Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 16, 2022)

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of yesterday, 3/16:

Data Points in the Default View and SPAC Details View:

NAV (Trust per share) from proxy filing, Date of filing used for Trust per Share, Link to relevant filing

Data Points in the SPAC Details View:

Upcoming extension vote date, extension vote link, extension vote redemption date, extension vote ex. redemption date

New De-SPAC Filters:

Completed in 2022, Redemption Levels (<50%, 50%+, 75%+, 90%+), Post-closing S-1 effective

**Please note that all of the Pro data points on the Pro Screener along with which table “view” and download eligibility can be found here: spactrack.io/screener-instructions

The Stats:

Pre-Market Movers:

DWAC +3.1%, GGPI +1.5%, BREZ -1.4%

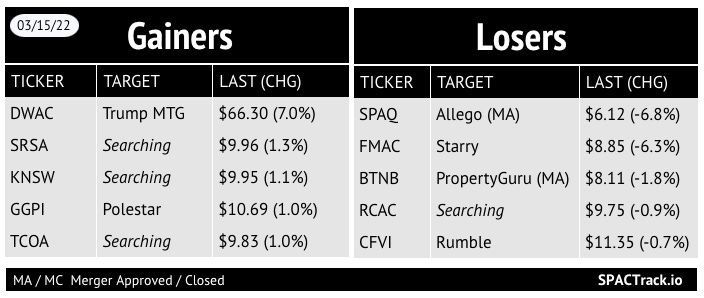

Yesterday’s Movers and Volume Leaders:

Volume Leaders

APGB 4.4M, DWAC 2.4M, FCAX 2.0M. PSTH 1.7M, GGPI 1.5M, KAHC 1.4M, HIGA 1.3M, GMBT 1.2M, NSTB 1.2M, ENPC 1.1M

The Deals:

No new deals

News:

EO Charging’s merger with First Reserve Sustainable Growth (FRSG) may be in doubt after the parties failed to extend a deadline that expired last week, Sky News understands. (Sky News)

The 30 year-old founder of a British electric vehicle charging company which counts Amazon among its customers has seen his ambition of taking it public in a $675m merger disrupted by volatile global stock markets.

Sky News understands that EO Charging, which agreed a deal to list in the US last summer, has yet to agree on an extension to a merger agreement that expired last Friday.

Market sources said the absence of an announcement confirming a new deadline to close the deal implied that it was in trouble.

EO Charging, which was founded by Charlie Jardine in a former pig shed in Suffolk, said it would combine with First Reserve Sustainable Growth (FRSG), a New York-listed special purpose acquisition company (SPAC).

A further extension beyond the 11 March deadline remains possible, but Mr Jardine could be forced to revise the deal's terms or abandon it if a new agreement with the SPAC's board is not reached.

Homebuying Startup Knock Scraps Plans to Go Public, Lays Off Half Its Staff (Bloomberg)

Homebuying startup Knock is scrapping plans to go public and laying off nearly half its staff after a tumultuous year for property technology companies.

Knock, which pioneered a type of financing that gives homebuyers a leg-up in competitive markets, was on the verge of going public through a merger with a special purpose acquisition company last year, Chief Executive Officer Sean Black said in an interview Tuesday.

Waning investor interest in blank-check companies pushed Knock to pursue a private fundraising round tapping some of the institutions that had expressed interest in a potential SPAC deal, said Black, who detailed the challenges in a blog post. The effort was also frustrated by the pandemic and the high-profile collapse of Zillow Group Inc.’s home-flipping operation.

Knock, which had hoped to go public at a $2 billion valuation, was left to lower its ambitions. The company is raising $70 million in a round led by Foundry Group, according to a statement Tuesday. Existing investors First American Financial and RRE Ventures joined the round, as did real estate executive Mauricio Umansky and filmmaker M. Night Shyamalan. Knock also raised $150 million in new debt.

Black declined to say how the new round values Knock, but said it wasn’t lower than the company’s last fundraising.

“The business is doing great, but we built to be a public company, and there’s no IPO market right now,” Black said. “It does feel like money has gotten very scarce and very expensive.”

The blank-check company that planned to merge with Knock was InterPrivate II Acquisition Corp. (IPVA), according to people with knowledge of the matter. Representatives for Knock and InterPrivate II declined to comment.

Black was an early executive at the online real estate platform Trulia, which was acquired by Zillow in 2015. He co-founded Knock that same year with Jamie Glenn and Karan Sakhuja and focused on building products that improve the homebuying experience. Its main product, Home Swap, lends customers money to make no-contingency offers, helping them win bidding wars in hot markets and allowing them to buy their new home before selling their old one.

A handful of companies, including Orchard, FlyHomes and Ribbon, are plying similar models. It’s a different approach than the so-called iBuying model that pushed Zillow to take a $405 million writedown, but the collapse made it harder for Knock to raise capital. In December, Knock was approached by a potential strategic acquirer but couldn’t reach an agreement, according to Black’s blog post.

More News:

Second BuzzFeed (BZFD) employee complaint filed over botched IPO (Axios)

Updates:

Motive Capital Corp (MOTV) shareholders approve the business combination with Forge Global

Closing is expected to be on 3/21 with the ticker change to FRGE expected on 3/22

Bridgetown 2 Holdings Limited (BTNB) shareholders approve the business combination with PropertyGuru

17.7M shares were redeemed, or 59.3% of the public SPAC shares

The merger is slated to close tomorrow, 3/17, with the ticker change to PGRU expected on 3/18

Zanite Acquisition Corp. (ZNTE) adds $2.3M to the PIPE for its merger with Embraer, bringing the total aggregate PIPE proceeds to $317.3M

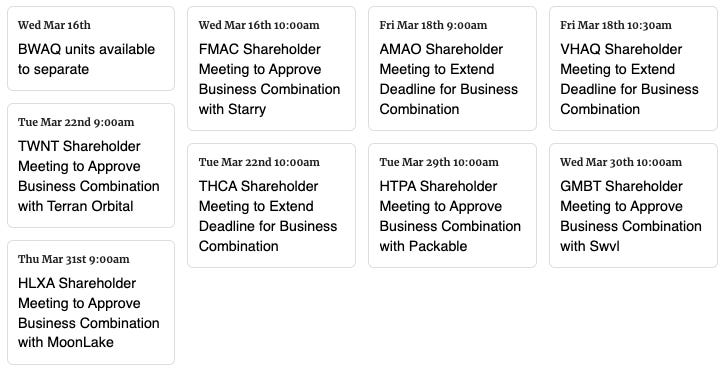

Tailwind Two Acquisition Corp. (TWNT) and Terran Orbital amend their merger agreement to, among other things, remove the max. net debt and 85% max redemption conditions

Spartan Acquisition Corp. III (SPAQ) and Allego expect the merger to close today, 3/16, with the ticker change to ALLG expected to occur tomorrow

Tuscan Holdings Corp. II (THCA) has adjourned its extension vote meeting (to extend deadline from 3/31 to 6/30). The meeting was set for 3/22 and is now adjorned to 3/29

Deadline to redeem has been pushed to 3/25

Merger Vote Set: Queen’s Gambit Growth Capital (GMBT) & Swvl: 3/30

New SPACs (S-1s):

No new S-1s

Registration Withdrawal

CCIF Acquisition Corp. (DSPQ)

Aperture Acquisition Corp (APCP)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4 filings:

DPCM Capital, Inc. (XPOA) & D-Wave

Biotech Acquisition Company (BIOT) & Blade Therapeutics

Effective:

Queen’s Gambit Growth Capital (GMBT) & Swvl

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,