Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (June 15, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): DUNE +13.2%, DWAC +6.9%

Some De-SPAC Moves (10%+): BOXD +31%, ASTL +18.7%, UP +11%, CPTN -13.2%, ELMS -13.4%, ATNF -40.2%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals (2):

Yesterday afternoon’s deal:

1) Future Health ESG Corp. (FHLT) & Excelera

Excelera is a technology-enabled care delivery platform that equips physicians with precision medicine insights and financial resources to succeed in Medicare's value-based delivery programs. We earn profits by effectively managing cost in the value chain so that doctors can deliver better care while realizing substantial improvements in their bottom line. Like Airbnb and Uber for independent homeowners and drivers, Excelera offers a platform that allows physicians to remain independent, but operate with the sophistication of a nationally networked health maintenance organization (HMO). We provide the contracting vehicles, technology, and other necessary services to make our doctors clinically and financially successful.

Valuation: $459M Pro-forma Enterprise Value

Additional Financing: $100M PIPE at $11/share and $20M FPA

This morning’s deal:

2) LightJump Acquisition Corp. (LJAQ) & Moolec Science

Moolec is a science-based ingredient company focused on producing real animal proteins in plants through Molecular Farming, a disruptive technology in the alternative protein landscape. Its purpose is to upgrade taste, nutrition, and affordability of alternative protein products while building a more sustainable and equitable food system. The company’s technological approach aims to have the cost structure of plant-based solutions with the organoleptic properties and functionality of animal-based ones. Moolec’s technology has been under development for more than a decade and is known for pioneering the production of a bovine protein in a crop for the food industry. Moolec is run by a diverse team of Ph.Ds and Food Insiders, and operates in the United States, Europe, and South America.

Valuation: $504M Pro-forma Equity Value

Updates:

Tuatara Capital Acquisition Corporation (TCAC) completed its merger with springbig and will start trading as SBIG today

Dune Acquisition Corporation (DUNE) shareholders approved the deadline extension from 6/22 to 12/22 of next year.

DUNE did not deposit any additional funds to the trust for the extension

16,409,033 shares were redeemed or an estimated ~95% of the public SPAC shares, leaving $8.4M in trust

Altitude Acquisition Corp. (ALTU) shareholders approved the deadline extension from 6/11 to 10/11

24,944,949 shares were redeemed or an estimated ~83% of the public SPAC shares, leaving $50.6M in trust

Virgin Group Acquisition Corp. II (VGII) shareholders approved the merger with Grove Collaborative

The transaction is expected to close on 6/16 with the ticker change to GROV on 6/17

Ackrell SPAC Partners I Co. (ACKIT), which has its extension vote scheduled for 6/21 to extend its deadline on a monthly basis from 6/23 to 9/23, announced that the sponsor will deposit “an amount equal to the lesser of $0.043 per share and $200,000” per each monthly extension

New SPACs (S-1s):

1) Pono Capital Two, Inc. (Ticker n/a)

$100M, 1/2 Warrant

Focus: High growth tech

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

Brookline Capital Acquisition Corp. (BCAC) & Apexigen (2nd amendment)

ArcLight Clean Transition Corp. II (ACTD) & OPAL Fuels (6th amendment)

Upcoming Dates:

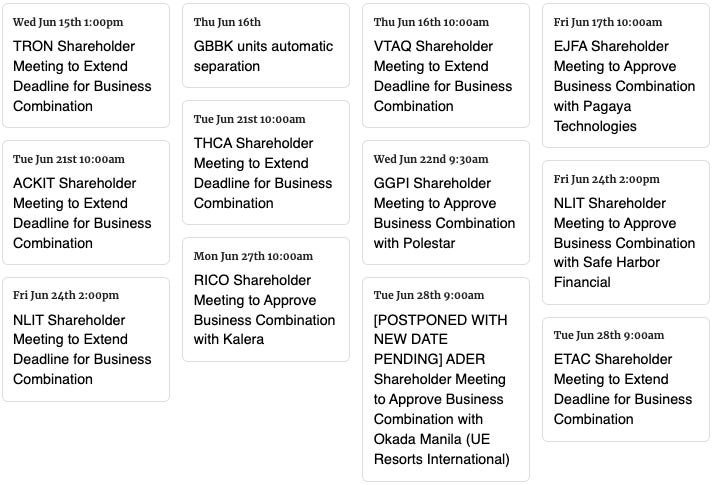

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,