Nightcap: SoftBank SPAC reportedly shunned for higher valuation in private markets while Momentus agrees to a halvening

Nightly recap of the day's SPAC highlights (June 29th, 2021)

Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

Subscribe to the free nightly newsletter here:

The Stats:

The Deals:

1) FS Development Corp. II (FSII: $9.99) & Pardes Biosciences

Pardes Biosciences and FS Development Corp. II Announce Merger Agreement Creating Publicly Listed Biopharmaceutical Company Advancing Oral Antiviral Drugs to Treat and Prevent SARS-CoV-2 Infections (Press Release)

Merger Partner Description:

Pardes Biosciences is an agile biopharmaceutical company committed to solving some of the world’s most pressing public health challenges. Pardes leverages structure-based drug design and a tunable, reversible covalent chemistry platform for novel drug discovery. The company’s lead product candidate, PBI-0451, is being developed as a potential direct-acting, oral antiviral drug to treat and prevent SARS-CoV-2 infections.

Valuation: $658M post-money equity value

PIPE: $75M led by Foresite Capital, with investments from Gilead Sciences, RA Capital Management, and Frazier Life Science

Pardes Biosciences Investor Presentation

1) Trebia Acquisition Corp. (TREB: $9.93) & System1

System1, a Leading Omnichannel Customer Acquisition Platform, to Become a Publicly Listed Company Through a Business Combination With Trebia Acquisition Corp. (Press Release)

Merger Partner Description:

System1 combines best-in-class technology & data science to operate the world’s most advanced Responsive Acquisition Marketing Platform (RAMP). System1’s RAMP is omni-channel and omni-vertical, and built for a privacy-centric world. RAMP enables the building of powerful brands across multiple consumer verticals, the development & growth of a suite of privacy-focused products, and the delivery of high-intent customers to advertising partners.

Valuation: $1.44B EV

PIPE: No PIPE

Additional Financing: Backstop of $200M equity commitment from Cannae Holdings and $218M in BofA Securities debt commitment

System1 Investor Presentation

Deal News Reports:

1) SoftBank SPAC hunts new merger partner as Mapbox deal falters

Sky News has learnt that SVF Investment Corp. 3 (SVFC: $9.92) - a special purpose acquisition company (SPAC) listed in New York - and Mapbox aborted discussions in recent weeks.

Banking sources said that Mapbox had decided to secure funding in the private markets at a higher valuation after the SoftBank SPAC sought to cut the price of its target to around $1.5bn.

The company, which initially supplied mapping data to international development organisations such as the World Bank and the United Nations, has grown from a Washington DC garage in 2010 to a 500-person business with offices around the world.

It competes with the likes of Google Maps in the provision of sophisticated mapping tools to 600 million monthly users globally.

Its products are used by tech giants including Adobe, IBM and Instacart.

Insiders said that the SoftBank Vision Fund remained a supportive private shareholder in Mapbox.

They added that the SPAC had sought to reduce Mapbox's valuation as part of the merger talks as a result of wider sentiment in the public markets rather than an attempt to improve SoftBank's economics in the deal.

IPOs to Begin Trading Tomorrow*:

1) Shelter Acquisition Corp I (SHQA-U)

$200M, 1/2 warrant

Focus: Proptech

Directors:

Anthony Foxx (Former US Secretary of Transportation and Chief Policy Officer of Lyft)

David Panton (Co-founder & Partner at Navigation Capital Partners)

2) Mountain Crest Acquisition Corp. IV (MCAF-U)

$50M, 1 R (1/10th of a share)

Sponsor’s Previous SPAC Activity: Mountain Crest Acquisition Corp (MCAC) merged with PLBY Group (PLBY; Formerly Playboy Enterprises) in February. PLBY closed the day at $39.27.

3) Thunder Bridge Capital Partners IV, Inc. (THCP-U)

$225M, 1/5 warrant

Focus: Financial Services

Directors:

David Mangum (Former COO of Global Payments, and Former CFO of CheckFree Corporation)

Advisors:

Pete Kight (Founder, Former Chairman, & CEO of CheckFree Corporation, Former Director & Vice Chairman of Fiserv, and Director of Bill.com)

Sponsor’s Previous SPAC Activity: Thunder Bridge Acquisition II (THBR) merged with indie Semiconductor (INDI: $10.08) earlier this month.

*Priced at the time of this writing

Quick News Corner:

Virtuoso Acquisition Corp. (VOSO: $9.91) and its merger partner, Wejo, announce an additional $25M PIPE investment by Microsoft and Sompo, bringing the total PIPE proceeds to $125M.

Climate Change Crisis Real Impact I Acquisition Corp (CLII: $15.36) shareholders approve merger with EVgo. CLII is expected to begin trading as EVGO on July 2nd.

Falcon Capital Acquisition Corp. (FCAC: $10.00) shareholders approve merger with Sharecare. FCAC is expected to begin trading as SHCR on or around July 2nd.

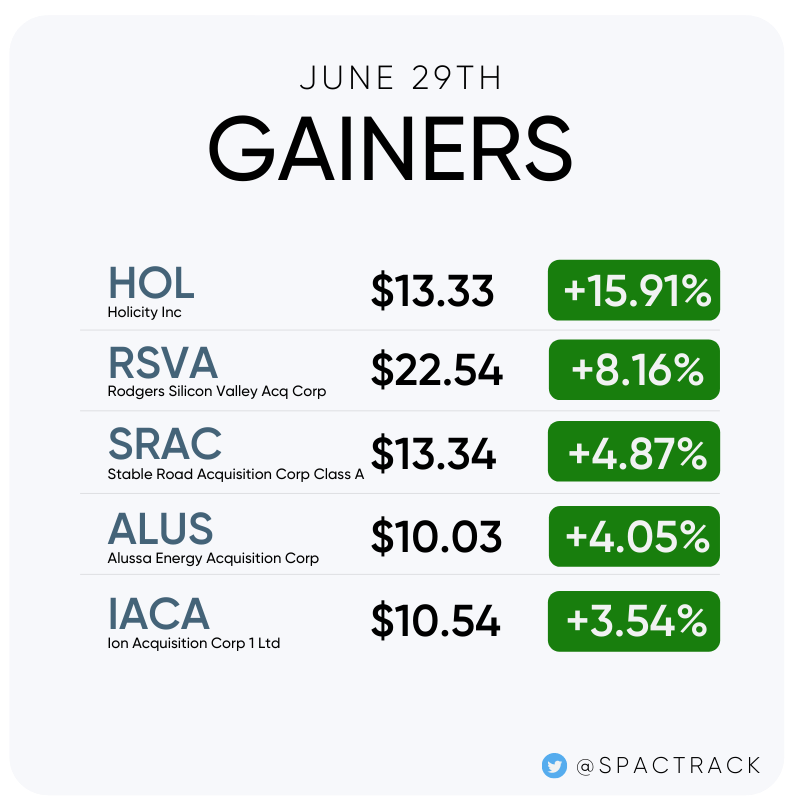

Stable Road Acquisition Corp. (SRAC: $13.34) reduced the enterprise valuation of merger partner, Momentus, from $1.131B to $566.6M

Sports Entertainment Acquisition Corp.’s (SEAH: $10.10) merger partner, Supergroup, gives updates on its Betway brand. Betway is live in 2 states and 3 expected in the upcoming months

FinTech Acquisition Corp V’s (FTCV: $12.20 +0.4%) merger partner, eToro, reports Q1 commissions of $347M (+141% YoY) and new users +214% YoY

Scientific Games intends to divest its Lottery and Sports Betting businesses and is evaluating the SPAC route along with the IPO, sale, or traditional merger.

New S-1 Filings:

1) Black Spade Acquisition Co (BSAQ)

$150M, 1/2 warrant

Focus: Entertainment industry, with a focus on enabling technology, lifestyle brands, products, or services, and entertainment media

Directors:

Russell Galbut (Chairman of Norwegian Cruise Line Holdings and Co-Founder & Managing Principal of Crescent Heights)

Robert Moore (Former Vice Chairman of Paramount Pictures and Former CFO at Walt Disney Studios)

S-1 Link: https://www.sec.gov/Archives/edgar/data/1851908/000119312521203371/d145833ds1.htm

2) Alpha Star Acquisition Corp (Ticker not available yet)

$100M, 1 warrant (exercisable for 1/2 of a share), and 1 right (1/10 of a share)

Focus: Asian market

S-1 Link: https://www.sec.gov/Archives/edgar/data/1865111/000110465921086903/tm2119933d1_s-1.htm

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits:

Wednesday, June 30th

Holicity Inc. (HOL: $13.33) Shareholder Meeting to Approve Business Combination with Astra

Alussa Energy Acquisition Corp (ALUS: $10.03) Shareholder Meeting to Approve Business Combination with FREYR Battery

Apex Technology Acquisition Corp (APXT: $12.11) Shareholder Meeting to Approve Business Combination with AvePoint

Foley Trasimene Acquisition Corp (WPF: $9.94) Shareholder Meeting to Approve Business Combination with Alight

If you find that this newsletter keeps you informed of SPAC news, please consider sharing it with a friend or colleague and suggest they subscribe!

Thanks for reading,