Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (June 8, 2022)

The Stats:

Pre-Market Movers*:

Active Moves (1%+): DYNS +6.3%

Some De-SPAC Moves (5%+): RDBX +21.9%, FSRD +10.2%, KPLT +9.7%, MLTX +6.2%, KIND +6.2%, OWLT +5.9%, CRXT -5.3%

*as of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Better.com Misled Investors Ahead of Stalled SPAC Deal, Former Executive Alleges (WSJ)

In her complaint, filed Tuesday in federal court in Manhattan, Ms. Pierce says Mr. Garg and the company’s alleged misrepresentations were made in an effort to keep its merger [with Aurora Acquisition Corp. (AURC)] on track. Ms. Pierce’s complaint alleged Mr. Garg and Better.com’s treatment of her constituted unlawful retaliation, defamation and intentional infliction of emotional distress.

The company lost $304 million last year, according to company filings. Last winter, Mr. Garg allegedly told the company’s board and investors that the company would become profitable again by the end of the first quarter in 2022, according to the lawsuit. Ms. Pierce said her operations team, in partnership with the company’s finance department, had presented internal projections to Mr. Garg that showed the company couldn’t expect to break even until at least the second half of this year.

The lawsuit contains colorful remarks allegedly made by Mr. Garg. He allegedly replaced one of the words in the acronym for the accounting phrase, GAAP, or “generally accepted accounting principles” with a profanity. He told other executives at Better.com that interest rates would stay low because President Biden would contract Covid-19 and die, according to the suit. Another former Better.com executive said they also remembered the GAAP comments and Mr. Garg’s expectations that unforeseen events would keep rates low.

Akulaku to increase stake in Indonesian digibank to 40% (Tech in Asia)

Fintech lender Akulaku is set to increase its ownership at Bank Neo Commerce – an Indonesian digital bank – to around 40% or more, reported DealStreetAsia, citing a statement from the former’s CEO William Li.

According to Li, Akulaku is raising funds ahead of a planned IPO. In January, Bloomberg reported that the company was in early talks with Patrick Grove’s SPAC [Catcha Investment Corp (CHAA)] for a US listing this year.

The fintech firm is also aiming to consolidate its wealth management and insurance businesses.

Based on a disclosure to the Indonesian stock exchange, Akulaku owned a 25.7% stake in Bank Neo Commerce as of May 23. Launched in March 2021, the digital bank currently has around 13 million users in the country.

Cazoo (CZOO) to cut 750 jobs in UK and across Europe amid recession fears (The Guardian)

Bird (BRDS) is laying off 23% of staff (TechCrunch)

Updates:

Tribe Capital Growth Corp I (ATVC) Tribe Capital Growth Corp, led by Arjun Sethi- a former partner at Social Capital and features Anthony Pompliano as an advisor, is handing the reigns of the SPAC over to their co-sponsor, Arrow Capital

Americas Technology Acquisition Corp (ATA) files the investor presentation for its merger with Rally

Oaktree Acquisition Corp. II (OACB) shareholders approved the merger with Alvotech

Dynamics Special Purpose Corp. (DYNS) shareholders approved the merger with Senti Bio

14,549,537 shares were redeemed or an estimated ~63% of the public SPAC shares. 7.96M shares were subject to non-redemption agreements

Delwinds Insurance Acquisition Corp. (DWIN) shareholders approved the extension of the deadline from 6/15 to 9/15 and DWIN will add $0.035 per remaining public share for each month

9,077,422 shares were redeemed or an estimated ~45% of the public SPAC shares

SVF Investment Corp. 3 (SVFC) completes its merger with Symbotic with the combined company set to trade as SYM starting today

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

Anghami (ANGH)

Super Group (SGHC)

S-4 Activity:

S-4/A:

ITHAX Acquisition Corp. (ITHX) & Mondee (3rd amendment)

Upcoming Dates:

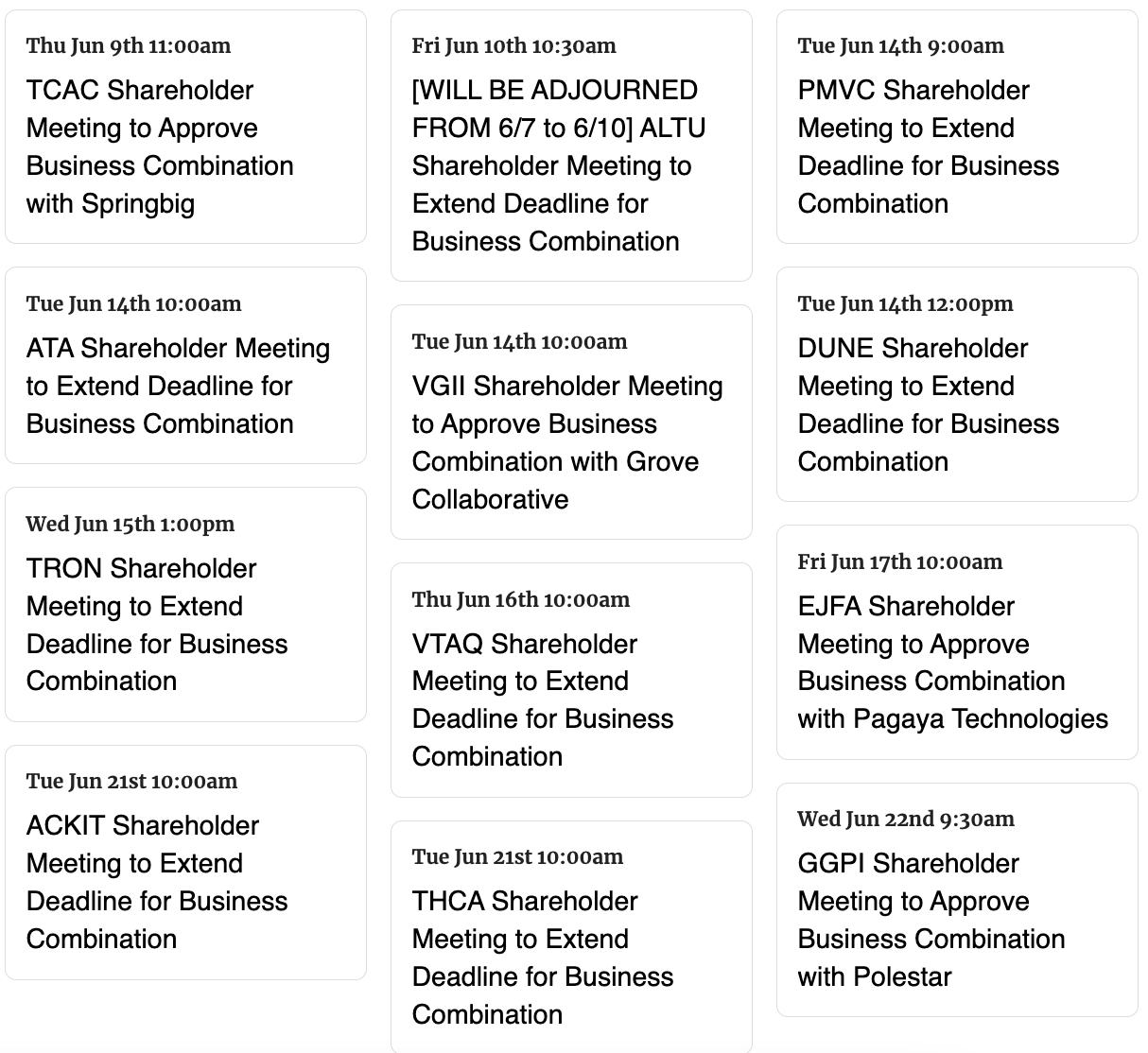

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,