Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 29, 2022)

The Stats:

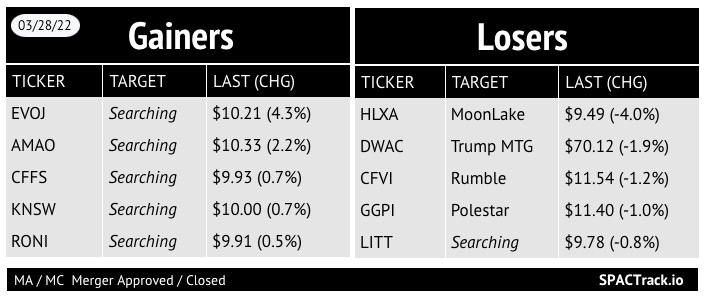

Pre-Market Movers:

HLXA +4.8%, MEKA +4.0%, DWAC +1.4%

Last Session’s Movers and Volume Leaders:

The Deals:

No new deals

News:

Bankers for Spac deals cut fees as redemptions rise (FT)

Updates

Spring Valley Acquisition Corp. (SV) & NuScale Power announce an additional $10M PIPE investment from SailingStone Capital increasing total PIPE proceeds to $221M

FirstMark Horizon Acquisition Corp. (FMAC) and Starry announce that the merger is expected to close and the ticker is expected to change to STRY today

$176M in gross proceeds was raised from the transaction

Magnum Opus Acquisition Limited (OPA) and Forbes extend termination date to 5/31/22

New SPACs (S-1s):

1) A SPAC II Acquisition Corp. (ASCB)

$185M, 1/2 Warrant, 1 Right (1/10th of a share)

Focus: Proptech, Fintech (ESG)

UW: Maxim

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

Sky Harbour (SKYH)

S-4 Activity:

S-4/A:

Silver Crest Acquisition Corporation (SLCR) & Tim Hortons China (3rd amendment)

Far Peak Acquisition Corporation (FPAC) & Bullish (4th amendment)

Spring Valley Acquisition Corp. (SV) & NuScale Power (3rd amendment)

TradeUP Global Corp (TUGC) & SAITECH Limited (6th amendment)

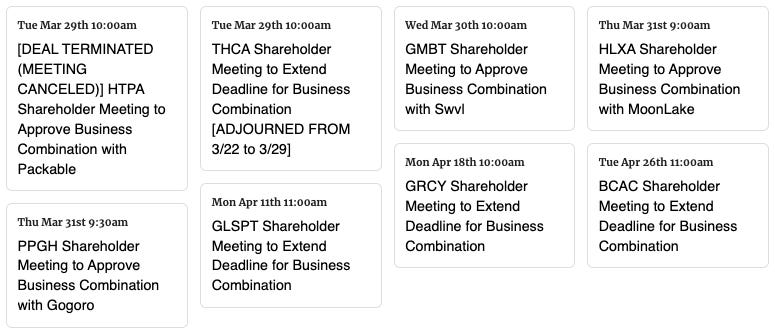

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

New Data Points and Filters have been added to the Pro Screener as of 3/16. A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,