Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 6, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): DNAC +13.8% // NLIT -3%

Some De-SPAC Moves (10%+): ENJY +59%, EOSE +30%, PGY +18.4% //

SAII -15.5%, LTRY -11.5%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Brazil's Ambipar subsidiary to merge with U.S.-listed SPAC HPX (Reuters)

Brazilian environmental services firm Ambipar said on Wednesday its subsidiary Emergencia Participacoes has agreed on a tie-up with U.S.-listed SPAC HPX Corp (HPX) to form a company which will be publicly traded in New York.

The deal gives the combined company, Ambipar Emergency Response, an enterprise value of 3.1 billion reais ($575.50 million) and is expected to fuel its growth across global markets, with its equity value seen at 2.9 billion reais.

The move comes less than a year after Ambipar had to call off the initial public offering (IPO) of its waste management company Ambipar Environmental due to unfavorable market conditions.

The Brazilian company said in a securities filing the deal includes a guaranteed minimum capitalization of $168 million for Ambipar Response. If there is no share redemption by current shareholders of HPX, the capitalization could reach up to $415 million, it added.

The proceeds will be used to accelerate growth internally as well as through deals for Ambipar Response, said Ambipar, which will remain as the majority shareholder of the combined company holding about 71.8% of its share capital.

Ambipar Response holds a portfolio of more than 10,000 clients in locations such as the United States, Brazil, Canada and the United Kingdom, and will take over Emergencia's role as Ambipar's provider of industrial and environmental emergency response services.

Crypto Mining Giant [Core Scientific (CORZ)] Dumped Most of Its Bitcoin Holdings in June (Bloomberg)

Updates:

Social Capital Suvretta Holdings Corp. III (DNAC) intends to adjourn its shareholder meeting to vote on its merger with ProKidney "to permit SCS and ProKidney additional time to satisfy conditions to closing of the Business Combination with respect to approval by The Nasdaq Capital Market"

—> A new date has not been set: “SCS intends to reconvene the Extraordinary General Meeting at a later date”

Merger Vote Set:

American Acquisition Opportunity Inc. (AMAO) files its investor presentation for its merger with Royalty Management Corporation

Vickers Vantage Corp. I (VCKA) shareholders approved the deadline extension from 7/11 to 8/11 and ability to extend on a monthly basis for up to five times

—> 4,073,605 shares were redeemed, leaving $99.8M remaining in trust

—> VCKA will deposit $0.0333 per public SPAC share that remains outstanding) for each month’s extension

E.Merge Technology Acquisition Corp. (ETAC) shareholders approved the deadline extension from 8/4 to 11/4

—> 27,222,020 shares were redeemed, leaving an estimated ~$328M remaining in trust

—> ETAC deposited $0.035 per public SPAC share that remains

Ace Global Business Acquisition Limited (ACBA)’s sponsor has deposited $0.099 per public share to extend its deadline from 7/9 to 10/8

Nocturne Acquisition Corp. (MBTC) announced that it deposited $0.10 per public share into the trust to extend its deadline by three months from 7/5 to 10/5

Broadscale Acquisition Corp. (SCLE) & Voltus file an investor presentation with updated financial projections

HUB Cyber Security (Israel) Limited, Mount Rainier Acquisition Corp.’s (RNER) merger partner, announced that it “has submitted a formal request to the Israeli district court to allow the Company shareholders decide on ‘same-day’ delisting from the Tel-Aviv Stock Exchange (TASE) and start of trade on its expected trading on NASDAQ”

“As part of its anticipated SPAC merger, HUB’s shareholders are expected to vote on delisting in parallel to the NASDAQ listing, rather than the mandatory 90-day dual trading period required by law”

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

Silver Crest Acquisition Corporation (SLCR) & Tim Hortons China (7th amendment)

Bull Horn Holdings Corp. (BHSE) & Coeptis Therapeutics (1st amendment)

Cleantech Acquisition Corp. (CLAQ) & Nauticus (5th and 6th amendment)

Effective:

Founder SPAC (FOUN) & Rubicon Technologies

Brookline Capital Acquisition Corp. (BCAC) & Apexigen

Upcoming Dates:

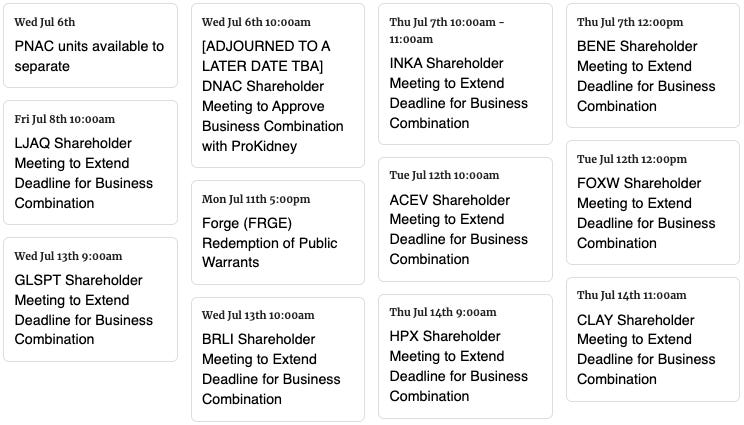

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,