Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (April 4, 2022)

The Stats:

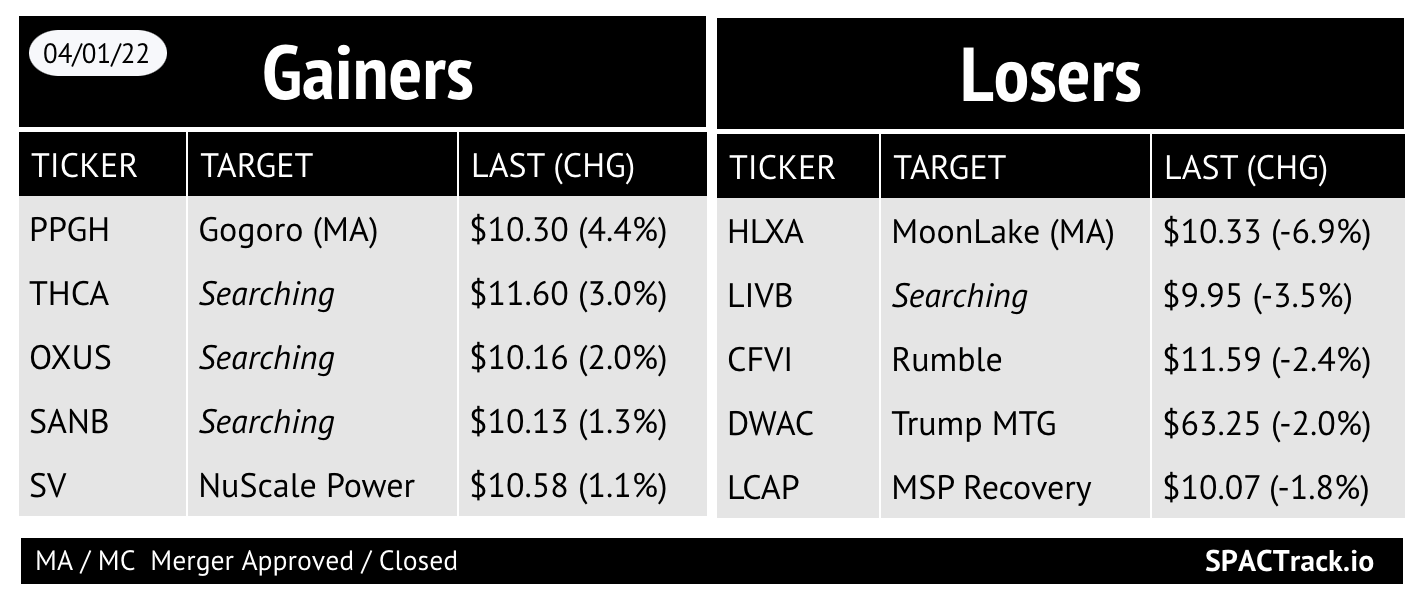

Pre-Market Movers:

DWAC -13%, CFVI -3.2%, GGPI +8%, THCA +1.7%, ISAA +1.4%, PPGH +1.2%, TWND +1%

Previous Session Movers & Volume Leaders:

The Deals (2):

1) Iron Spark I Inc. (ISAA) & Hypebeast (no warrants)

Hypebeast uncovers the latest emerging trends in culture and lifestyle (including fashion, art, sports, technology, and food) and creates an ecosystem for cultural discovery and connection. Comprised of three major divisions – HYPEMEDIA, an umbrella of online editorial and social media platforms; HYPEMAKER, an in-house creative production agency; and HBX, an e-commerce platform and omnichannel shopping destination – Hypebeast’s global readership spans 80+ countries across Asia, Europe, and the US.

Valuation: $352.7M EV

PIPE: $13.3M including investments from Tom Brady, Naomi Osaka, Kevin Durant, Rich Kleiman, Tony Hawk, Joe Gebbia, Jonah Hill, Adam Levine, and Electric Feel Ventures

2) Riverview Acquisition Corp. (RVAC) & Westrock Coffee Company (warrants +34% pre-market)

Westrock Coffee Holdings, LLC is a leading integrated coffee, tea, flavors, extracts, and ingredients solutions provider in the U.S., providing coffee sourcing, supply chain management, product development, roasting, packaging, and distribution services to retail, food service and restaurant, convenience store and travel center, non-commercial account, CPG, and hospitality industries around the world. With offices in 10 countries, the company sources coffee and tea from 35 origin countries.

Valuation: $1.09B EV

PIPE: $250M including “$60M from R. Brad Martin, NFC Investments, LLC, and the other Riverview Acquisition Corp. founders, $25M from Westrock Coffee founders, and $78M each from HF Capital, the Haslam family investment office, and funds managed by Southeastern Asset Management.”

Additional Financing: “financing commitment from Wells Fargo for a $300 million Senior Secured Pro Rata Credit Facility including a $150 million term loan and a $150 million revolving loan commitment. The term loan will be fully funded at closing and the revolver is expected to be largely undrawn”

News:

Hertz to buy up to 65,000 electric vehicles from Polestar [merging with Gores Guggenheim, Inc (GGPI)] (Reuters)

FinAccel [terminated merger with VPC Impact Acquisition Holdings II (VPCB) on 3/14/22] Spends $200 Million for Indonesia Digital Banking Push (Bloomberg)

Updates:

Virgin Group Acquisition Corp. II (VGII) and Grove announce a $27.5M subscription agreement and a $22.5M backstop between Grove and Corvina, an affiliate of VGII’s sponsor

New SPACs (S-1s):

1) Chenghe Acquisition Co. (CHEA)

$100M, 1/2 Warrant

Focus: Fintech

Registration Withdrawals

TPG Pace Tech Opportunities II Corp. (TPGT)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

Allego (ALLG)

S-1/A:

System1 (SST)

S-4 Activity:

S-4/A:

Dynamics Special Purpose Corp. (DYNS) & Senti Bio (1st amendment)

Oaktree Acquisition Corp. II (OACB) & Alvotech (3rd amendment)

Biotech Acquisition Company (BIOT) & Blade Therapeutics (1st amendment)

Alberton Acquisition Corp (ALAC) & SolarMax Technology (8th amendment)

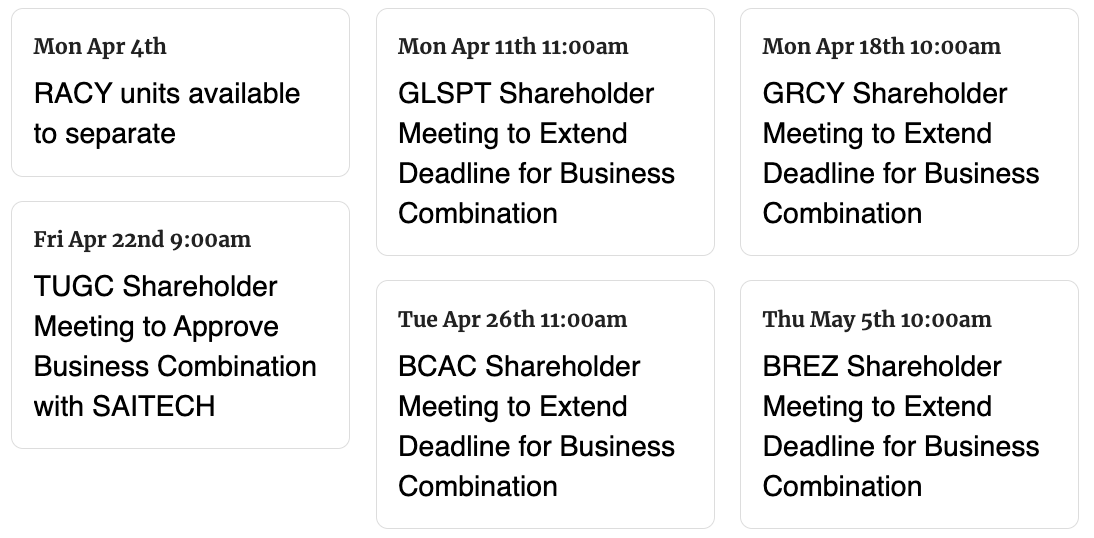

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,