Nightcap: SEC Charges SPAC for Misleading Disclosures (and a Panini Deal)

Nightly recap of the day's SPAC highlights (July 13, 2021)

Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

If you find that this newsletter keeps you informed of SPAC news, please consider sharing it with a friend or colleague and suggest they subscribe!

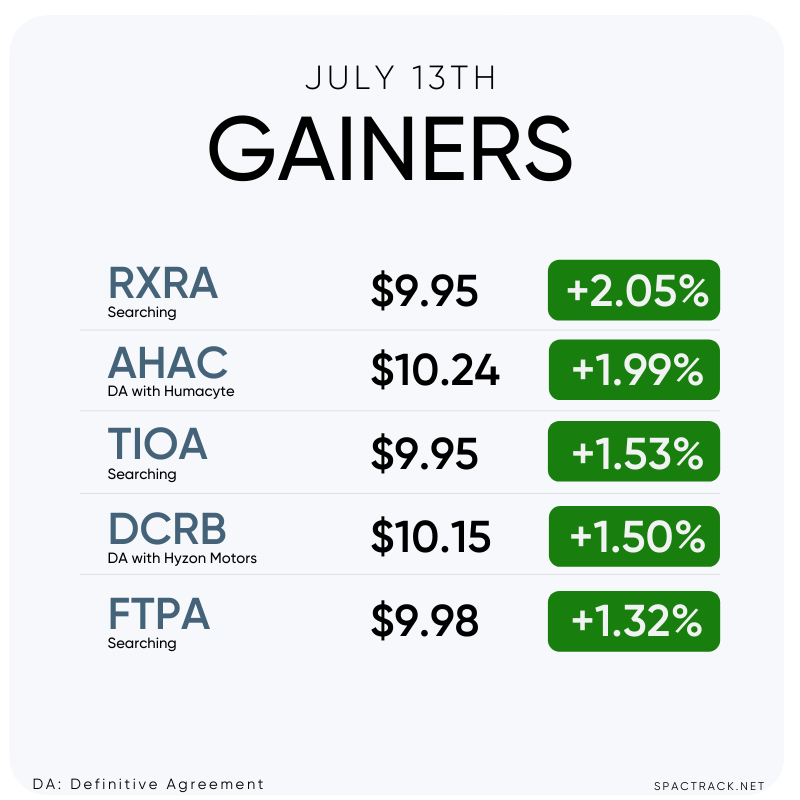

The Stats:

The Deals:

1) CBRE Acquisition Holdings, Inc. (CBAH: $9.96) & Altus Power

Altus Power, Inc., a Market-Leading Clean Electrification Company, Announces Business Combination with CBRE Acquisition Holdings, Inc.; Combined Company Expected to Be Listed on New York Stock Exchange (Press Release)

Merger Partner Description:

Altus Power, based in Greenwich, Connecticut, is creating a clean electrification ecosystem, serving its commercial, public sector and community solar customers with locally-sited solar generation, energy storage, and EV-charging stations across the U.S. Since its founding in 2009, Altus Power has developed or acquired more than 200 distributed generation facilities totaling in excess of 265 megawatts from Vermont to Hawaii.

Valuation: $1.62B Pro-forma EV

PIPE: $275M fully-committed common stock PIPE, anchored by CBRE Group, Inc. and existing investors, Altus Power management and Blackstone Credit, as well as new investors, including ValueAct Capital, Liberty Mutual Investments

Altus Power Investor Presentation

2) Ivanhoe Capital Acquisition Corp. (IVAN: $10.01) & SES Holdings

SES, a Lithium-Metal battery supplier for electric vehicles, to list on NYSE via combination with Ivanhoe Capital Acquisition Corp. (Press Release)

Merger Partner Description:

SES is the world leader in development and manufacturing of high-performance Li-Metal batteries for automotive and transportation applications. Founded in 2012, SES is an integrated Li-Metal battery manufacturer with strong capabilities in material, cell, module, AI-powered safety algorithms, and recycling. Formerly known as SolidEnergy Systems, SES is headquartered in Singapore and has operations in Boston, Shanghai and Seoul.

Valuation: $2.68B Pro-forma EV

PIPE: $200M including investments from General Motors, Hyundai Motor Company, Geely Holding Group, Kia Corporation, SAIC Motor, Koch Strategic Platforms, LG Technology Ventures, Foxconn, Vertex Ventures, Fidelity Investments Canada ULC (certain funds), and Franklin Templeton

SES Holdings Investor Presentation

Deal News Reports:

A-Rod’s Slam SPAC Is in Merger Talks With Italy’s Panini Group (article behind paywall)

Alex Rodriguez’s blank-check firm Slam Corp. (SLAM: $9.77) is in talks to merge with Panini SpA, which makes sports stickers, cards and other collectibles traded by fans around the world, according to a people with knowledge of the matter.

A transaction is set to value the combined entity at $3 billion or more, the person said. Due diligence is in progress and it’s possible terms change or a deal isn’t consummated.

Panini was founded six decades ago in Modena, Italy, and has been weighing a potential sale, Bloomberg News reported in February. It has sold stickers for every FIFA World Cup since the 1970 tournament in Mexico and huddles of collectors trading cards are a familiar sight ahead of major competitions. Complete Panini sticker collections and rare single-card items can demand high prices in the collectors’ market, and the company surpassed $1 billion of annual sales in 2018.

A representative for Panini Group couldn’t immediately be reached for comment. A Slam spokesperson declined to comment.

Slam, a special purpose acquisition company formed in partnership between Rodriguez’s investment firm A-Rod Corp. and hedge fund Antara Capital LP, raised $575 million in a February initial public offering. It said in listing documents that it’ll focus on acquisition targets in the sports, media, entertainment, health and wellness and consumer technology sectors.

Another collectibles specialist, The Topps Co., in April agreed to go public through a merger with Mudrick Capital Acquisition Corp. II.

Panini in January signed a licensing agreement with UFC to become the mixed martial arts organization’s trading card partner. The company at the time touted its direct-to-consumer “Panini Instant” platform which makes trading cards of key sporting events available hours after they occur. Panini has said it holds licenses for other sporting codes including the NFL, NBA, FIFA, Disney and Epic Games.

Quick News Corner:

The SEC announces charges for Stable Road Acquisition Corp (SRAC: $11.88) for “Misleading Disclosures Ahead of Proposed Business Combination”.

Momentus and Stable Road consent to pay $8M in fines, forfeit 250k founder shares and give PIPE investors the ability to terminate their subscription agreement

Landcadia Holdings III, Inc. (LCY: $11.93) shareholders approve merger with Hillman Group

Behind the Lordstown (RIDE: $8.75) Debacle, the Hand of a Wall Street Dealmaker (article behind paywall)

How To Conjure A $20 Billion Fortune Using A SPAC (LCAP: $10.08)

New S-1s (1)

1) Global Technology Acquisition Corp. I (GTAC)

$150M, 1/2 warrant

Focus: Technology companies that operate in the marketplace, FinTech and SaaS verticals within Europe, Latam, and the U.S.

Management:

Fabrice Grinda (Co-Founder & MP of FJ Labs, Co-founder & Co-CEO of OLX, and Co-founder & CEO of Aucland)

Directors:

Juan Villalonga (Former Executive Chairman & CEO of Telefónica Group and Co-founder & Partner at Hermes Growth Partners)

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Wednesday, July 14th

Empower Ltd. (EMPW: $10.08) Shareholder Meeting to Approve Business Combination with Holley

Sandbridge Acquisition Corporation (SBG: $9.08) Shareholder Meeting to Approve Business Combination with Owlet

GX Acquisition Corp (GXGX: $9.75) Shareholder Meeting to Approve Business Combination with Cellularity

Thursday, July 15th

NewHold Investment Corp (NHIC: $9.83) Shareholder Meeting to Approve Business Combination with Evolv Technologies

Decarbonization Plus Acquisition Corporation (DCRB: $10.15) Shareholder Meeting to Approve Business Combination with Hyzon Motors

Friday, July 16th

FG New America Acquisition Corp. (FGNA: $10.12) Shareholder Meeting to Approve Business Combination with OppFi

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,