Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (Feb 25, 2022)

The Stats:

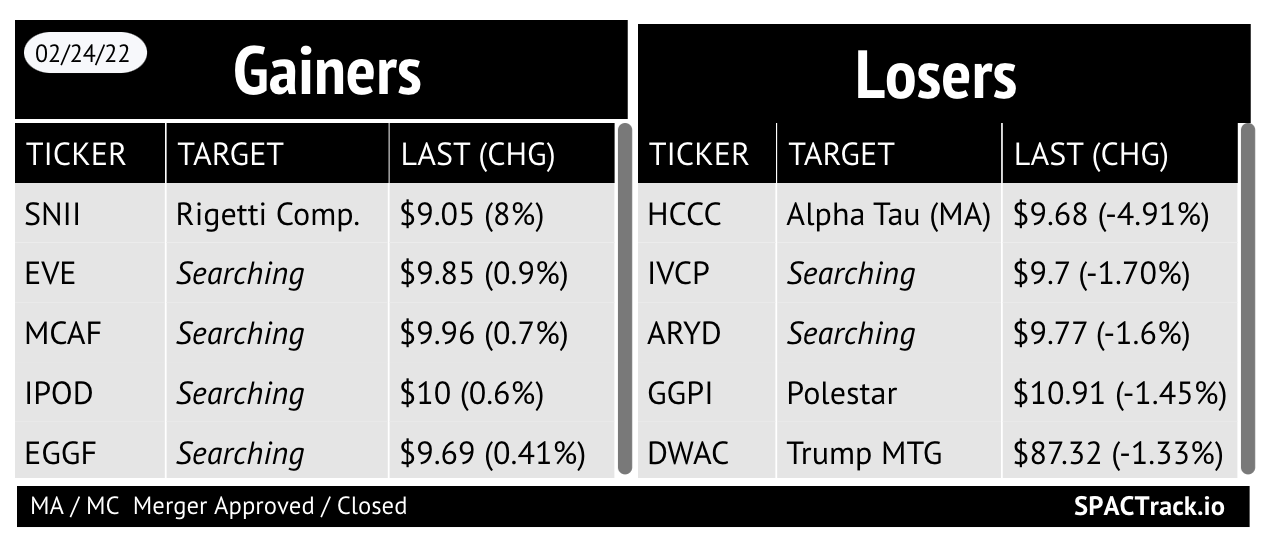

Pre-Market Movers:

SNII +3.8%, DWAC +1.4%

Yesterday’s Movers and Volume Leaders:

The Deals:

1) Delwinds Insurance Acquisition Corp. (DWIN) & FOXO Technologies (announced Thurs. afternoon)

Merger Partner Description:

FOXO is a technology company aiming to make longevity science fundamental to life insurance. By applying epigenetic science and AI to commercialize saliva-based biomarkers, FOXO plans to simplify the consumer underwriting journey and enhance the consumer value proposition. FOXO’s platform will modernize the life industry with saliva-based underwriting technology and consumer engagement services. FOXO is the parent company of the FOXO Life Insurance Company.

Valuation: $369M EV

News:

Amicus exits gene therapy (Evaluate)

Amicus surprised investors in September with plans to spin off its gene therapy division into a Spac [. Barely five months later it has surprised them again, today saying the deal was off.

The group cited poor market conditions for biotech Spacs and, perhaps more interestingly, an increasingly tough environment for standalone gene therapy companies. A look at the share price performance of some of these developers over past year shows that they have indeed had a rough ride.

Perhaps the writing was on the wall after what would have been the spin-off's lead project, for CLN6 Batten disease, failed to show durable results. Amicus discontinued that asset in January. But comments by Amicus executives on a call today suggest that much broader concerns about the gene therapy space persuaded all involved to scrap the whole deal.

Amicus made it pretty clear that its current crop of gene therapies are unlikely to progress. The group does not want to interfere with its plans to become profitable by 2023, so will cut costs to save around $400m from now until 2026 – similar to the savings Amicus would have made with the spin-off.

As part of this effort, Amicus is not planning to take any gene therapy projects into the clinic in the next few years, its outgoing chief executive, John Crowley, said during the company’s fourth-quarter earnings call today. The group will also “suspend indefinitely” its plans to build an internal gene therapy manufacturing facility.

It will shed 7% of its workforce, around 35 employees, mainly in R&D, as it seeks to keep staff numbers flat over the next few years. Amicus does have room to recruit personnel to sell its Fabry disease therapy Galafold, which it hopes will become a $1bn product, and help support the launch of its Pompe candidate AT-GAA, which is awaiting an FDA approval decision. Still, AT-GAA is far from a dead cert given that its pivotal trial failed its primary endpoint.

Merger Votes/ Completions:

Supernova Partners Acquisition Company II, Ltd. (SNII) announces that it expects all closing conditions to be met for its merger with Rigetti Computing and expects the merger to close on March 2

IPOs*:

1) GSR II Meteora Acquisition Corp. Announces the Pricing of Its $275 Million Initial Public Offering (GSRM-U)

*Announced pricing as of this writing

New SPACs (S-1s):

1) Haymaker Acquisition Corp. IV (HYIV)

$261M, 1/3 Warrant

Focus: Consumer and consumer-related products and services industries

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A filings:

TradeUP Global Corporation (TUGC) & SAITECH (4th amendment)

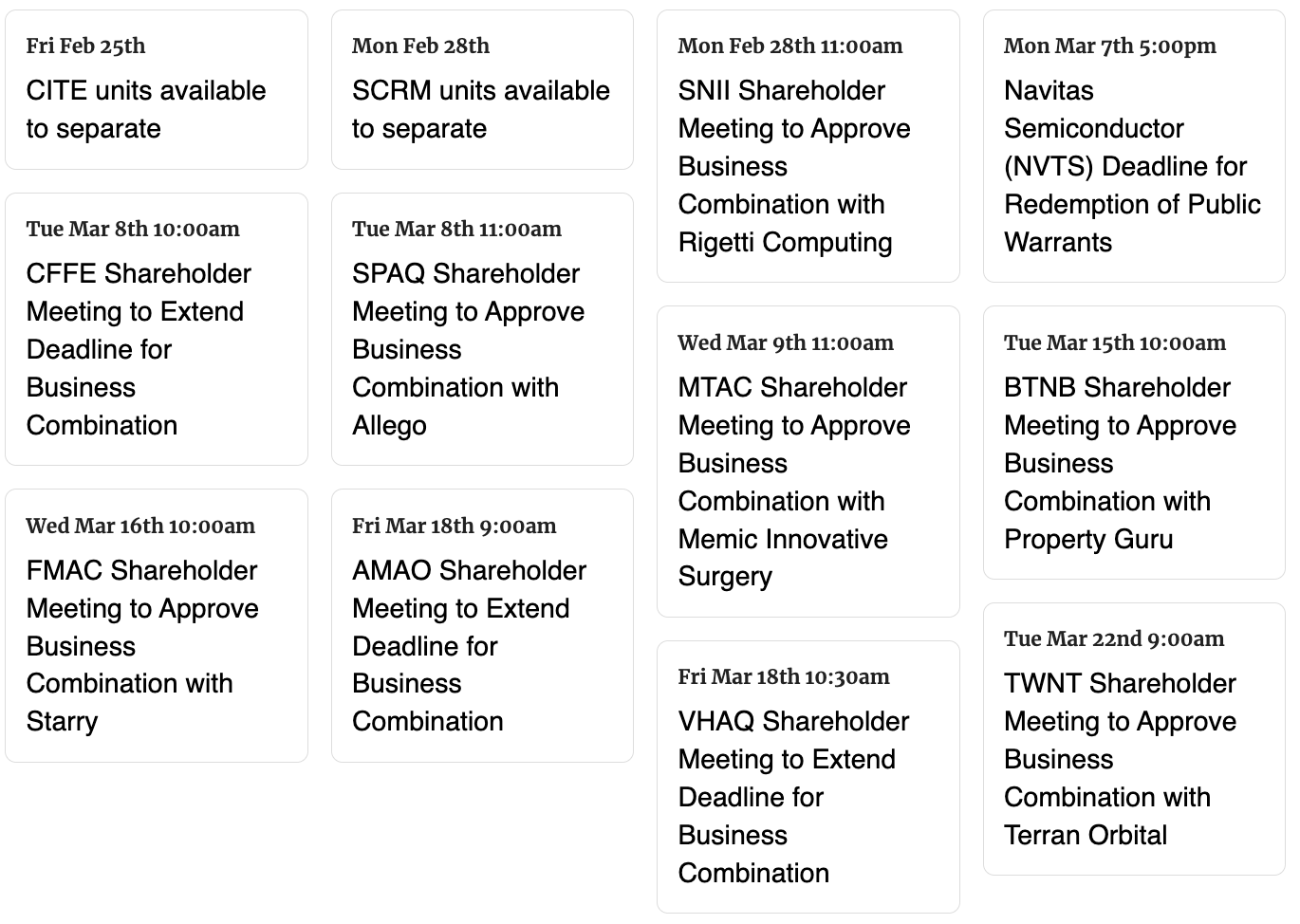

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,