Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (April 18, 2022)

The Stats:

Pre-Market Movers:

THCA -1.5%, ZNTE -1.1%, ESSC +3%

The Deals:

East Stone Acquisition Corporation (ESSC) issued a press release on Saturday morning announcing the new deal and noting that the merger agreement with JHD Holdings was terminated.

1) East Stone Acquisition Corporation (ESSC) & NTWN (warrants +36% pre-market)

NWTN is one of the world’s pioneering smart electric vehicle company which aims to integrate avant-garde design, life-style personalization, IoT connectivity, and autonomous driving technology into “a passenger-centric green premium mobility solution to the world”, a vision coined by its founder and chairman Mr. Alan Wu, who has defined this Smart Passenger Vehicle (“SPV”) vehicle concept for the global automobile industry.

Valuation: $2.5B “post-combination valuation”

PIPE: No PIPE

News:

A court battle that has raised concerns about Spacs (FT)

Updates:

Dune Acquisition Corporation (DUNE) Files Lawsuit Against its merger partner, TradeZero

DUNE “alleges, among other things, that TradeZero and the other defendants named therein fraudulently induced Dune to enter into the Agreement and Plan of Merger among Dune, TradeZero and the other parties thereto and that TradeZero has materially breached the Merger Agreement"

However, DUNE is also “continuing to work with TradeZero under the terms of the Merger Agreement to finalize the proxy statement and intends to call a special meeting of Dune’s stockholders to vote on the business combination with TradeZero as promptly as practicable.”

CHP Merger Corp. (CHPM) and Accelus mutually terminate merger due to market conditions with CHPM opting to liquidate on 4/25

Merger Vote Set:

OTR Acquisition Corp. (OTRA) & Comera Life Sciences (5/10)

Global SPAC Partners Co. (GLSPT) shareholders approved the deadline extension from 4/13/22 to 7/13/22

$0.03 per public share was added to the trust

3.8M shareholders redeemed leaving 12.9M public shares remaining

New SPACs (S-1s) (3):

1) Abri SPAC 2, Inc. (ASPP)

$100M, 1 Warrant, 1 Right (1/10th of a share)

Focus: Tech

Directors:

Robert Small (Co-founder & Former CEO of Miniclip)

Jurgen Post (CEO of Miniclip)

2) Biotech Group Acquisition Corp (BGAC)

$100M, 1 Warrant

Focus: Biotech in North America and the Asia-Pacific region (excluding China, Hong Kong and Macau)

3) EF Hutton Acquisition Corp I (Ticker n/a)

$100M, 1/2 Warrant

Focus: Consumer and retail

Registration Withdrawals

Foresite Life Sciences (FSAC)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4:

Brilliant Acquisition (BRLI) & Nukkleus

S-4/A:

ACE Convergence Acquisition Corp (ACEV) & Tempo Automation (3rd amendment)

Biotech Acquisition Company (BIOT) & Blade Therapeutics (2nd amendment)

ArcLight Clean Transition Corp. II (ACTD) & OPAL Fuels (2nd amendment)

Effective:

OTR Acquisition Corp. (OTRA) & Comera Life Sciences

Upcoming Dates:

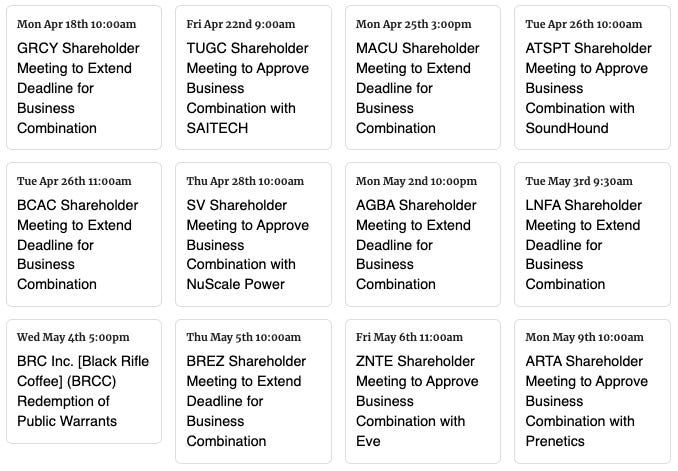

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,