Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 12, 2022)

The Stats:

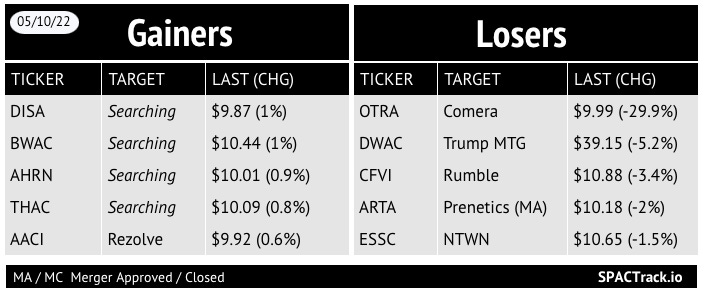

Pre-Market Movers:

DWAC -3.5%, CFVI -1.2%, OMEG -1%, ARTA +2.2%

Previous Session Movers & Volume Leaders:

Earnings*:

Yesterday After-Close: ENVX

This Morning: UTZ, IS, GENI, UPH, BIOX, BRCC, BKKT, PCT, WE

*De-SPACs completed 2019- per Earnings Whispers

The Deals:

Yesterday late morning deal:

1) InterPrivate II Acquisition Corp. (IPVA) & Getaround (warrants +0.6% at yesterday’s close)

Getaround connects safe, convenient and affordable cars with people who need them to live and work. We are the world's first carsharing marketplace offering a 100% digital experience with proprietary technology and data that make sharing vehicles superior to owning them. Our community includes guests who rely on our cars for on-demand mobility 24/7, and hosts who share cars on our platform including those who operate their own car sharing businesses. Founded in 2009, today Getaround is active in over 950 cities worldwide.

Valuation: $1.2B Pro-forma Equity Value

Additional Financing: Convertible note commitment of up to $175M provided by affiliates of Mudrick Capital Management

2) Kensington Capital Acquisition Corp. IV (KCAC) & Amprius Technologies (warrants +5.3% pre-market)

Amprius Technologies, Inc. is a leading manufacturer of high-energy and high-power lithium-ion batteries producing the industry's highest energy density cells. The company's corporate headquarters is in Fremont, California where it maintains an R&D lab and a pilot manufacturing facility for the fabrication of silicon nanowire anodes and cells.

Valuation: $939M Pro-forma Equity Value

Additional Financing: up to $200 million in additional equity financing to be raised prior to the closing of the business combination

News:

Lordstown Motors (RIDE) closes $230 million deal to sell its Ohio factory to Foxconn, injecting needed cash days before deadline (CNBC)

Updates:

ArcLight Clean Transition Corp. II (ACTD), announced that investors comprising $110.8M in PIPE investments, or appx 89%, have entered into amendments extending the termination date for the PIPE subscriptions in connection with its merger with Opal Fuels

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

Effective:

Cepton Technologies (CPTN)

Core Scientific (CORZ)

S-4 Activity:

S-4/A:

Tuatara Capital Acquisition Corporation (TCAC) & SpringBig (4th amendment)

Upcoming Dates:

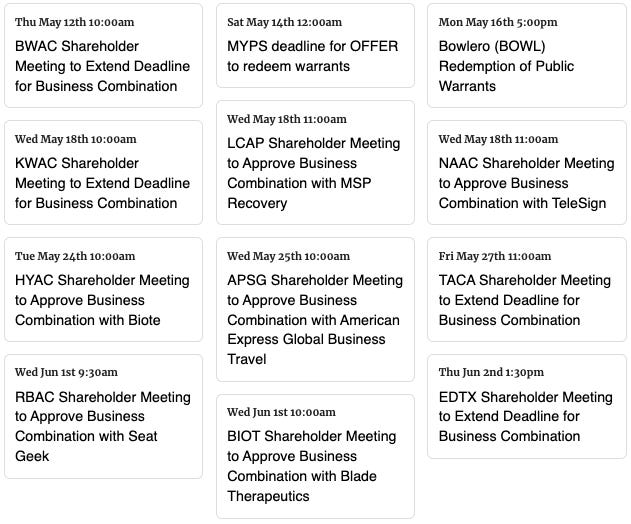

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,