Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (May 26, 2022)

The Stats:

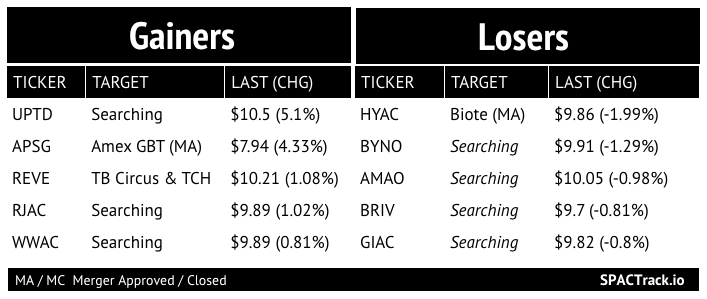

Pre-Market Movers:

CFVI -2%

Previous Session Movers & Volume Leaders:

The Deals:

1) Legato Merger Corp. II (LGTO) & Southland Holdings (warrants +78% to $0.399 after hours)

With roots dating back to 1900, Southland and its subsidiaries, together, make up one of the largest construction companies in North America, with experience throughout the world. The company has built transportation infrastructure that connects our nation, constructed water pipelines and built treatment facilities to carry water across vast regions, bored tunnels through some of the world’s most challenging geology, and completed some of the nation’s most iconic structural landmarks. The Southland family of companies are innovators in construction technology and means-and-methods engineering, bringing unique solutions to challenging construction projects.

Valuation: $810M Pro-forma Enterprise Value

2) Crescent Cove Acquisition Corp. (COVA) & ECARX (warrants +127% to $0.25 after hours)

ECARX is transforming vehicles into seamlessly integrated information, communications and transportation devices. It is shaping the interaction between people and cars by rapidly advancing the technology at the heart of smart mobility. ECARX's current core products include infotainment head units (IHU), digital cockpits, vehicle chip-set solutions, a core operating system and integrated software stack. Beyond this, ECARX is developing a full-stack automotive computing platform. Over the last three years, ECARX's technology has been integrated into more than 3.2 million cars worldwide. ECARX was founded in 2017 and has since grown to over 2,000 team members, with facilities in China and Europe. The co-founders are two automotive entrepreneurs, Chairman and CEO Ziyu Shen and Eric Li (Li Shufu), who is also the founder and chairman of Zhejiang Geely Holding Group (Geely), one of the largest automotive groups in the world that holds ownership interest and investment in international brands such as Lotus, Lynk & Co, Polestar, smart and Volvo Cars.

Valuation: $3.5B Pro-forma Enterprise Value

Updates:

Merger vote set: Gores Guggenheim, Inc. (GGPI) & Polestar (6/22)

Apollo Strategic Growth Capital (APSG) announces shareholders have approved its merger with American Express Global Business Travel

The transaction is expected to close on 5/27

Vivid Seats (SEAT) announces warrant exchange offer and $40M share repurchase program

Warrant holders have the opportunity to receive 0.240 shares of Class A Common Stock in exchange for each warrant

New SPACs (S-1s):

1) Aquaron Acquisition Corp. (AQU)

$50M, 1 Warrant, 1 Right (1/10th of a share)

Focus: New Energy

UW: Chardan

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4:

Bull Horn Holdings Corp. (BHSE) & Coeptis Therapeutics

S-4/A:

26 Capital Acquisition Corp. (ADER) & Okada Manila (3rd amendment)

Edoc Acquisition Corp. (ADOC) & Calidi Biotherapeutics (1st amendment)

Effective:

Gores Guggenheim, Inc. (GGPI) & Polestar

Upcoming Dates:

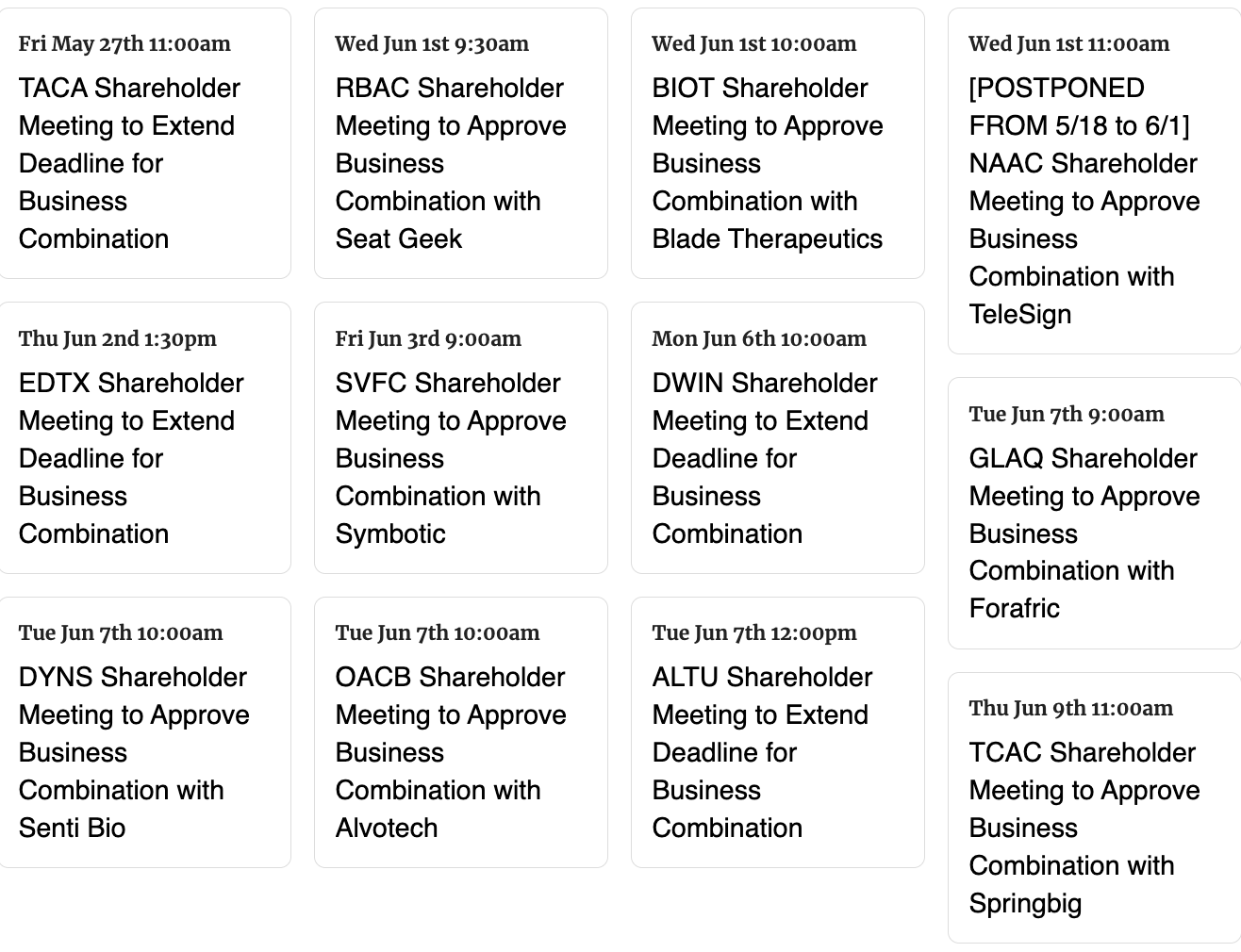

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,