Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (May 27, 2022)

The Stats:

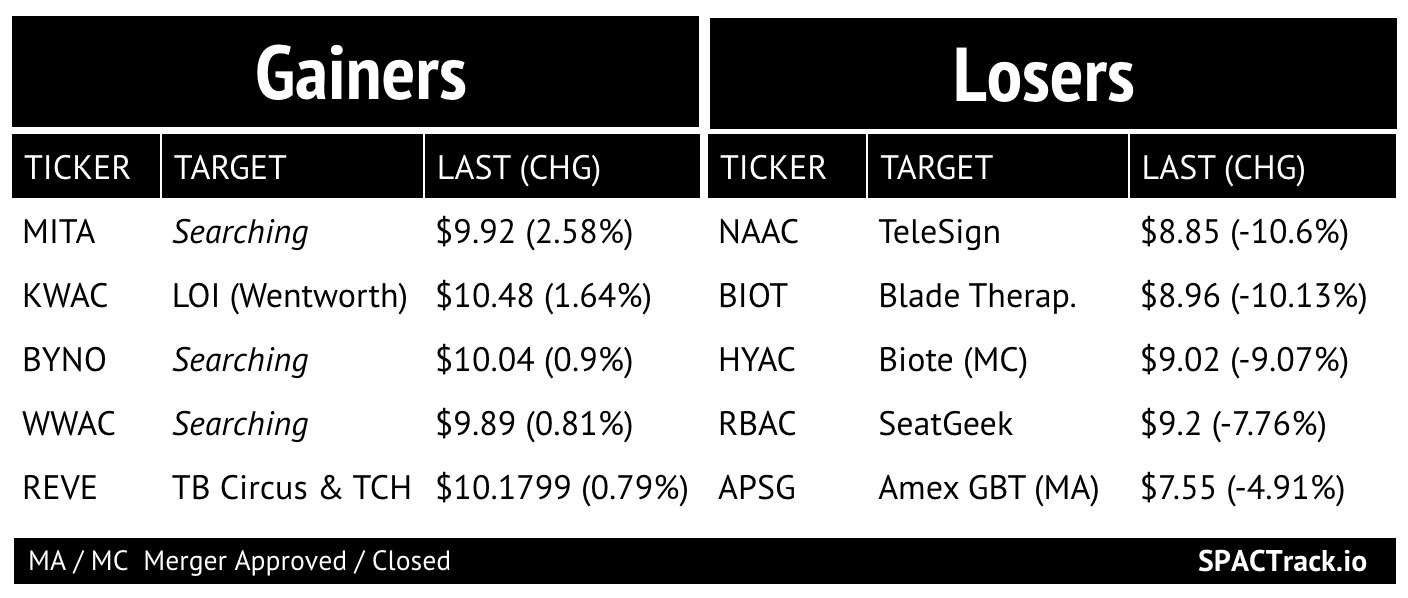

Pre-Market Movers:

Active Moves: UTAA -1.5%

Some De-SPAC Moves: BTMD +14%, LTRY +12%, BIOT +10.5%

Previous Session Movers & Volume Leaders:

The Deals:

Yesterday late morning deal:

1) Goldenbridge Acquisition Limited (GBRG) Auto Services Group (SunCar) (warrants +149% at close to $0.0995)

SunCar, together with its affiliates, provide enterprise clients with digitalized, comprehensive, on-demand and plug-in aftermarket auto services and auto insurance solutions to better serve their end customers. Founded in 2012, SunCar is now a leader in China’s auto service market. SunCar’s solutions and digital systems connected over 1,100 clients and 47,000 sales partners. The Company engages with over 40,000 suppliers and 70 insurance companies, covers over 2500 districts and counties, and serves end customers in most cities in China. All the services are distributed at all times through over 700 sub-systems on the SunCar Cloud, helping its clients better react to their customers’ demands.

Valuation: $858M Pro-forma Enterprise Value

2 Aesther Healthcare Acquisition Corp. (AEHA) & United Gear & Assembly

For nearly 50 years, Hudson Wisconsin-based United Gear has been a supplier of precision gears, shafts, and related assemblies to global OEMs. With a vast combination of production machines, precision measuring tools, and professional skills, United Gear successfully delivers products demanding tighter tolerances, shorter deadlines and greater added value. Its quality control and state of the art manufacturing process create a unified and integrated system. United Gear is ISO/IATF 16949 registered, assuring consistency of product and quality of performance for its customers. We are proud members of the American Gear Manufacturers Association. In 2017, United Gear expanded its prototype department to accommodate a broader range of products.

Updates:

Trepont Acquisition Corp I (TACA) announced it will liquidate effective of 6/10. The redemption price per share is $10.10

Haymaker Acquisition Corp. III (HYAC) completed its merger with Biote and will start trading as BTMD today

Merger vote date updated: EJF Acquisition Corp. (EJFA) & Pagaya Technologies (6/17)

New SPACs (S-1s):

1) ESH Acquisition Corp. (ESH)

$300M, 1 Warrant

Focus: Global entertainment, sports and hospitality sectors

Management:

James Francis (Former CEO of Chesapeake Lodging Trust), Earvin "Magic" Johnson (Former NBA star and Director at Fanatics)

2) Mars Acquisition Corp. (MARX)

$75M, 1/2 W, 1 R (1/10th of a share)

Focus: Artificial intelligence and any other related technology innovations market operating businesses.

Registration Withdrawals:

Sparta Healthcare Acquisition Corp. (SPTA) — registration abandoned

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

PropertyGuru (PGRU)

S-4 Activity:

S-4/A:

B. Riley Principal 150 Merger Corp. (BRPM) & FaZe Clan (3rd amendment)

Provident Acquisition Corp. (PAQC) & Perfect Corp (1st amendment)

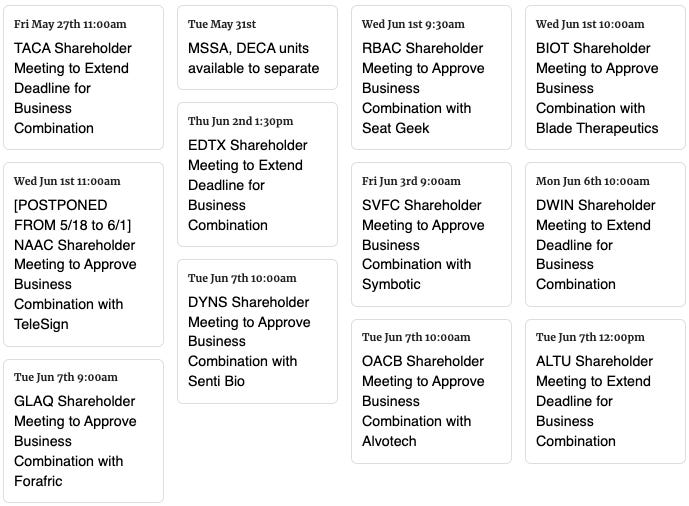

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,