in Asia)

3) Riverview Acquisition Corp. (RVAC-U)

$250M, 1/2 warrant

Focus: Consumer, including e-commerce, renewables and energy services, insurance & financial services

Management:

Brad Martin (Former CEO of Saks Inc., Former Chairman of the Board of Chesapeake Energy, and Former Director of First Horizon National, Caesars Entertainment, Dillard’s, Gaylord Entertainment Company, lululemon athletica, & Ruby Tuesday)

*Priced at the time of this writing

New S-1s:

1) Achari Ventures Holdings Corp. I (AVHI)

$100M, 1/2 warrant

Focus: Cannabis

Directors:

Seth Farbman (Former CMO of Spotify)

2) Cascadia Acquisition Corp. (CCAI)

$150M, 1/2 warrant

Focus: Industry 4.0 and Sustainability

3) Hash Space Acquisition Corp (HAC)

$40M, 1 right (to receive 1/10th of a share)

Focus: Blockchain

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Friday, August 6

Merger Meeting: SC Health Corp (SCPE: $9.95) & Rockley Photonics

Unit Split: Zimmer Energy Transition Acquisition Corp. (ZTAQU: $10.12) —> ZT

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,