Nightcap: Sad City for XPOA, while Churchill & Lucid celebrate the end of the CCIV saga

Nightly recap of the day's SPAC highlights (July 23, 2021)

Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

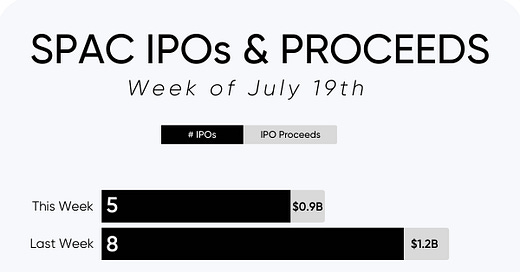

The Weekly Stats:

The Stats:

If you find that this newsletter keeps you informed of SPAC news, please consider sharing it with a friend or colleague and suggest they subscribe!

The Deals (2):

1) Dragoneer Growth Opportunities Corp. II (DGNS: $9.95) & Cvent

Cvent, a Leading Enterprise Event Technology Provider, to Become Publicly Traded After Combining with Dragoneer Growth Opportunities Corp. II (Press Release)

Merger Partner Description:

Cvent is a leading meetings, events, and hospitality technology provider with nearly 4,000 employees and more than 200,000 users worldwide. Founded in 1999, the company delivers a comprehensive event marketing and management platform and offers a global marketplace where event professionals collaborate with venues to create engaging, impactful experiences. Cvent is headquartered in McLean, Virginia, just outside of Washington D.C., and has additional offices in London, Frankfurt, Dubai, Melbourne, New Delhi, and Singapore among others, to support its growing global customer base. The comprehensive Cvent event marketing and management platform offers software solutions to event organizers and marketers for online event registration, venue selection, event marketing and management, virtual and onsite solutions, and attendee engagement.

Valuation: $5.3B Pro-forma EV

PIPE: $575M including $50M FPA from Dragoneer

Cvent Investor Presentation

2) Bridgetown 2 Holdings Limited (BTNB: $9.94) & PropertyGuru

PropertyGuru, Southeast Asia’s Leading Digital Property Marketplace Group, Plans to Go Public in Partnership with Bridgetown 2 (Press Release)

Merger Partner Description:

PropertyGuru Group is Southeast Asia’s leading property technology company1 and the preferred destination for 37 million property seekers to find their dream home, every month. PropertyGuru and its group companies empower property seekers with more than 2.8 million real estate listings, in-depth insights, and solutions that enable them to make confident property decisions across Singapore, Malaysia, Thailand, Indonesia, and Vietnam.

Valuation: $1.35B Pro-forma EV

PIPE: $100M including investments from Baillie Gifford, Naya, REA Group, Akaris Global Partners, and one of Malaysia’s largest asset managers

Additional Financing: $32M equity investment from REA Group

PropertyGuru Investor Presentation

Deal News:

Jam City Ends SPAC Deal That Would Have Made $1.2 Billion Firm (Bloomberg article behind paywall)

Mobile entertainment company Jam City Inc. has called off its plan to go public through a combination with a blank-check firm that would have valued the combined company at $1.2 billion.

Jam City and special purpose acquisition company DPCM Capital Inc. (XPOA: $9.85) said in a joint statement Friday that they were terminating their merger agreement because of current market conditions. DPCM Capital will evaluate merger targets, according to the statement.

As part of that transaction, Jam City had planned to acquire Montreal-based game publisher Ludia Inc., Jam City and DPCM Capital said in May when they announced their agreement. Ludia, which makes games based on the “Jurassic World” movies, was valued at $175 million in the takeover, the companies said.

“We’ve proven our ability to acquire new companies and we’ve proven our ability to build great mobile entertainment experiences in-house,” Jam City Chief Executive Officer Chris DeWolfe said in an interview at the time. “We want to fuel that growth -- we need more capital to do that, and we need a public currency to do that.”

Like virtually all its peers, the developer behind mobile games such as Cookie Jam and Disney Pop Town benefited from the home-entertainment surge during the coronavirus pandemic. Shares of gaming platform Roblox Corp. have climbed 27% from the opening trades when it went public in a direct listing in March.

The SPAC’s Press Release announcing the deal termination:

DPCM Capital, Inc., a publicly traded special purpose acquisition company, and Jam City, Inc., a leading mobile entertainment company behind some of the world’s highest grossing and most enduring mobile games, today announced that both companies have mutually agreed to terminate the previously announced business combination agreement, effective immediately. In light of current market conditions, DPCM Capital and Jam City believe that terminating the business combination agreement is the best path forward for the parties and their respective stockholders. DPCM Capital intends to continue to pursue a business combination and is proceeding to evaluate alternative business combinations.

Quick News Corner:

Churchill Capital Corp IV (CCIV: $24.25) completes its merger with Lucid Motors. The company is renamed Lucid Group and will start trading as LCID on Monday.

New S-1s

None today!

Upcoming Dates:

Next Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Tuesday, July 27

Merger Meetings:

Capitol Investment Corp. V (CAP: $9.65) & Doma

Roth CH Acquisition II Co (ROCC: $9.59) & Reservoir Media

Wednesday, July 28

Merger Meetings:

Nebula Caravel Acquisition Corp. (NEBC: $10.00) & Rover

Starboard Value Acquisition Corp. (SVAC: $9.92) & Cyxtera Technologies

Thursday, July 29

Merger Meetings:

Dragoneer Growth Opportunities Corp. (DGNR: $9.98) & CCC Intelligent Solutions

Reinvent Technology Partners Z (RTPZ: $9.98) & Hippo

Friday, July 30

Merger Meeting: Tailwind Acquisition Corp. (TWND: $9.82) & QOMPLX (Adjourned from 7/20)

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,