Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (Feb 23, 2022)

The Stats:

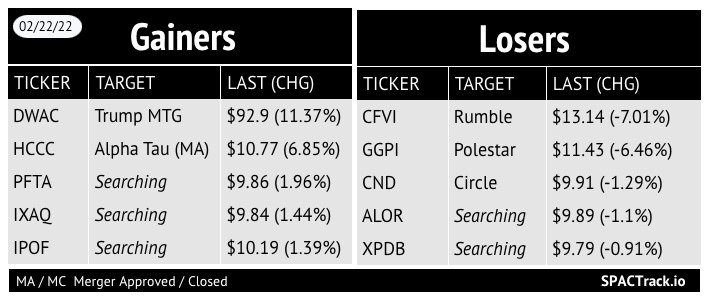

Pre-Market Movers:

SNII -3.7%, DWAC -3.1%

Yesterday’s Movers and Volume Leaders:

The Deals:

1) Brilliant Acquisition Corp (BRLI) & Nukkleus

Merger Partner Description:

Nukkleus, Inc. (OTC: NUKK) combines its world-class multi-asset technology with digital asset exchange execution and payment services, providing institutional clients with a full-service offering to operate effectively in the modern world. Nukkleus’s portfolio delivers institutional-grade custody and access to traditional and digital asset markets globally, along with a UK FCA registered EMD agent for the handling of professional and accredited client funds to conduct cryptocurrency conversion to and from fiat currencies.

Valuation: $140M pre-money EV

Investor Presentation pending

Merger Votes/ Completions:

Breeze Holdings Acquisition Corp. (BREZ) announced that it deposited $0.10 per public share, into the trust in order to extend the deadline from 2/25 to 5/25/22

News:

Nasdaq is taking steps to remove SoftBank-backed View from its exchange after the glass maker failed to meet another deadline to file missing financials (Business Insider)

SoftBank-backed glass maker View, Inc. is another step closer to being booted off Nasdaq.

The Nasdaq Listing Qualifications Department has initiated a process to delist View from the exchange, which only welcomed the glass manufacturer less than 12 months ago when it raised $815 million through a de- SPAC

transaction with financial services firm Cantor Fitzgerald last March.

Headquartered in Milpitas, California, View manufactures eco-friendly "smart glass" for commercial building windows. Japanese investor SoftBank is its largest shareholder after it invested $1.1 billion in the company in 2018.

View's been in hot water in recent months after it received two deficiency notices from Nasdaq for failing to file quarterly reports throughout 2021. Insider reported in December that the company was at risk of delisting due to its missing filings.

The company stated in January that it expected to restate financial reports for 2019, 2020, and 2021 during this quarter. But in a press release published Tuesday regarding the delisting process, View noted there could be "no assurance" it will file revised reports before the end of March.

Nasdaq's latest move to potentially de-list View comes after the company failed to file missing financial statements by February 14, a deadline set by the exchange.

The trading of View shares will not immediately be suspended. In its press release, View said it intends to appeal Nasdaq's process to delist the company, known as a Staff Delisting Determination, and has requested a hearing before the exchange to present its plan to fall back into compliance with Nasdaq's requirements.

The request automatically grants View a stay of 15 days, and hearings are generally scheduled for 30 to 45 days after the date of request, at which time View's shares will continue to trade on Nasdaq, according to the release.

New SPACs (S-1s):

1) Giant Oak Acquisition Corporation (GOSC)

$100M, 1 Warrant, 1 Right (1/10th of a share)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4 filings:

26 Capital Acquisition Corp. (ADER) & Okada Manila

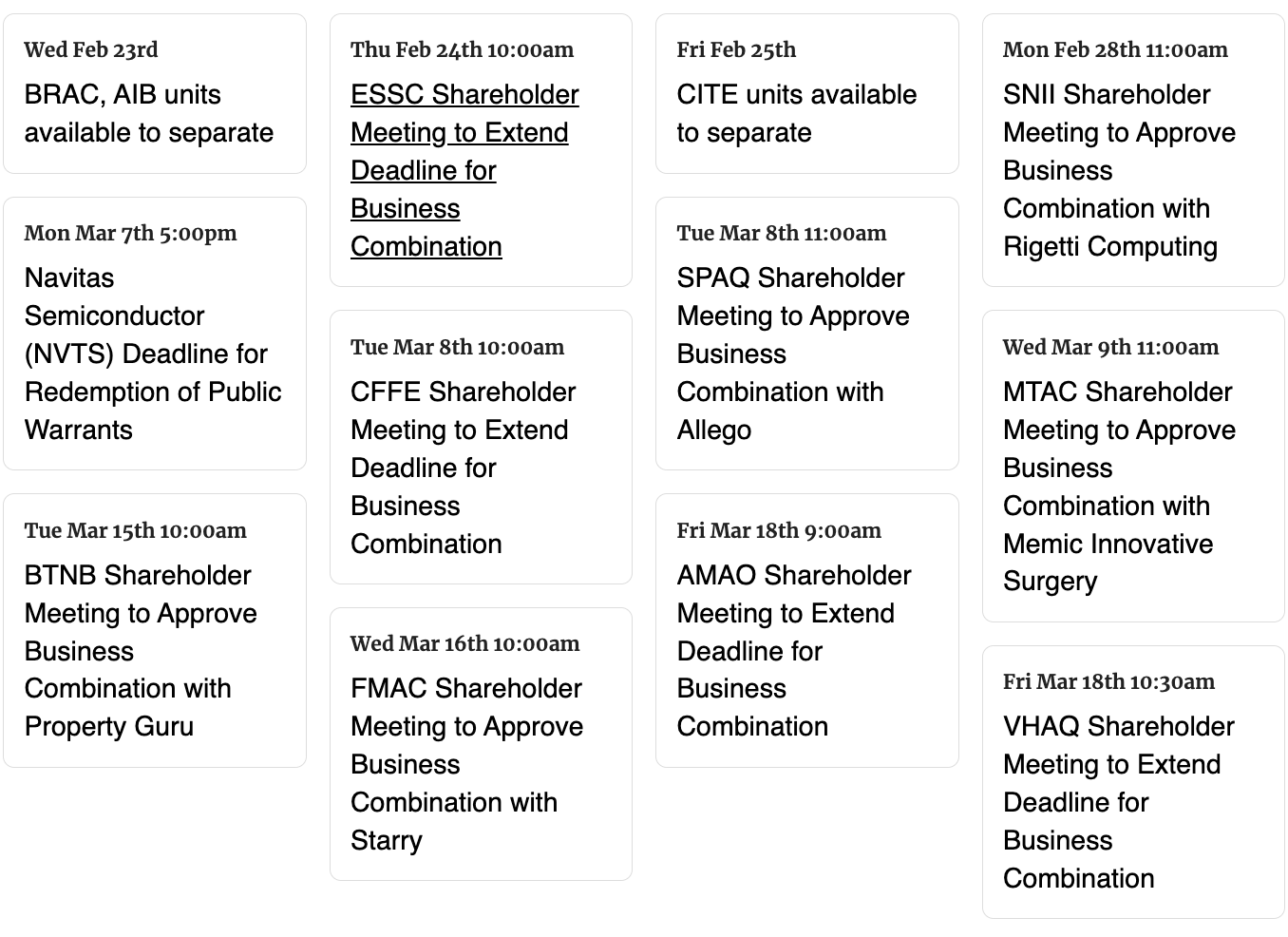

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,