Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 3, 2022)

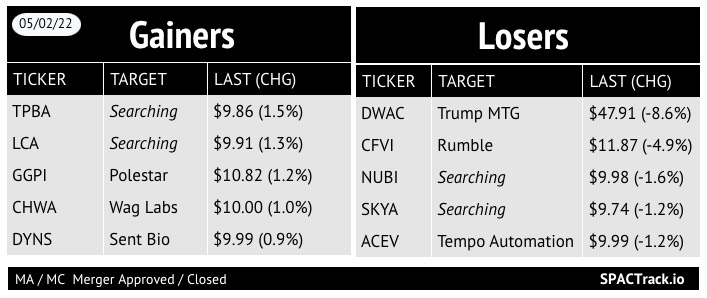

The Stats:

Pre-Market Movers

UTAA +3.9%, JMAC +1.5%, LMAO +1.5%, ACEV +1.3%, DWAC +1.1%, CFVI +1%

ZNTE -3%

Previous Session Movers & Volume Leaders:

The Deals (2):

Yesterday's late morning and afternoon deals:

1) Mountain Crest Acquisition Corp. IV (MCAF) & CH-AUTO

CH-AUTO is a technology-driven company founded in 2003 and has been an electric vehicle manufacturing and design service company in China. In 2015, CH-AUTO established "QIANTU MOTOR" to enter the electric vehicle market. In 2018, it built a new production facility in Suzhou, China, which replaces the traditional four techniques “Stamping, Welding, Painting & Assembly” of the automobile manufacturing process with just two techniques of “Body and Assembly.” In the same year, QIANTU MOTOR put into production the Qiantu K50 series of all-electric urban supercars. Another series, Qiantu K20, for the young Gen-Z consumers around the world will also be launched in the second half of 2022.

Valuation: $1.25B equity value

2) Fortune Rise Acquisition Corporation (FRLA) & VCV Digital Technology

VCV Digital Technology is an emerging U.S.-based digital assets business providing computing infrastructure for Crypto/Web3 networks to help accelerate adoption of digital asset mining solutions. VCV Digital Technology intends to provide computing infrastructure not only to Bitcoin mining, but also to the fast-growing ecosystem of blockchain. The Companies believe that the blockchain computing infrastructure will replace the current dominant centralized platforms with its transparency, security, protection of privacy and censorship resistance.

Valuation: $294.1M Pro-forma EV

Updates:

Spring Valley Acquisition Corp. (SV) announces closing of the merger with NuScale Power and will begin trading as SMR today, 5/3

Transaction raised gross proceeds of $380M

Dune Acquisition Corporation (DUNE) announces that its Board of Directors unanimously recommends that Dune’s stockholders vote against the merger when the vote occurs

Dune continues to work with TradeZero under the terms of Dune’s Agreement and Plan of Merger with TradeZero and other parties (the “Merger Agreement”) to finalize Dune’s proxy statement (the “Proxy Statement”) and will call a special meeting of Dune’s stockholders to vote on the Business Combination as promptly as practicable. The Board unanimously determined that the failure to change its recommendation would reasonably be expected to constitute a breach of its fiduciary duties to Dune’s stockholders.

IPOs*:

1) A SPAC II Acquisition Corp. Announces Pricing of $185 Million Initial Public Offering (ASCB-U)

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

S-1/A:

MoonLake Immunotherapeutics (MLTX)

S-4 Activity:

Effective:

Lionheart Acquisition Corp. II (LCAP) & MSP Recovery

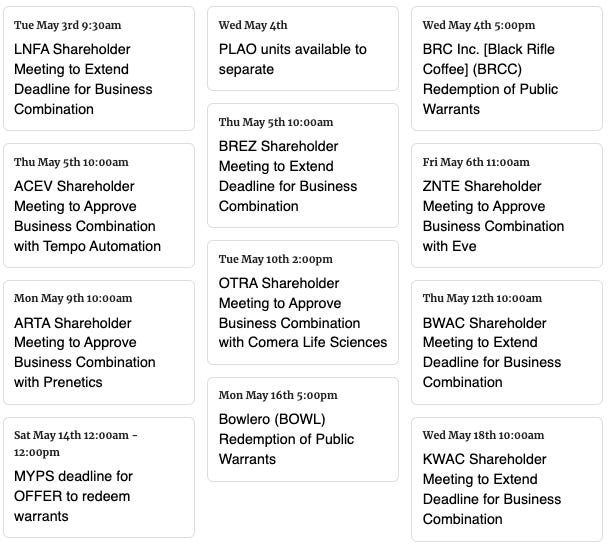

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of 4/26:

New Data Points: Estimated $ Discount/premium to trust value per share, Estimated % Disc/prem to trust value per share

New Filters: Deadline approaching within 1-4 months

**Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,