Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (June 1, 2022)

The Stats:

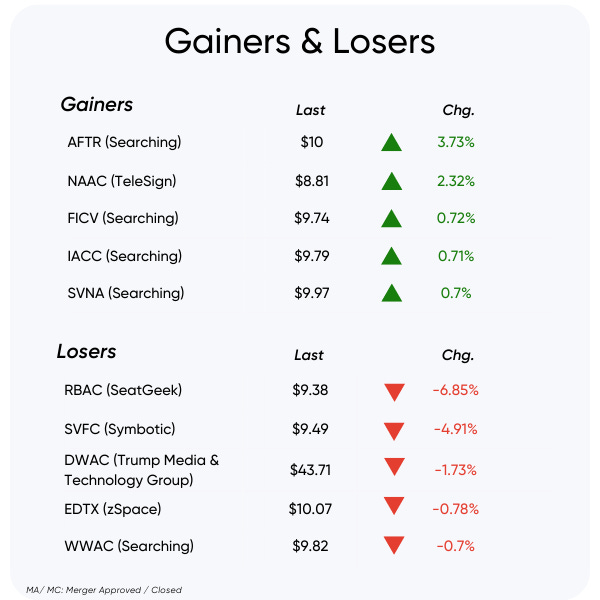

Pre-Market Movers:

Active Moves: NAAC +10.7%, RBAC +6.1%

Some De-SPAC Moves: MLTX -16%, BKSY -10%, BARK -8%, ARQQ -6%, MSPR -5.1%, VIEW +15%, CMRA +11%, BRDS +7%, QNGY +6.8%

Previous Session Movers & Volume Leaders:

The Deals:

Announced yesterday afternoon:

1) Gesher I Acquisition Corp. (GIAC) & Freightos (warrants +65% to $0.34 pre-market)

Freightos Limited, a Cayman Island-registered online global freight booking platform, has expanded its services amid rising demand for supply chain transparency.

Freightos.com is believed to be the largest digital international freight marketplace, connecting logistics providers and importers/exporters for instant pricing, booking, and shipment management with offices globally. Over ten thousand SMBs and enterprise organizations have sourced shipping services via Freightos.

Valuation: $436M Pro-forma Enterprise Value

Additional Financing: $80M in total commitments including:

$10M investment from Qatar Airways, $60M ($40M in units, $10M waived redemption, and $10M backstop commitment) from M&G Investments, and $10M backstop from Composite Analysis Group

2) Americas Technology Acquisition Corp. (ATA) & Rally

Rally is a Mass Mobility as a Service company that has mobilized millions of riders with innovations designed to meet the needs of surge demand and middle mile travel challenges.

Rally’s premier product is the bus rideshare which aggregates individuals going to large events, creating bus trips on-demand. Their algorithms automatically route together crowdsourced bus stops to create productive routes. Additionally, Rally’s “OurBus” product disrupts regularly scheduled intercity bus travel by utilizing data science to create optimized intercity routes and automating the business of buses. Rally does not own or operate any buses and employs no drivers or mechanics.

Valuation: $208M Pro-forma Enterprise Value

Updates:

Magnum Opus Acquisition Limited (OPA) announces the termination of its merger agreement with Forbes, after the outside date of 5/31 passed

OPA intends to continue to search for a merger partner

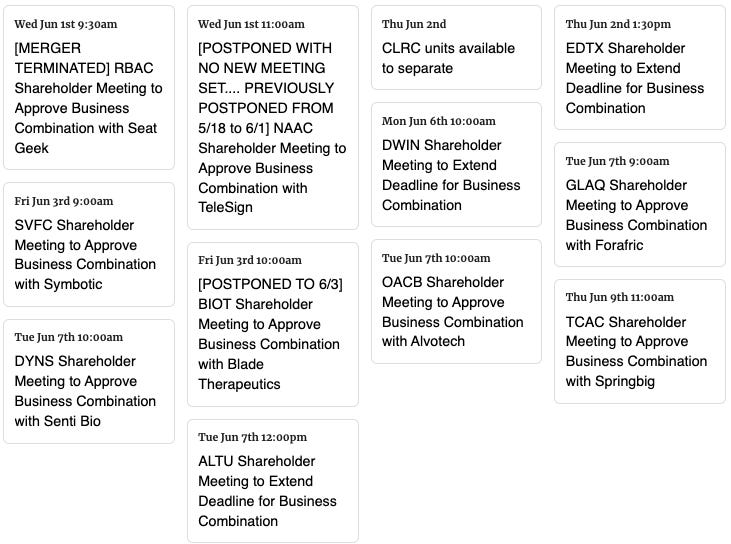

RedBall Acquisition Corp. (RBAC) and SeatGeek announce they have mutually agreed to terminate their merger agreement due to “unfavorable market conditions”. The shareholder meeting to vote on the merger was scheduled for today

North Atlantic Acquisition Corporation (NAAC) postpones its shareholder meeting to vote on its merger with TeleSign that was scheduled for today. No new date has been set. This is the 2nd postponement

Corner Growth Acquisition Corp. 2 (TRON) files for an extension noting that it has entered into a non-binding LOI with “a differentiated food tech platform (the “Target”) for an initial business combination. The Target is a vertically integrated producer of premium bulk grains, value-added ingredients, and CPG goods, driving fundamental change with significant attention around supply chain certainty, food security, plant-based foods and ESG”

Group Nine Acquisition Corp. (GNAC) files an 8-K noting that the sponsor has sold “Class A interests of the Sponsor held by Seller, which economically corresponds to 4,025,000 shares of Class B common stock” to 890 5th Avenue Partners (the team behind the SPAC that brought BuzzFeed public via SPAC merger in December of 2021)

Altus Power, Inc. (AMPS) announced it has entered into privately negotiated warrant exchange agreements with multiple holders of public warrants to purchase shares of its Class A common stock

“981,113 shares of its Class A common stock in exchange for the surrender and cancellation of an aggregate of 4,087,962 Public Warrants, which were previously issued by the Company as part of its initial public offering in December 2020. The exchanges will reduce the total number of outstanding Public Warrants by 40.6%, to 5,974,528 from 10,062,490”

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

SAI.TECH Global (SAI)

Eve (EVEX)

S-4 Activity:

S-4/A:

Far Peak Acquisition Corporation (FPAC) & Bullish (6th amendment)

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,