Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 28, 2022)

The Stats:

Pre-Market Movers:

FMAC -2.6%, PPGH -1.3%, CFVI +1.2%

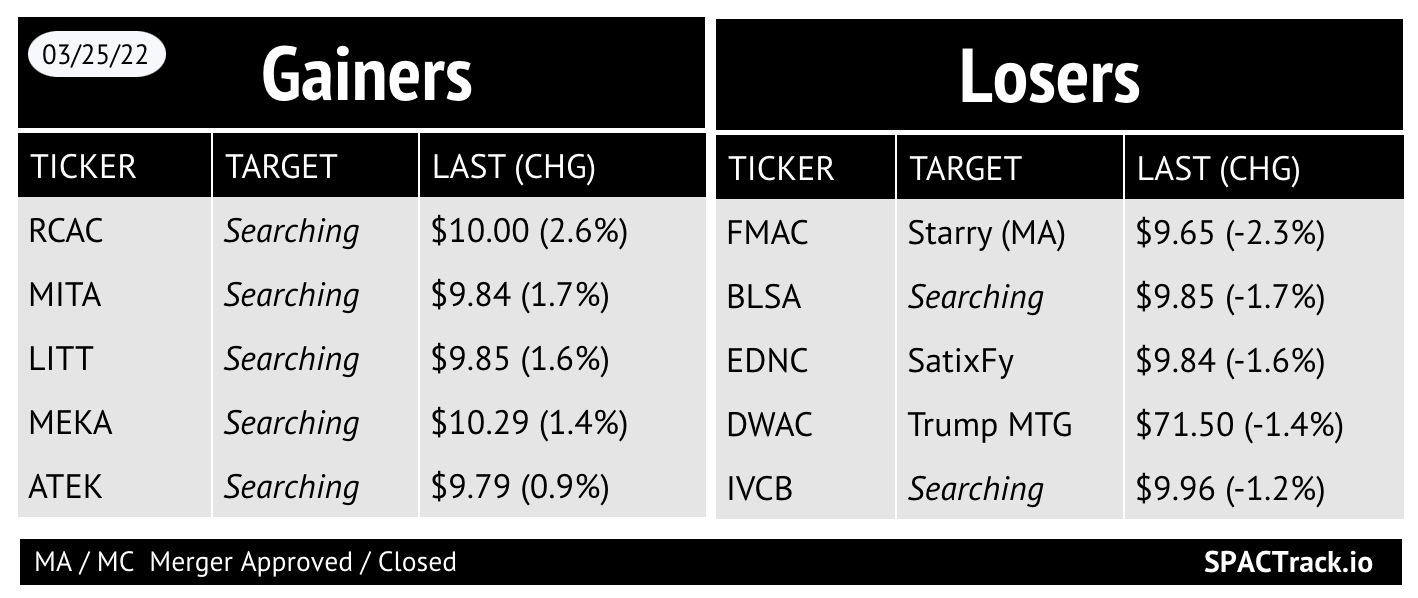

Friday’s Movers and Volume Leaders:

The Deals:

No new deals

News:

Chelsea: Four contenders given April 11 deadline to submit bids (Sky Sports)

Sky News revealed this weekend a so-called 'blank cheque' vehicle set up by one of the world's most powerful media tycoons also tabled a proposal to merge with Chelsea this month.

City sources said Liberty Media Acquisition Corp (LMAC), a New York-listed special purpose acquisition company - or SPAC - was among the parties which was eliminated from the auction, largely because of the complexity of finalising a deal on a timetable which was truncated by Abramovich's sanctioning.

Mr Malone, who has placed huge bets on sports by engineering the takeovers of Formula One motor racing and the Atlanta Braves Major League Baseball team, is said to have lodged a credible offer for Chelsea.

Had it been successful, it would have seen Chelsea join Manchester United as a US-listed company.

Sources said Raine would assess the four bids against a set of criteria including the level of equity and debt funding; price; future investment commitments; speed and certainty of execution; and the claims each party has to being an appropriate steward of a prestigious sporting brand.

Investors unconvinced on HUB Security's SPAC merger

Israeli cybersecurity solutions company HUB Security (TASE: HUB) share price fell 35.16% this morning to NIS 4.55, giving a market cap of NIS 563,000 ($175,000), after the company reported that Israel's Ministry of Defense had disqualified a winning bid in a tender of its subsidiary QPoint Technologies. HUB Security added that the disqualification and cancelation of the tender "might influence the company's results in 2022."

This development comes after last week, HUB Security announced that it had signed a memorandum of understanding (MoU) to merge with special purpose acquisition company (SPAC) Mount Rainier Acquisition Corp., which is traded on Nasdaq, at a company valuation of $1.28 billion. The merger will provide HUB with $172 million in additional cash, although redemptions by Mount Rainier's public stockholders could reduce that amount. HUB also said that it has entered into subscription agreements with Israeli and American institutional investors for gross proceeds of $50 million in public investment private equity (PIPE) funding.

But investors have not given the planned SPAC merger a vote of confidence. After initially raising the share fell back even before today's sharp falls, which leaves it with a market cap of one eighth of the planned SPAC merger.

More News:

SEC to Consider New SPAC Rule Amendments (Pymnts.com)

Updates

Highland Transcend Partners I Corp. (HTPA) and Packable terminate their merger agreement

There is a $2M termination fee in the event of qualifying financing, change of control, or in the event of HTPA liquidation

Tailwind Two Acquisition Corp. (TWNT) announced the completion of its business combination with Terran Orbital and TWNT will begin trading as LLAP starting today

31.6M shares were redeemed or ~92% of the public SPAC shares

Gores Guggenheim, Inc. (GGPI) amended the merger and PIPE subscription agreements to, among other things, reflect the assingment of much of the PIPE subscriptions of the sponsor and another initial PIPE investor to other investors

An additional $27.2M was raised for the PIPE at an average price of $9.57 per share from investors that include “certain affiliates and employees of Sponsor”

Forge Global (FRGE) releases redemption details from its merger with Motive Capital Corp:

40.6M shares were redeemed or ~98% of the public SPAC shares

Queen’s Gambit Growth Capital (GMBT) and Swvl enter into a committed equity agreement of up to $525M (less proceeds from SPAC trust upon merger closing) from B. Riley Principal Capital to backstop redemptions

In addition, three PIPE investors have purchased $5.3M in exchangeable notes of Swvl (exchangable at $9.50 per share), “effectively pre-funding their subscription commitment”, reducing the total PIPE proceeds from $55M to $49.7M

American Acquisition Opportunity Inc (AMAO) shareholders approved the extension of the deadline from 3/22/22 to 9/22/22

~8.9M shares were redeemed removing $90.3M from trust

In addition, FPA agreements were added in the amount of 1.12M shares at a purchase price of $10.35 per share

Ace Global Business Acquisition Limited (ACBA) deposited $0.099 per share to extend the deadline from 4/9/22 to 7/8/22

Gesher I Acquisition Corp. (GIAC) enters into an amended FPA agreement with M&G Investment Management Limited for $40M at $10 per unit and agrees to not to redeem

In addition M&G is providing a backstop commitment of $10M in exchange for 500k warrants and up to 1M shares

FirstMark Horizon Acquisition Corp. (FMAC) and Starry (whose merger has been approved by shareholders) amend agreement to, among other things, waive the minimum cash condition, reduce PIPE from $10/share to $7.50/share

In addition, Tiger Global has subscribed for an additional $10M at $7.50/share

New SPACs (S-1s):

1) Aimfinity Investment Corp. I (AIMA)

$70M, One Class 1 Warrant, One-Half of a Class 2 Warrant

Focus: Tech

UW: Tiger Brokers & EF Hutton

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

OTR Acquisition Corp. (OTRA) & Comera Life Sciences (1st amendment)

ArcLight Clean Transition Corp. II (ACTD) & OPAL Fuels (1st amendment)

Alberton Acquisition Corp (ALAC) & SolarMax Technology (7th amendment)

Gores Guggenheim, Inc. (GGPI) & Polestar (4th amendment)

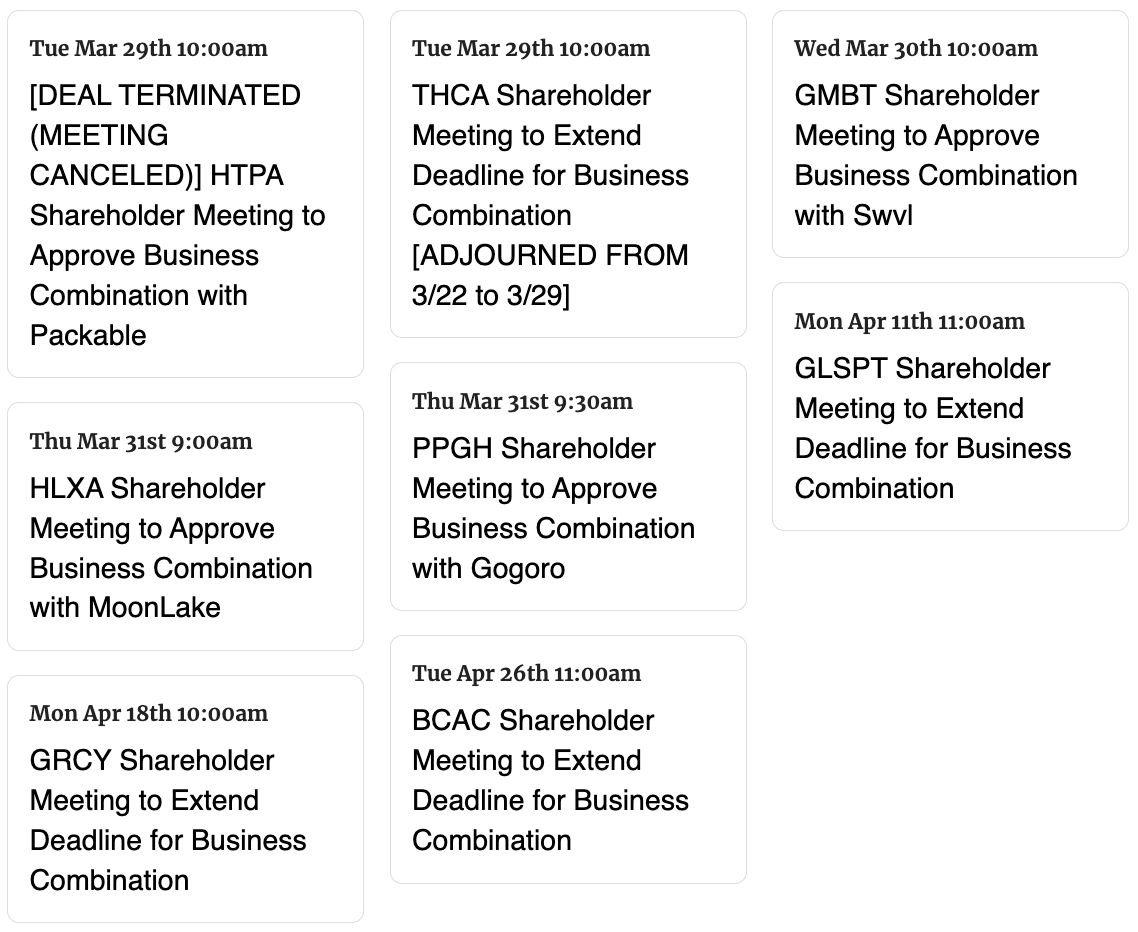

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

New Data Points and Filters have been added to the Pro Screener as of 3/16. A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,