Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 15, 2022)

The Stats:

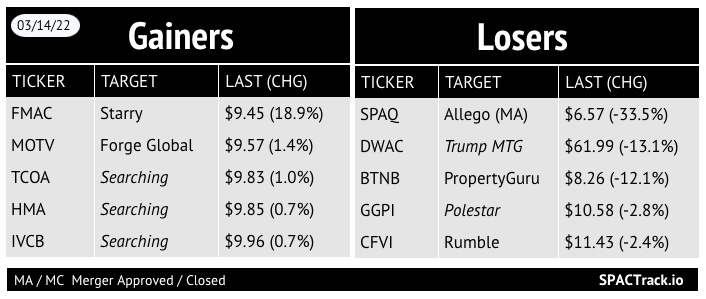

Pre-Market Movers:

FMAC -9.7%, THCA -2.1%, SPAQ +2%, BTNB +1.8%

Yesterday’s Movers and Volume Leaders:

The Deals:

No new deals

News:

Electric Last Mile shares plummet to $1 after company confirms SEC probe (CNBC)

Shares of EV start-up Electric Last Mile Solutions (ELMS) plummeted during trading Monday to less than $1 a share after the company confirmed a probe by the Securities and Exchange Commission into its operations.

The late-Friday disclosure is the latest problem for the Troy, Michigan-based company following unexpected resignations last month of both the company’s chairperson and CEO. The departures were connected to ELMS’ determination that the executives lied during an internal investigation into share purchases ahead of the company going public through a special purpose acquisition company, or SPAC.

ELMS said it learned of the investigation by the SEC on March 7, according to the regulatory filing Friday. The company also said it was withdrawing previous guidance and would need to raise cash to its vehicles to market.

Shares of ELMS were down by as much as 53% during intraday trading Monday before closing at 99 cents a share, down 48% for the day. The company’s stock has declined 86% in 2022.

The company said it has sufficient cash to continue operations through between July and September 2022.

Updates:

VPC Impact Acquisition Holdings II (VPCB) and Kredivo mutually agree to terminate their business combination due to “unfavorable market conditions”

According to the press release: “VPCB is considering future options, including seeking an alternative business combination. The parties have agreed that, in the event that VPCB is liquidated, Kredivo shall issue a penny warrant to VPCB providing VPCB with the ability to acquire a stake equal to 3.5% of the fully diluted equity securities of Kredivo.”

Americas Technology Acquisition Corp. (ATA) deposits $0.10 per share, extending its deadline to 6/17/22

New SPACs (S-1s):

1) ClimateRock (CLRC)

$75M, 1 Warrant

Focus: Sustainable energy industry, specifically within climate change, environment, renewable energy, and emerging, clean technologies

UW: Maxim

Registration Withdrawal

Denham Sustainable Performance Acquisition Corp. (DSPQ)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A filings:

Oaktree Acquisition Corp. II (OACB) & Alvotech (2nd amendment)

Global SPAC Partners Co. (GLSPT) & Gorilla Technology Group (2nd amendment)

Poema Global Holdings Corp. (PPGH) & Gogoro (4th amendment)

CC Neuberger Principal Holdings II (PRPB) & Getty Images (1st amendment)

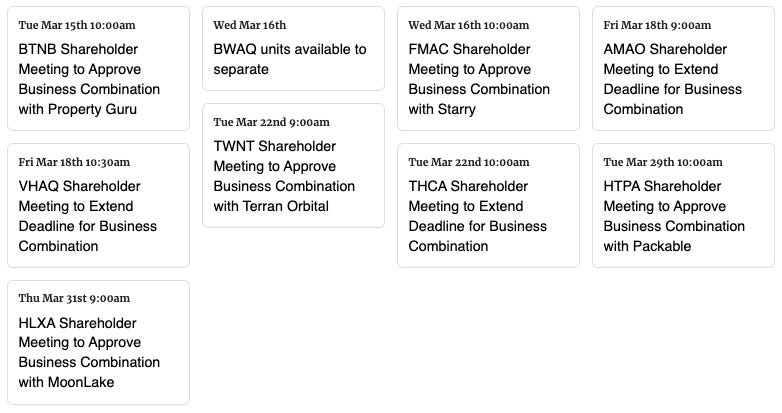

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,