Nightcap: What do SPACs and Square have in common?

Nightly recap of the day's SPAC highlights (August 2, 2021)

Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

The Stats:

If you find that this newsletter keeps you informed of all things SPAC, please consider sharing it with a friend or colleague and suggest they subscribe!

The Deals (2):

1) Yellowstone Acquisition Company (YSAC: $10.08) & Sky Harbour

Sky Harbour LLC, a Developer of Private Aviation Infrastructure, to Become a Public Company Through a Combination with Yellowstone Acquisition Company (Press Release)

Merger Partner Description:

Sky Harbour LLC is an aviation infrastructure company building the first nationwide network of Home-Basing solutions for business aircraft. The Company develops, leases and manages business aviation hangars across the United States based on its proprietary targeting and acquisition model, targeting airfields with significant hangar supply and demand imbalances in the largest US markets. Sky Harbour hangar campuses feature exclusive private hangars and a full suite of dedicated services specifically designed for home-based aircraft. Benefits of the Sky Harbour Home-Basing model include security, efficiency of flight and maintenance operations, enhanced safety and complete privacy, all delivered in a beautiful, thoughtfully designed environment.

Valuation: $777M Pro-forma Equity Value

PIPE: No PIPE

Additional Financing:

Boston Omaha Corporation has agreed to provide a backstop valued at $45 million to help assure net investment in cash and securities at closing of at least $150 million to SHG

Sky Harbour Investor Presentation not filed as of yet

2) VPC Impact Acquisition Holdings II (VPCB: $9.77) & FinAccel (Parent company of Kredivo)

Kredivo, the Leading Digital Consumer Credit Platform in Southeast Asia, Announces Plans to Become a Publicly Traded Company via Merger with VPC Impact Acquisition Holdings II (Press Release)

Merger Partner Description:

Kredivo provides customers instant credit financing for e-commerce and offline purchases, as well as personal loans, based on proprietary, AI-enabled real-time decisioning. With nearly 4 million approved customers today and a presence across eight of the top 10 e-commerce merchants in Indonesia, it is the largest and fastest growing buy now, pay later (BNPL) platform in Indonesia today, with plans to expand into regional markets such as Vietnam and Thailand in the near future. Kredivo serves a target segment that comprises the rapidly growing middle class of Indonesia, with interest rates that are amongst the lowest in the country, and an application and approval process that takes as little as two minutes.

Valuation: $2.02B Pro-forma EV

PIPE: $120M including investments from Marshall Wace, Corbin Capital, SV Investment, Palantir Technologies, Maso Capital, and sponsor Victory Park Capital

Additional Financing:

Concurrent equity commitment of $55M from existing FinAccel investors NAVER and Square Peg

Kredivo Investor Presentation

News:

Grab Posts 39 Pct Q1 Sales Boost As Altimeter SPAC Deal Moves Forward (PYMNTS.com)

Singapore-headquartered Grab posted first quarter sales of $507 million, which represents 39 percent growth year on year, as the super app continues its momentum for a public offering with the special purpose acquisition company (SPAC) Altimeter Growth Corp (AGC: $10.86).

“We are pleased with our progress toward becoming a publicly traded company, which we expect to occur in Q4 2021,” Grab Group CEO and Co-Founder Anthony Tan said in a press release Monday (Aug. 2).

“As we prepare to become a listed company, we’re sharing our first-ever quarterly financial results, and we continue to deliver strong growth, despite the ongoing impact of COVID-19,” Tan said in the release. “Southeast Asian consumers trust Grab to meet their everyday needs in a growing number of ways, and we are excited about the emerging growth opportunities we see in our grocery delivery and financial services offerings.”

First quarter results for 2021 showed record revenue of $216 million, with an EBITDA up by $233 million year on year. Grab and Altimeter Growth Corp. also filed a draft registration with the U.S. Securities and Exchange Commission (SEC). Gross merchandise value (GMV) went up 5 percent year on year to $3.6 billion.

Net loss was $652 million, compared to $771 million in Q1 2020. Spend per user, defined as GMV per monthly transacting users (MTU), increased by 31 percent year on year.

Quick News Corner:

Reinvent Technology Partners Z (RTPZ: $9.79) & Hippo announced their merger is complete with the ticker change to HIPO starting tomorrow.

CCC Intelligent Solutions Inc. (CCCS: $10.06) & Dragoneer Growth Opportunities Corp. (DGNR) announced their merger is complete. The ticker change to CCC took place today.

AJAX I (AJAX: $9.95) and Cazoo Announce Second Quarter Fiscal 2021 Preliminary Results for Cazoo

Trident Acquisitions Corp.’s (TDAC: $10.92) merger partner, Lottery.com Issues Business Update and Provides Preliminary Second Quarter 2021 Results

IPOs to Begin Trading Tomorrow*:

1) Healthwell Acquisition Corp. I (HWEL-U)

$250M, 1/2 warrant

Focus: Healthcare Tech

*Priced at the time of this writing

New S-1s:

None!

Contributor Highlight:

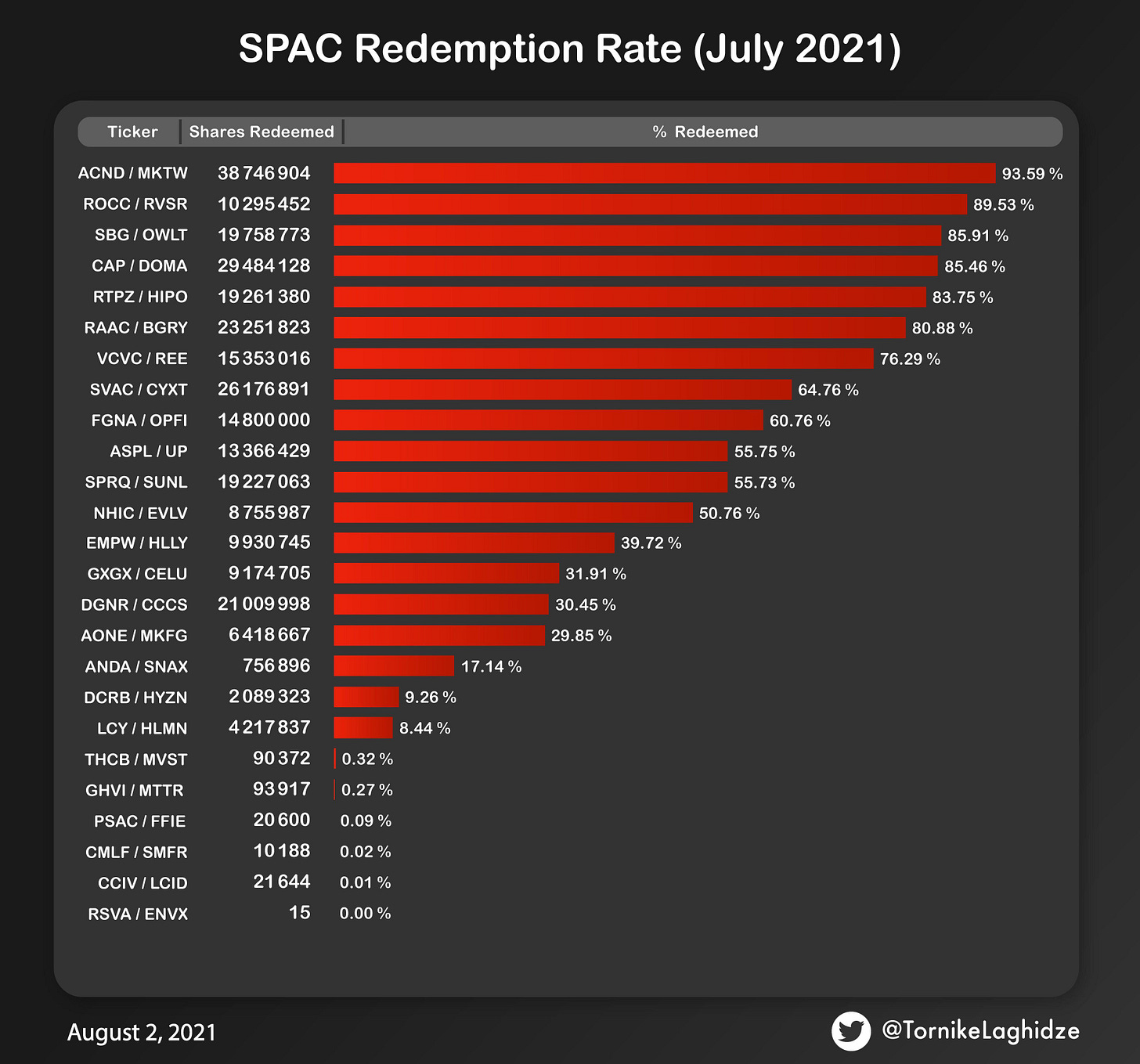

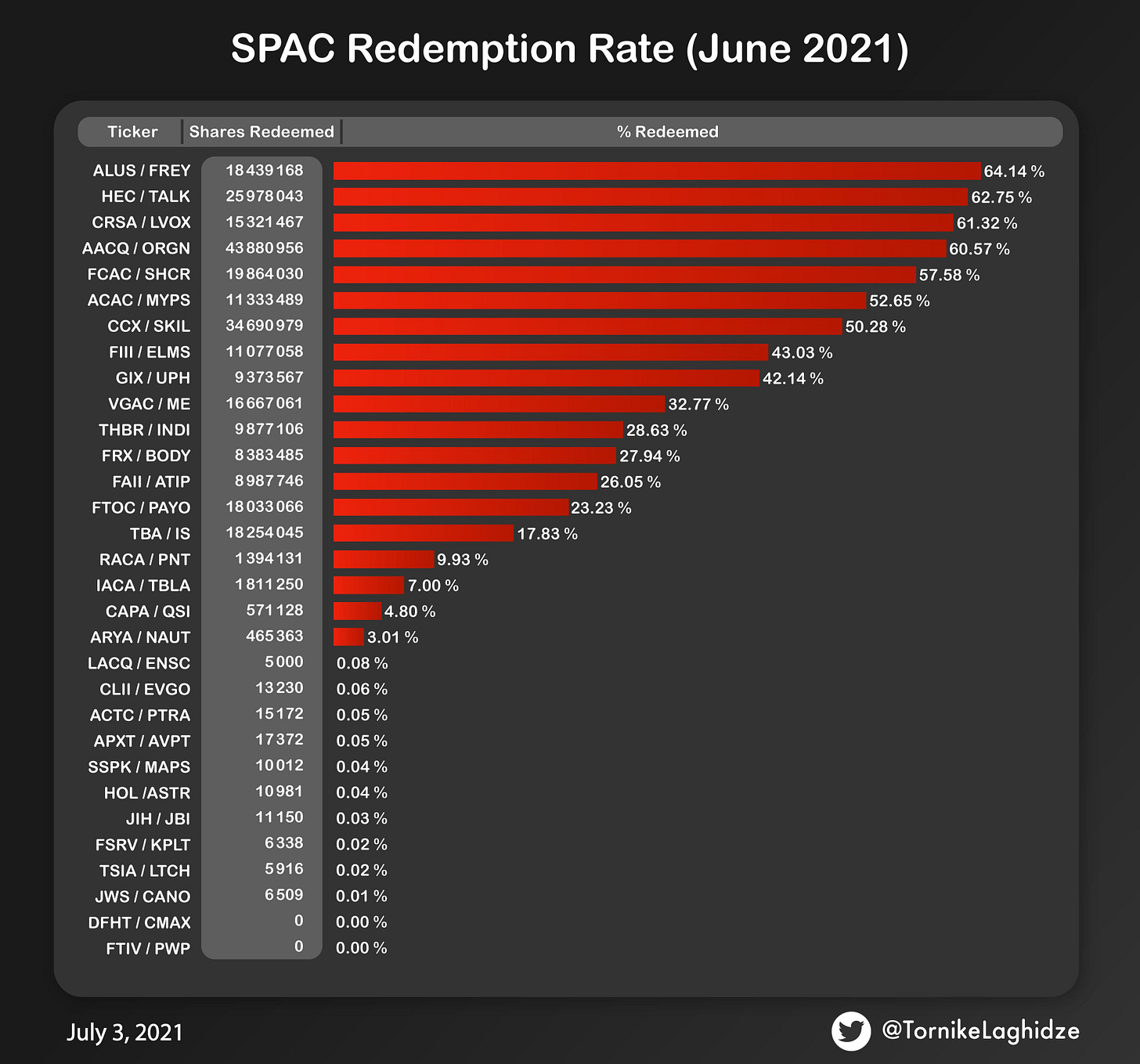

Tornike (SPAC Graphic Guru):

Nikita (Entertaining weekly SPAC review newsletter):

Daniel (The deal tracking data that will bring tears to your eyes):

See all of the SPAC Track Contributor content right here.

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Tuesday, August 3

Merger Meeting: Gores Holdings V, Inc (GRSV: $10.27) & Ardagh Metal Packaging

Wednesday, August 4

Unit Split: CleanTech Acquisition Corp. (CLAQ-U: $10.25)

Thursday, August 5

Merger Meetings:

Peridot Acquisition Corp. (PDAC: $9.88) & Li-Cycle

Reinvent Technology Partners (RTP: $9.90) & Joby Aviation

Friday, August 6

Merger Meeting: SC Health Corp (SCPE: $9.99) & Rockley Photonics

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,