Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 16, 2022)

The Stats:

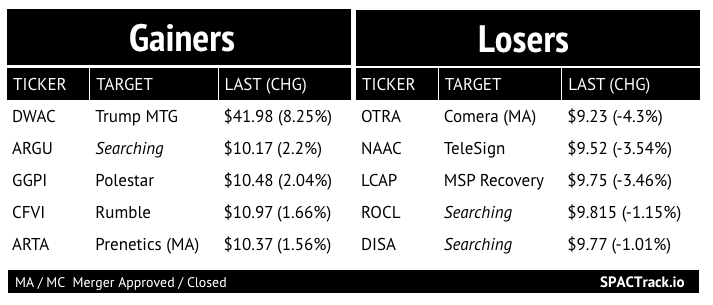

Pre-Market Movers:

OTRA -5.1%, BWAC -1%, DWAC +5.6%, UTAA +1%

Previous Session Movers & Volume Leaders:

Earnings*:

This Morning:

$ENJY $BHIL $LTRY $AMPS $FATH $WEJO $QNGY $NRXP $ALLG

*De-SPACs completed 2019- per Earnings Whispers

The Deals (2):

1) Executive Network Partnering Corporation (ENPC) & Grey Rock Investment Partners oil and gas assets to Form Granite Ridge Resources (warrants +150% pre-market)

Grey Rock Investment Partners is a Dallas-based private equity firm with more than $525 million of committed capital under management and interests in more than 2,500 wells in core areas of the Midland, Delaware, Bakken, Eagle Ford, DJ, and Haynesville plays. With a focus on lower and mid-market non-operated working interests, Grey Rock builds positions with low breakeven costs to provide investors with attractive risk-adjusted returns. Grey Rock was founded and is led by three managing directors: Matt Miller, Griffin Perry and Kirk Lazarine.

Valuation: $1.32B Pro-forma Enterprise Value

Additional Financing: No PIPE

2) Chardan NexTech Acquisition 2 Corp. (CNTQ) & Dragonfly Energy (warrants +47% pre-market)

Dragonfly Energy Corp., headquartered in Reno, Nevada, is a leading manufacturer of deep cycle lithium-ion batteries. Dragonfly's battery products are designed and assembled in the USA, and the Company's research and development initiatives are revolutionizing the energy storage industry through innovative technologies and manufacturing processes. Today, Dragonfly's non-toxic deep cycle lithium-ion batteries are displacing lead-acid batteries across a wide range of end-markets, including RVs, marine vessels, off-grid installations, and other storage applications. Dragonfly is also focused on delivering an energy storage solution that enables a more sustainable and reliable smart grid through the future deployment of the Company's proprietary and patented solid-state cell technology.

Valuation: $500M Pro-forma Enterprise Value

Additional Financing: $5M PIPE from the sponsor, $75M senior secured term loan, and $150M Chardan Equity Facility

News:

Big Law Is Bullish on SPACs Even as Large Banks Pull Out (Bloomberg Law)

Updates:

Kingswood Acquisition Corp. (KWAC) enters into a non-binding Letter of Intent with Wentworth Management Services, “a platform of RIAs/broker dealers which employ differentiated advisor business models with a shared support services backbone, providing optionality to their advisors and investors”

KWAC expects to announce additional details regarding the proposed business combination when a definitive agreement is executed, which is expected later in Q2'2022 and with a closing anticipated in Q3'2022.

Better World Acquisition Corp. (BWAC) shareholders approved the deadline extension from May 17 to August 17 with ~5.6M shares redeemed or an estimated ~45% of the public SPAC shares

Mount Rainier Acquisition Corp.’s (RNER) merger partner, HUB Cyber Security, announces a $5M PIPE at $1.76 per share, or a ~100% premium to the trading price (TASE: Tel Aviv Stock Exchange: HUB) as of the PR issuance, and 4.5M in warrant coverage. The TASE gave approval for the PIPE to proceed on May 10

Lionheart Acquisition Corporation II (LCAP) Enters into Non-Binding Term Sheets for up to 3.5M share FPA and up to $1B Equity Facility with Cantor Fitzgerald

Merger vote set: Dynamics Special Purpose Corp. (DYNS) & Senti Bio (6/7)

New SPACs (S-1s):

1) Metaverse Acquisition Corp (Ticker N/A)

$150M, 1 Warrant, 1 Right (1/10th of a share)

Focus: Metaverse

Directors:

John Joyce (Former CFO of IBM)

Darcy Antonellis (Former CTO of Warner Bros. Entertainment)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

Effective:

Quanergy Systems (QNGY)

S-4 Activity:

S-4:

Vickers Vantage Corp. I (VCKA) & Scilex Holding Company, a Sorrento Therapeutics Inc. Subsidiary

Digital World Acquisition Corp. (DWAC) & Trump Media & Technology Group

S-4/A:

Cartesian Growth Corp (GLBL) & Tiedemann Group and Alvarium Investments (1st amendment)

Agrico Acquisition Corp. (RICO) & Kalera (2nd amendment)

Virgin Group Acquisition Corp. II (VGII) & Grove Collaborative (4th amendment)

Delwinds Insurance Acquisition Corp (DWIN) & FOXO Technologies (1st amendment)

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup (4th amendment)

Software Acquisition Group Inc. III (SWAG) & Nogin (1st amendment)

Benessere Capital Acquisition Corp. (BENE) & Ecombustible (2nd amendment)

Effective:

Agrico Acquisition Corp. (RICO) & Kalera

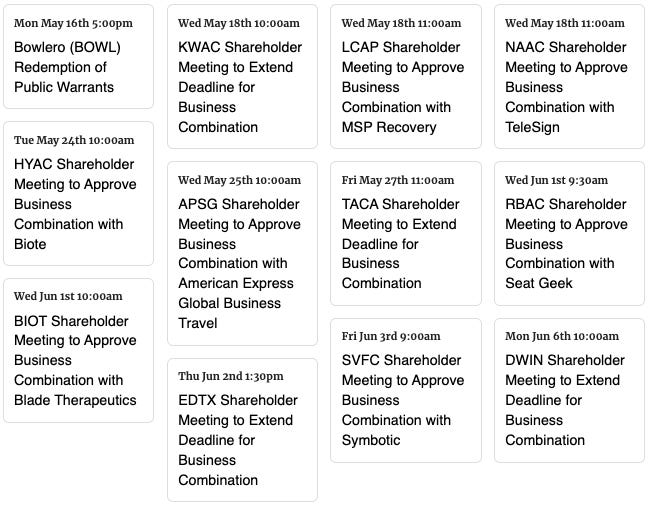

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,