Nightcap: 3 more SPAC merger completions, but the IPOs continue to outpace

Nightly recap of the day's SPAC highlights (July 1st, 2021)

Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

If you find that this newsletter keeps you informed of SPAC news, please consider sharing it with a friend or colleague and suggest they subscribe!

Another 4 IPOs began trading today. 2 closed the day below $10, while the other 2 closed at $10 and slightly above.

The (bowling) ball has certainly been rolling with 3 merger completions today and a total of 9 on the week. However, there have been 13 SPAC IPOs this week. For the month of June, there were 26 merger completions with a total of 31 IPOs.

This brings the total number of currently active SPACs to 577, of which 426 are searching for a merger partner.

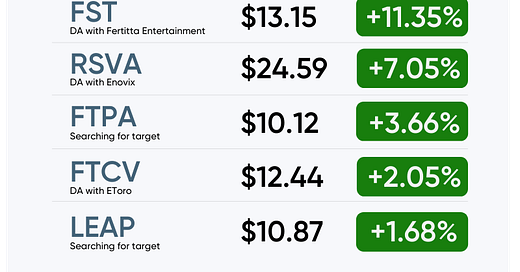

The Stats:

The Deals:

1) Isos Acquisition Corp (ISOS: $9.92) & Bowlero

Bowlero, World’s Largest Owner and Operator of Bowling Centers and Owner of the Professional Bowlers Association, to List on NYSE Through Merger With Isos Acquisition Corporation (Press Release)

Merger Partner Description:

Bowlero Corp is the worldwide leader in bowling entertainment, media, and events. With more than 300 bowling centers across North America, Bowlero Corp serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. In 2019, Bowlero Corp acquired the Professional Bowlers Association, the major league of bowling, which boasts thousands of members and millions of fans across the globe.

Valuation: $2.6B EV

Financing: $450M fully committed “consisting of convertible preferred and common stock has been secured in consideration for $345 million in cash and $105 million of Atairos’ existing equity in Bowlero, anchored by investors including funds managed by affiliates of Apollo Global Management, Inc., Brigade Capital Management, Soros Fund Management LLC, The Donerail Group LP and Wells Fargo Asset Management”

$250M PIPE

$105M exchange common equity for convertible preferred

$95M convertible preferred issued for shares

Bowlero Investor Presentation

Quick News Corner:

Apex Technology Acquisition Corp (APXT: $12.11) completes its merger with AvePoint. APXT will trade AVPT starting tomorrow.

Falcon Capital Acquisition Corp. (FCAC: $9.00) completes its merger with Sharecare. FCAC will trade SHCR starting tomorrow.

Kismet Acquisition One Corp (KSMT: $9.94 + 0.3%), merger partner, Nexters, estimates year-on-year revenue growth of 48% in Q1 20201 and raises forecasts

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits:

Friday, July 2nd

Unit Split: Orion Biotech Opportunities Corp. (ORIA-U: $10.00)

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,