Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (April 29, 2022)

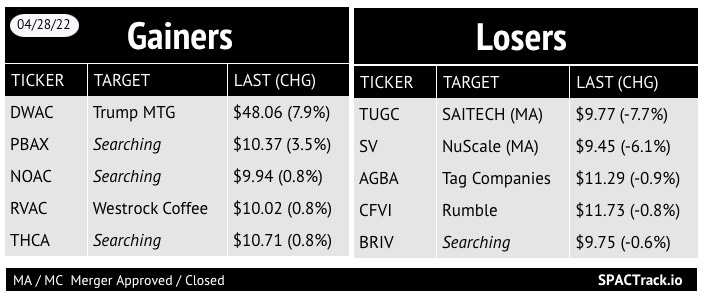

The Stats:

Pre-Market Movers

DWAC +10.7%, SV +3.4%, CFVI +2%, GGPI -1.1%

Previous Session Movers & Volume Leaders:

The Deals:

Yesterday afternoon deal:

1) Ignyte Acquisition Corp. (IGNY) & Peak Bio

Peak Bio is a clinical-stage biopharmaceutical company focused on developing therapeutics addressing significant unmet needs in the areas of oncology and inflammation. Peak Bio’s management team has a combined 50 years of industry experience in the areas of small molecules, antibodies, and antibody-drug-conjugates (ADC) forging successful companies that create best-in-class therapeutics.

Valuation: $278M Pro-forma equity value

PIPE: $25M including investments from Palo Alto Investors and Peak Bio’s CEO, Hoyoung Huh

Updates:

Spring Valley Acquisition Corp. (SV) shareholders approved the merger with NuScale Power

The merger raised ~$380M in gross proceeds and is expected to close on 5/2 with the ticker change to SMR on 5/3

8.6M shares were redeemed or an estimated ~37% of the public SPAC shares

Zanite Acquisition Corp. (ZNTE) and Eve UAM announce the merger is expected to close on 5/9, subject to approval at the shareholder meeting on 5/6

New SPACs (S-1s):

1) Hudson Acquisition I Corp. (HUDA)

$60M, 1 Right (1/8th of a share)

UW: Chardan

Registration Withdrawals

Space Acquisition Corp. I (OUTR)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

Sky Harbour (SKYH)

S-4 Activity:

S-4/A:

Apollo Strategic Growth Capital (APSG) & American Express Global Business Travel (4th amendment)

Quantum FinTech Acquisition Corporation (QFTA) & TradeStation (1st amendment)

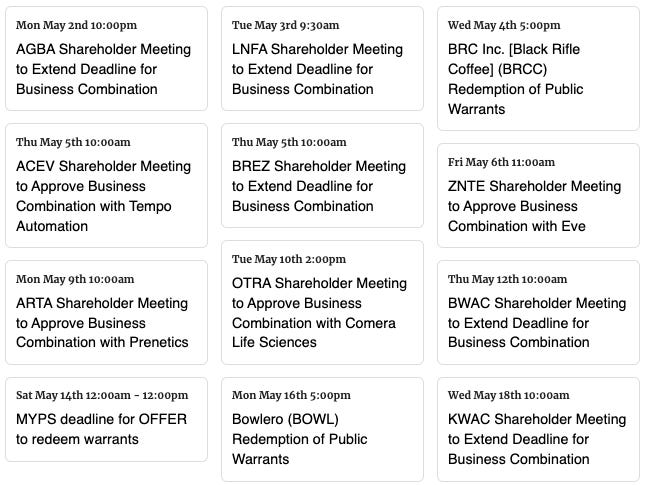

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of 4/26:

New Data Points: Estimated $ Discount/premium to trust value per share, Estimated % Disc/prem to trust value per share

New Filters: Deadline approaching within 1-4 months

**Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,