Not so FST

More FST drama today in this edition of the Morning Update, the pre-market recap for SPAC Track Pro subscribers.

Good Morning,

Special Opportunities Fund (SPE) announces it has filed a class action lawsuit filed against FAST [$FST] in the Delaware Court of Chancery for its handling of the settlement associated with the termination of the Fertitta Entertainment deal (PR)

The Chairman of SPE had a few words:

We have seen some brazen self-serving schemes by public company insiders over the years but the attempt by a SPAC sponsor, after failing to achieve a business combination, to grab a parting gift for itself and management at the expense of the SPAC’s public stockholders, as it intends to do here, represents a new low in corporate governance.

FAST responded in its own press release:

The Company previously disclosed that, in accordance with the foregoing terms and requirements of the Charter, any funds received pursuant to the Termination and Settlement Agreement that are remaining after the payment of expenses will not be part of any distributions with respect to the public shares. On August 9, 2022, a lawsuit was filed in the Court of Chancery of the State of Delaware by Special Opportunities Fund, Inc. as a putative class action against the Company, Fast Sponsor, LLC, and the Company’s directors. The lawsuit alleges breach of fiduciary duty and unjust enrichment, and seeks to enjoin dissolution and the distribution of any net assets outside of the Trust Account, or to impose a constructive trust over such net assets, and to order defendants to distribute such net assets to the holders of public shares or to award damages. The defendants believe the lawsuit is without merit and intend to defend it vigorously.

Though the settlement funds will not be distributed to shareholders, the SPAC did note that it is opting not to use funds from the trust account to pay taxes or dissolution expenses "despite the provisions in the Charter permitting it to do so".

Previous Session Stats

Gainers & Losers

Volume Leaders

The Deals

—

SPAC Updates

Terminations & Liquidations

Termination: Pono Capital [$PONO] & Benuvia (PR)

Liquidation Update: FAST [$FST] announces that it expects the redemption price to be $10.02 with the liquidation effective as of Aug 26th (PR)

Ahead of Equity Distribution’s [$EQD] liquidation, effective as of Sep 19th, NYSE suspended trading of EQD warrants yesterday (PR)

IPOs

Hainan Manaslu [$HMAC-U]

$60M, 1 Warrant, 1 Right (1/10th of a share)

UW: Ladenburg Thalmann

Registrations

New S-1s

—

Registration Withdrawals

—

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

Key Filings

SPAC S-4 Activity

S-4/A:

Vickers Vantage [$BRLI] & Nukkleus

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

S-1/A:

Kalera [$KAL]

Effective:

—

*including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

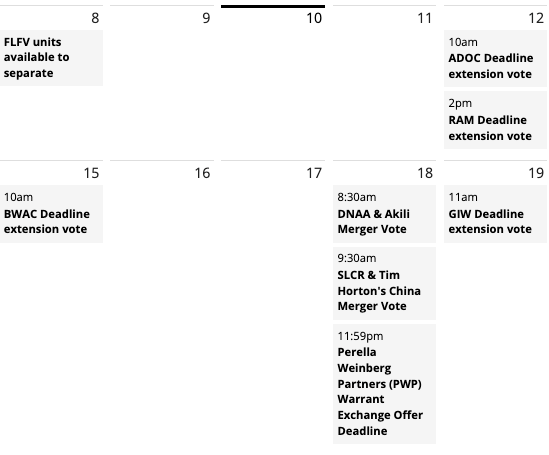

Upcoming Dates:

Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)