Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 5, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): NLIT -3.1%, DWAC -2.2%

Some De-SPAC Moves (5%+): PGY +13% // REVB -9.6%, FSRD -9.5%, AVCT -7.5%, GROV -5.4%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

1) Health Sciences Acquisitions Corporation 2 (HSAQ) & Orchestra BioMed

Orchestra BioMed is a biomedical company with a business model designed to accelerate high-impact technologies to patients through risk-reward sharing partnerships. Orchestra BioMed’s partnership-enabled business model focuses on forging strategic collaborations with leading medical device companies to drive successful global commercialization of products it develops. Orchestra BioMed’s flagship product candidates include BackBeat Cardiac Neuromodulation Therapy™ for the treatment of hypertension, the leading risk factor for death worldwide, and Virtue® Sirolimus AngioInfusion™ Balloon (SAB) for the treatment of certain forms of artery disease, the leading cause of mortality worldwide. Orchestra BioMed has a strategic collaboration with Medtronic, one of the largest medical device companies in the world, for development and commercialization of BackBeat CNT for the treatment of hypertension in pacemaker-indicated patients, and a strategic partnership with Terumo Corporation, a global leader in medical technology, for development and commercialization of Virtue SAB for the treatment of artery disease.

Valuation: $158.2M Pro-forma Enterprise Value

News:

Gottesman SPAC Dissolution Gets Shareholder Suit to Fold Too (Bloomberg Law)

AST SpaceMobile (ASTS) Announces Agreement to Sell Its Investment in NanoAvionics — The sale is expected to generate approximately $28 million net cash proceeds and close in the third quarter of 2022

How the man behind the Apple Store presided over a Spac catastrophe (FT)

Updates:

FinTech Acquisition Corp V (FTCV) and eToro terminated their merger agreement

The proposed merger, initially announced in March 2021, was conditioned on the satisfaction of certain closing conditions, including relating to the Company’s registration statement, within the timeframe outlined by the Merger Agreement and as extended by the Merger Agreement Amendment. Despite the parties’ best efforts, such conditions were not satisfied within such time frame and the parties were unable to complete the transaction by the June 30, 2022 deadline.

Betsy Cohen, Chairman of FinTech V commented: “eToro continues to be the leading global social investment platform, with a proven track record of growth and strong momentum. Although we are disappointed that the transaction has been rendered impracticable due to circumstances outside of either party’s control, we wish Yoni and his talented team continued success.”

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

SpringBig (SBIG)

S-1/A:

Swvl (SWVL)

S-4 Activity:

S-4/A:

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup (7th amendment)

Broadscale Acquisition Corp. (SCLE) & Voltus (2nd amendment)

Quantum FinTech Acquisition Corporation (QFTA) & TradeStation (2nd amendment)

Effective:

Duddell Street Acquisition Corp. (DSAC) & FiscalNote

Upcoming Dates:

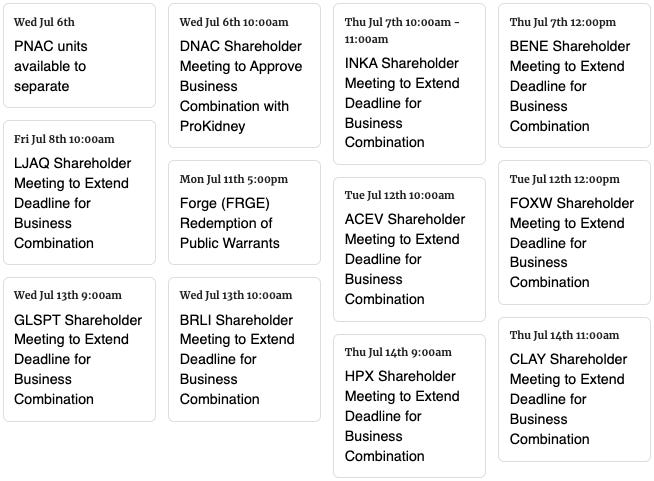

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,