Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 25, 2022)

Active SPAC Pre-Market Movers (1%+)*:

⬆️ WALD +3.2%

⬇️ CHWA -4.3%

De-SPAC Pre-Market Movers (10%+)**:

⬆️ REVB +87.7%, EVEX +14.2%, KERN +9.5%

⬇️ PGY -10.5%

*at the time of this writing

**De-SPACs from 2019-

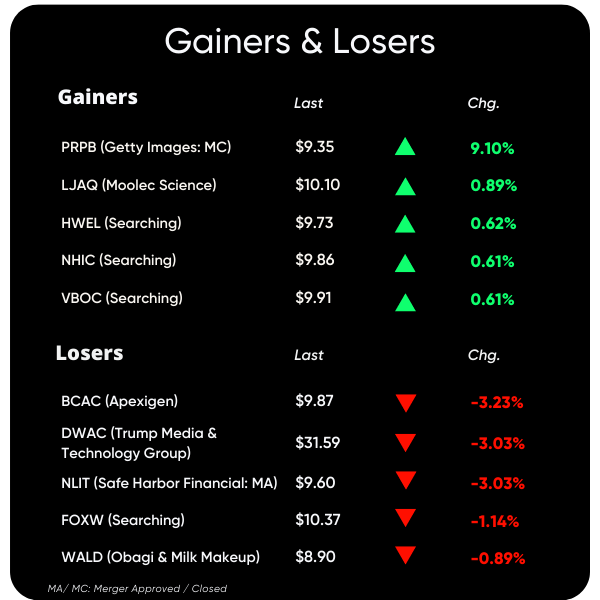

Previous Session Movers & Volume Leaders:

The Deals (2):

1) Frazier Lifesciences Acquisition Corporation FLAC 0.00%↑ & NewAmsterdam Pharma

NewAmsterdam Pharma is a private clinical-stage biopharmaceutical company whose mission is to improve patient care in populations with metabolic diseases where traditional therapies have not been sufficiently successful or well-tolerated. NewAmsterdam is investigating obicetrapib, a next-generation oral, low-dose and once-daily CETP inhibitor, as the preferred LDL-C-lowering therapy for high-risk cardiovascular disease (“CVD”) patients. Results from NewAmsterdam’s ROSE Phase 2b trial (presented at AHA Scientific Sessions in 2021) included observations that patients receiving obicetrapib 10mg experienced reduced LDL-C by 51% versus baseline in patients on statin therapy (vs. a 7% reduction in the placebo arm). Based in the Netherlands, the Company was founded in 2019 by the venture capital firm Forbion and John Kastelein, Chief Scientific Officer of the Company, and closed a $196 million (€160 million) Series A financing in January 2021 led by Forbion, Morningside Ventures and Ascendant BioCapital.

Valuation: $326M Pro-forma Enterprise Value

Additional Financing: $235M upsized PIPE co-led by Frazier Healthcare Partners and Bain Capital Life Sciences

2) DUET Acquisition Corp. DUET 0.00%↑ & AnyTech365

Founded in 2014 and headquartered in Marbella, Spain, AnyTech365 is a leading European IT Security and Support company helping end users and small businesses have a worry-free experience with all things tech. With 420 employees and offices in Marbella and Torremolinos (Spain), Casablanca (Morocco), Copenhagen (Denmark), and San Francisco (California, US), the Company offers an array of European native-speaking talent to help service client needs in more than 25 countries in Europe and across the world in 15+ different languages. Our qualified technicians are available 24/7, 365 days a year, providing fast technical support to help with practically any issues that users may experience with their PC, laptop, smartphone, wearable technology, smart home devices or any Internet-connected device.

Valuation: $200M Pro-forma Enterprise Value

Updates:

CC Neuberger Principal Holdings II PRPB 0.00%↑ completed its merger with Getty Images and will start trading as $GETY starting today

Gobi Acquisition Corp. GOBI 0.00%↑ shareholders approved the amendment to move up its deadline to 7/22/22 from its existing deadline of 7/1/23 so that it can liquidate a year early and thus the SPAC will liquidate

Tony DiMatteo, has resigned as CEO of Lottery .com LTRY 0.00%↑

—> This comes 1 week after the company disclosed it overstated its available unrestricted cash balance & that in the prior year it improperly recognized revenue. Its CRO resigned last week as well. LTRY also announced last week that its CRO resigned

InterPrivate III Financial Partners Inc. IPVF 0.00%↑ and Aspiration amended the merger agreement to, among other things, extend the outside date from 7/22 to 12/31

FaZe Clan FAZE 0.00%↑ releases redemption results from its merger with B. Riley Principal 150 Merger Corp. (BRPM)

—> 15,883,395 shares were redeemed, or an estimated ~92% of the public SPAC shares

Ginkgo Bioworks DNA 0.00%↑ to acquire Zymergen ZY 0.00%↑ in an all-stock deal that values the company at ~$300M

—> Zymergen's April 2021 IPO raised $500M at a market cap of around $3B

In addition, Ginkgo also announced it will acquire Bayer’s 175,000-square-foot West Sacramento Biologics Research & Development site, team, “and internal discovery and lead optimization platform” for $83M “in shares of its Class A common stock and/or cash”

New SPACs (S-1s):

No new S-1s

Registration Withdrawals

Virgin Group Acquisition Corp. III (VIII)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

*when applicable

S-4 Activity:

S-4/A:

Cleantech Acquisition Corp. CLAQ 0.00%↑ & Nauticus (7th amendment)

Upcoming Dates:

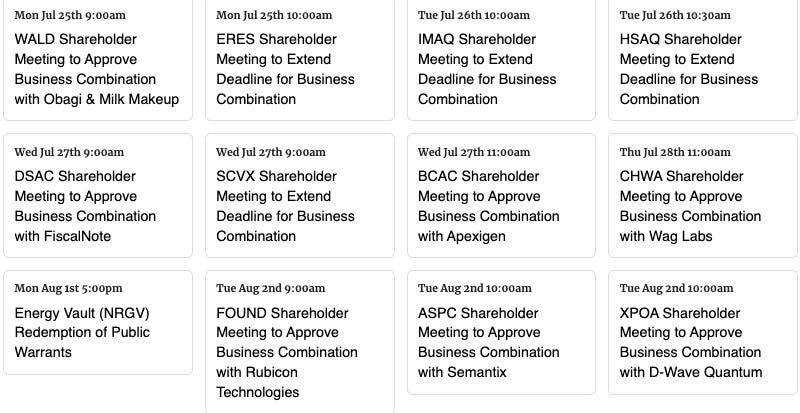

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,