Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 10, 2022)

The Stats:

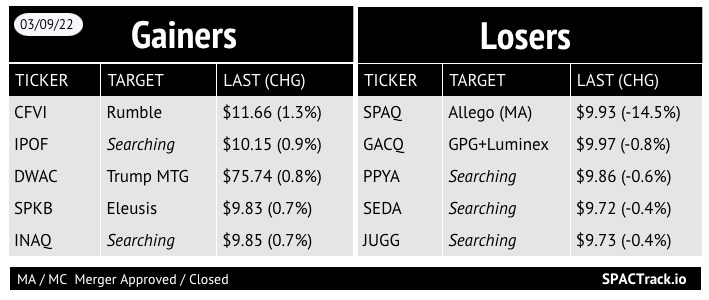

Pre-Market Movers:

SPAQ -7.8%, MOTV -2.9%, BTNB -2.5%, MTAC -2.2%, DWAC -1.8%

Yesterday’s Movers and Volume Leaders:

The Deals:

No new deals

News:

Loeb Pushes Cano Sale Due to Market’s Dislike of SPAC Deals

Dan Loeb is pushing Cano Health Inc. (CANO) to explore a sale in what may be the first time a prominent activist investor has targeted a company that went public via a blank-check deal in recent years.

Loeb’s Third Point disclosed a 6.4% stake Wednesday in the senior-care facility operator, saying it should put itself on the block due to “the market’s largely unfavorable view” of companies that merged with special purpose acquisition vehicles.

The company’s shares have fallen about 57% since the June closing of the merger with Jaws Acquisition Corp., a SPAC backed by billionaire Barry Sternlicht. The stock was up 40% to $6.39 at 1:31 p.m. in New York trading Wednesday, giving it a market value of about $3.1 billion.

Cano Health said in an emailed statement that it was successfully executing on its strategy to become America’s leading primary care company, and that its business has strong momentum. It said it was committed to maintaining an open, constructive dialog with all shareholders and to listening to their perspectives on improving returns.

“Cano Health’s board of directors and management team remain focused on delivering long-term value for shareholders and will continue to take actions to achieve that objective,’ it said.

Industry experts have speculated that companies that have gone public through SPACs will increasingly be targeted by activists because they have problems that might have deterred traditional initial public offering investors, including governance issues, regulatory risks and a lack of profitability.

New York-based Third Point said it didn’t plan to launch a proxy fight at the moment but may consider nominating directors if Cano Health’s board doesn’t address the valuation gap between where its shares are trading and its intrinsic value.

Loeb said he has faith in the Cano Health’s current strategy and management team. But the company should engage advisers for a strategic review because it’s unlikely to achieve a similar valuation on a standalone basis “in part due to structural issues with its shareholder base,” Loeb said.

Third Point participated in a $50 million equity investment when the SPAC deal was announced, alongside Sternlicht and funds affiliated with Fidelity Management & Research Co., BlackRock Inc., and Maverick Capital, the company said at the time

More News:

Better [merging with Aurora Acquisition Corp. (AURC)], after firing 900 employees over Zoom, is laying off 3,000 more workers (CNN Business)

Investing app Acorns taps ‘choppy’ private markets at $1.9 billion valuation after scrapping SPAC (CNBC)

Tomorrow.io Co-Founder Explains Backing out of SPAC, Maintains Satellite Constellation Plans (Via Satellite)

Bullish delays $9B SPAC merger, awaits SEC approval (Forkast)

Updates:

MedTech Acquisition Corporation (MTAC) and Memic Innovative Surgery mutually agree to terminate merger due to “market conditions and associated volatility as a result of recent world events”

CF Acquisition Corp. VIII (CFFE) announces shareholder approval of extension of the deadline to 9/30/22.

2.9M shares were redeemed and $0.20 per non-redeeming share was deposited into trust.

FirstMark Horizon Acquisition Corp. (FMAC) enters into non-redemption agreements for ~2.4M shares in connection with its merger with Starry

IPOs*:

1) Patria Latin American Opportunity Acquisition Corp. Announces Pricing of $200 Million Initial Public Offering (PLAO-U)

New SPACs (S-1s):

1) Redwoods Acquisition Corp. (RWOD)

$100M, 1 warrant, 1 right (1/10th of a share)

Focus: Carbon neutral and energy storage

Underwriter: Chardan

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A filings:

Golden Path Acquisition Corp (GPCO) & MC Hologram (3rd amendment)

Archimedes Tech Spac Partners Co (ATSPT) & SoundHound (2nd amendment)

Upcoming Dates:

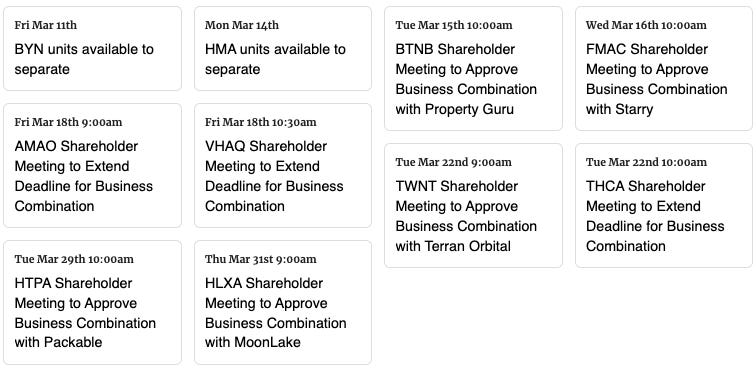

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,