Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 26, 2022)

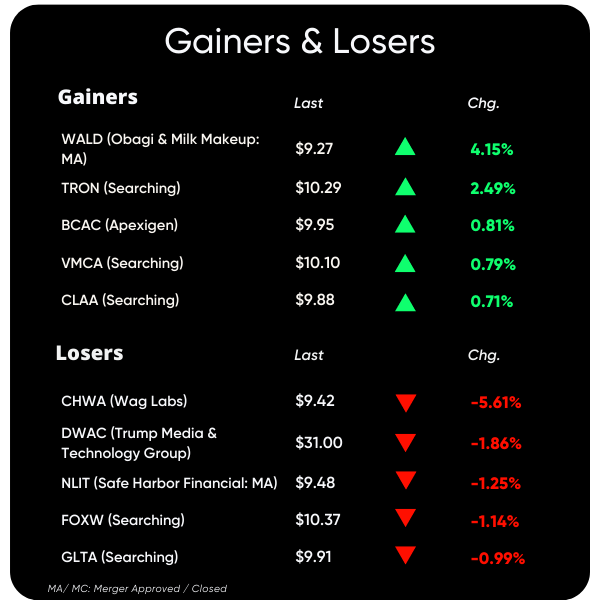

Pre-Market Movers*:

Active SPACs (1%+):

⬆️ —

⬇️ WALD -5.6%

De-SPACs (10%+):

⬆️ PGY +23.4%

⬇️ REVB -47.4%

*at the time of this writing; De-SPACs from 2019-

Previous Session:

Volume Leaders:

$PSTH 14M, $CVII 3.4M, $DSAC 2.7M, $KAHC 1.8M, $RBAC 1.1M, $HTPA 0.9M, $AUS 0.9M, $IPOF 0.9M, $DHHC 0.8M, $ISAA 0.7M

The Deals:

1) DHC Acquisition Corp DHCA 0.00%↑ & GloriFi

GloriFi is a pro-freedom, pro-America, pro-capitalism technology company that will soon offer best-in-class financial services such as credit cards, insurance, mortgages, brokerage, and banking products, empowering members to put their money where their values are and preserve the Country they believe in. Members will soon be able to download a state-of-the-art financial lifestyle app offering personalized news, weather, market data, and insights to help them navigate their finances and make better financial decisions amidst a challenging economy.

Valuation: $1.7B Pro-forma Enterprise Value

Investor Presentation: “Given the Summer Holiday Season, GloriFi intends to Post its Full Investor Presentation After Labor Day.”

2) Lionheart III Corp. LION 0.00%↑ & SecurityMatters

SMX is an enabler for a real-world circular economy that works by giving materials a memory of their origination and history, that facilitates the materials' ability to be recycled, reused, and authenticated multiple times.

Security Matters owns and commercialises technology to permanently and irrevocably mark any object either solid, liquid or gas, allowing identification, proof of authenticity, tracking supply chain movements & quality assurance for countless products in virtually every industry.

Security Matters’ technology comprises a chemical-based hidden"barcode" system, alongside a unique “reader” to identify these codes, and a blockchain record to store and protect ownership data.

Valuation: $200M pre-money equity value

News Coverage: ASX tech small cap snapped up by US SPAC at 15x premium (Financial Review)

News:

Faraday’s FFIE 0.00%↑ future on shaky ground as EV uction delayed again (TechCrunch)

Updates:

Abri SPAC I, Inc. ASPA 0.00%↑ terminated its merger with Apifiny Group

Waldencast Acquisition Corp. WALD 0.00%↑ shareholders approved the merger with Obagi Skincare and Milk Makeup

—> The merger is expected to close on 7/27 with the combined company renamed to Waldencast plc and will continue trading as WALD upon closing

—> 30,021,946 were redeemed or an estimated ~87% of the public SPAC shares

Ventoux CCM Acquisition Corp. VTAQ 0.00%↑ and Presto announce reduced valuation to $525M pre-money and a $60M equity investment from Cleveland Avenue

OCA Acquisition Corp. OCAX 0.00%↑ deposited $0.05 per share to extend its deadline from 7/20/22 to 01/20/23

East Resources Acquisition Company ERES 0.00%↑ shareholders approved the deadline extension from 7/27/22 to 01/27/23 (with monthly deposits of $0.033 per share)

—> 24,781,028 were redeemed or an estimated ~72% of the public SPAC shares

—> ERES deposited $0.033 per share to extend to 8/22

Wag!, announced it will reserve up to 300,000 shares of common stock at the close of its merger with CHW Acquisition Corporation CHW 0.00%↑ for its Community Shares Program, “charitable giving for the community of pet caregivers and for domestic pet nonprofit organizations to be arranged through and administered by Robinhood and DonateStock”

FoxWayne Enterprises Acquisition Corp. FOXW 0.00%↑ releases redemption results from its vote to extend its deadline

—> 4,406,322 shares were redeemed or an estimated 76% of the public SPAC shares

—> FOXW deposited $0.0125 per share into trust to extend from 7/22 to 10/22

In connection with Health Sciences Acquisitions Corporation 2’s HSAQ 0.00%↑ vote to extend its deadline from 8/6 to 11/6: 9,237,883 shares were presented for redemption

—> In addition, RTW Investments, an affiliate of the sponsor, purchased 1M shares at $10.01 per share in a negotiated transaction

More layoffs:

—> Pear Therapeutics PEAR 0.00%↑ will reduce headcount by 9% or appx 25 employees

—> Owlet OWLT 0.00%↑ is letting go of appx 74 employees

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

S-4 Activity:

S-4:

Future Health ESG Corp. FHLT 0.00%↑ & Excelera

S-4/A:

Cartesian Growth Corp GLBL 0.00%↑ & Tiedemann Group and Alvarium Investments (3rd amendment)

Mana Capital Acquisition Corp. MAAQ 0.00%↑ & Cardio Diagnostics (1st amendment)

Kensington Capital Acquisition Corp. IV & KCAC 0.00%↑ Amprius Technologies (1st amendment)

Ventoux CCM Acquisition Corp. VTAQ 0.00%↑ (3rd amendment)

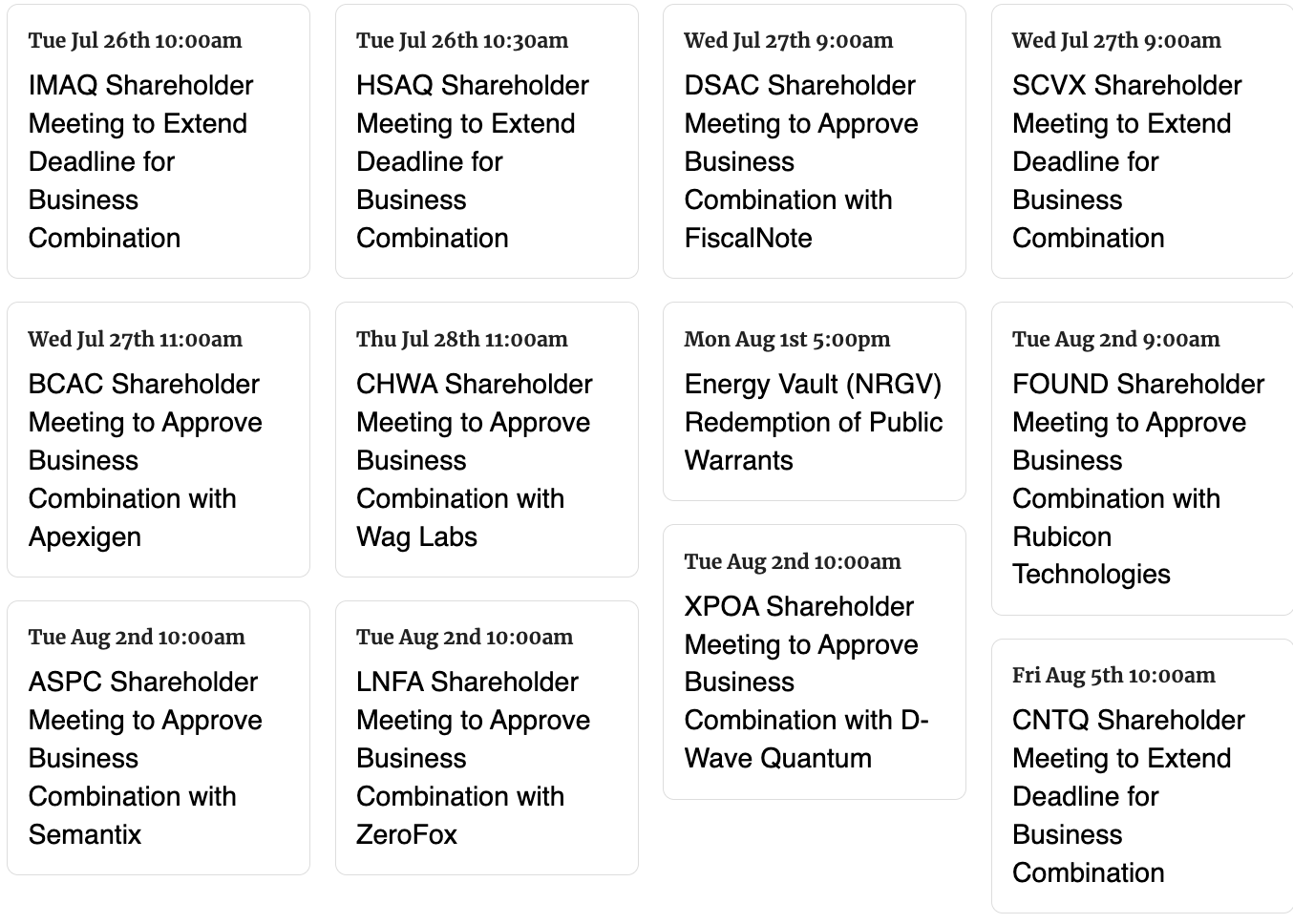

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,