Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 14, 2022)

The Stats:

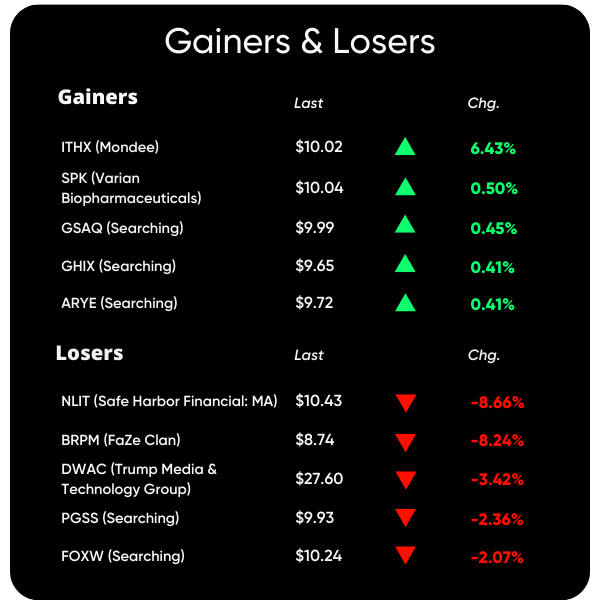

Pre-Market Movers*:

Active Moves (1%+): PRPB -3.1%, BRPM -2.4%, -5.8%

Some De-SPAC Moves (10%+): GOEV +12.9%

*at the time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Unity to Buy IronSource in $4.4 Billion Deal for Ad Tech (Bloomberg)

Unity Software Inc. agreed to buy app monetization company IronSource (IS) in an all-stock deal valued at about $4.4 billion to help the gaming platform boost its advertising technology, which has suffered under recent data-privacy changes by Apple Inc. The company also lowered its annual revenue forecast, sending shares plunging 18%.

The two companies have “some overlap,” Chief Executive Officer John Riccitiello said in an interview, citing the two companies’ ad networks and ability to “collect a lot of data.” However, Riccitiello says it would “take years” for Unity to internally build parts of IronSource’s ad technology, which gives game developers tools to find customers, make their games stickier, and earn money faster.

Unity’s advertising and monetization products, contained in its Operate Solutions unit, have been under pressure ever since Apple made it harder for companies from Meta Platforms Inc. to Snap Inc. to track ad views across mobile devices. Unity created what it thought was a workaround for Apple’s system, but in its latest earnings report, the company forecast lower revenue figures for the second quarter and this year, disappointing investors and suggesting the system wasn’t working. The stock plunged 30% on the report in May.

“Buying IronSource may improve Unity’s capabilities in advertising technology -- a bigger contributor to revenue than the core tools-subscriptions business,” Eileen Segall, a Bloomberg Intelligence analyst, wrote in a research note. “There’s room for ad-tech players to gain share in mobile in-app advertising amid pressure on walled gardens due to Apple’s recent changes to Identifier for Advertisers, which give advertisers fewer signals for targeting.”

Updates:

Merger Vote Set:

—> DPCM Capital, Inc. (XPOA) & D-Wave Quantum (8/2)

Global SPAC Partners Co. (GLSPT) and Gorilla Technology Group completed their merger and the combined company will begin trading as GRRR starting today

—> 88.4% of the subunits were redeemed

Aurora Acquisition Corp’s (AURC) merger with Better.com, which is now the oldest active SPAC deal, takes a step forward with an amended S-4 filing (the last one was ~3 months ago)

—> Barclays has resigned from advising Aurora and Citi resigned from advising Better.

Chardan NexTech Acquisition 2 Corp. (CNTQ) & Dragonfly Energy Corp. filed an updated investor presentation

FoxWayne Enterprises Acquisition Corp. (FOXW) shareholders approved the deadline extension from 7/22 to 10/22 and the SPAC’s ability to extend on a monthly basis for up to three months after the extended date

Viveon Health Acquisition Corp. (VHAQ) and Suneva amended the merger agreement to extend the outside date to 12/31 and reduce the min. cash condition from $50M to $30M

LightJump Acquisition Corporation (LJAQ) shareholders approved the deadline extension from 7/12/22 to 1/12/23

—> 11,032,790 shares were redeemed, leaving ~$28M remaining in trust

Kingswood Acquisition Corp (KWAC) was suspended by NYSE yesterday for not meeting market cap standards (after heavy redemptions) and will be delisted today, “as a result of its failure to maintain an average global market capitalization over a consecutive 30-day trading period of at least $15M”

—> KWAC expects to start trading on the OTC on or around today

SCVX Corp. (SCVX) files a preliminary proxy for an extension that notes: "We have identified a potential business combination target company ... and we are currently in advanced negotiations for an initial business combination involving the Target"

Two (of the many) Lidar De-SPACs are duking it out:

—> “On July 8th, Ouster (OUST) filed a complaint against Velodyne Lidar (VLDR) in the Superior Court of California, alleging multiple claims including intellectual property misappropriation and false advertising.

—> “On June 14, 2022, Velodyne filed a lawsuit against the Company in the District Court for the Northern District of California (Case No. 22-cv-033490) relating to two patents and requested an International Trade Commission proceeding with respect to the same two patents”

Pico, whose SPAC merger with FTAC Athena Acquisition Corp. (FTAA) was terminated in late February this year due to “Pico’s failure to deliver financial information as required”, signs agreement with Golden Gate Capital (who was slated anchor the PIPE, if the SPAC deal went through) for $200M investment to “Accelerate Next Phase of M&A Activity”

New SPACs (S-1s):

1) Vistas Acquisition Company II Inc. (VACX)

$200M, 1/2 warrant

Focus: Tech In Asia Pacific, Europe, and the Middle East

UW: EF Hutton

Previous SPACs: Vistas Acquisition Company II Inc. (VMAC) closed its merger with Anghami (ANGH - trading at $3.71) in February of this year

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

SoundHound AI (SOUN)

S-4 Activity:

S-4:

Viveon Health Acquisition Corp. (VHAQ) & Suneva Medical

S-4/A:

Silver Crest Acquisition Corporation (SLCR) & Tim Hortons China (8th amendment)

Broadscale Acquisition Corp. (SCLE) & Voltus (3rd amendment - exhibits only)

Aurora Acquisition Corp. (AURC) & Better (6th amendment)

Effective:

CHW Acquisition Corp (CHWA) & Wag Labs

DPCM Capital, Inc. (XPOA) & D-Wave Quantum

Upcoming Dates:

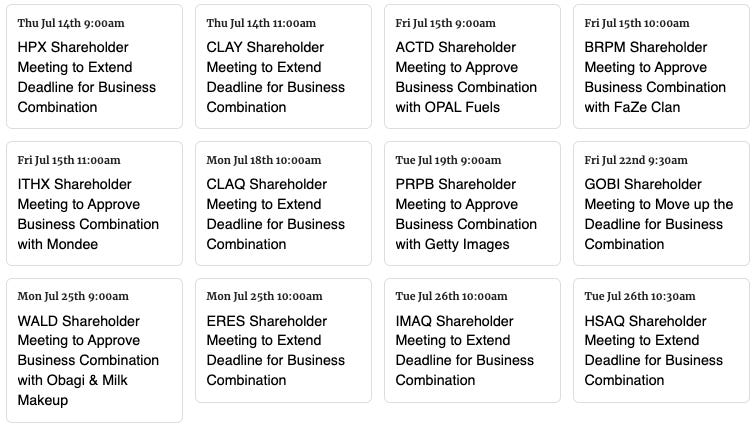

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,