Morning Update from SPAC Track

Pre-market recap of the action in the SPAC world for SPAC Track's premium subscribers. (July 19, 2022)

The Stats:

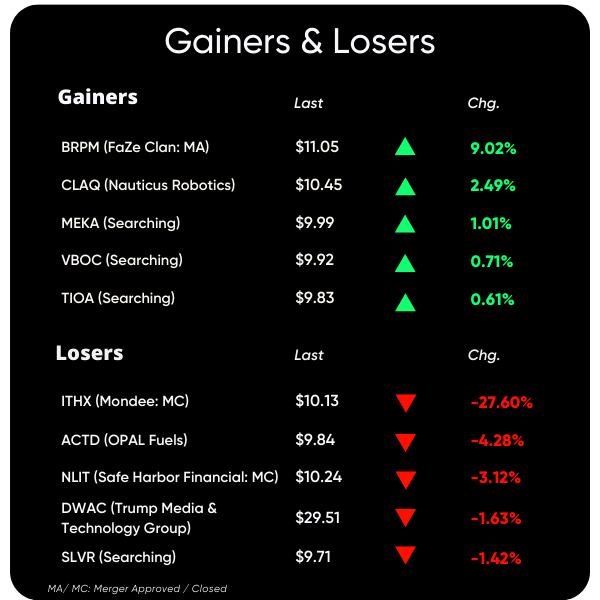

Pre-Market Movers*:

Active Moves (1%+): DWAC 0.00%↑ -2.7%

Some De-SPAC Moves (5%+): KERN 0.00%↑ -5.8%, CLNN 0.00%↑ -6.2%, LMDX 0.00%↑ -7.3% // QNGY 0.00%↑ +6.3%, VLD 0.00%↑ +6.7%, MSPR 0.00%↑ +9%

*at time of this writing

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

DWAC 0.00%↑ Word of Trump Media Deal Is Said to Have Leaked Months in Advance (The New York Times)

Updates:

ArcLight Clean Transition Corp. II ( ACTD 0.00%↑ ) entered into a FPA with Meteora Capital Partners in which Meteora can elect to sell OPAL up to 2M shares at $10.02 per share 6 months after the merger closes, provided that Meteora has acquired at least 1.9M shares from redeeming shareholders

ITHAX Acquisition Corp. (ITHX) completed its merger with Mondee and will trade as $MOND starting today

—>Mondee Holdings, Inc. also received a notice from Nasdaq that due to high redemptions, it is out of compliance with its minimum $20M market value and the minimum number of unrestricted publicly held shares. MOND has until 7/25 to request a hearing before delisting on 7/27

Akerna Corp. ( KERN 0.00%↑ ), which completed its SPAC merger in 2019 and is now trading at $0.17, filed a preliminary proxy for a shareholder meeting in which it seeks to effect a reverse stock split of 1-to-20

Gorilla Technology ( GRRR 0.00%↑ ) releases official redemption numbers from its merger with Global SPAC Partners Co. (GLSPT):

—> 11,440,338 shares were redeemed, or an estimated ~89% of the public SPAC shares, at $10.21 per share

SolarMax Technology files its IPO registration ( $SMXT ) to raise $30M at a roughly $190M valuation. The solar energy co announced a merger deal with Alberton Acquisition Corp (ALAC) in Oct 2020 at a $300M valuation. The deal was terminated in April, followed by Alberton's liquidation

InterPrivate III Financial Partners Inc. ( IPVF 0.00%↑ ) and Aspiration amend the merger agreement to extend the outside date from 7/19/22 to 7/22/22

Alpine Acquisition Corporation ( REVE 0.00%↑ ) announces it will issue a dividend of 0.665 shares for each public share to holders that do not redeem on the day after the closing of the merger with Two Bit Circus and acquisition of two convention hotels (from affiliates of Atrium Hospitality)

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

S-1/A:

S-4 Activity:

S-4/A:

Software Acquisition Group Inc. III ( SWAG 0.00%↑ ) & Nogin (3rd and 4th amendments)

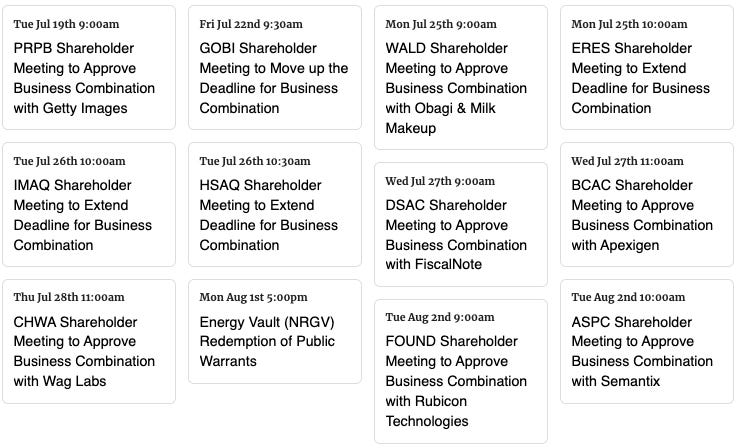

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,