Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 2, 2022)

The Stats:

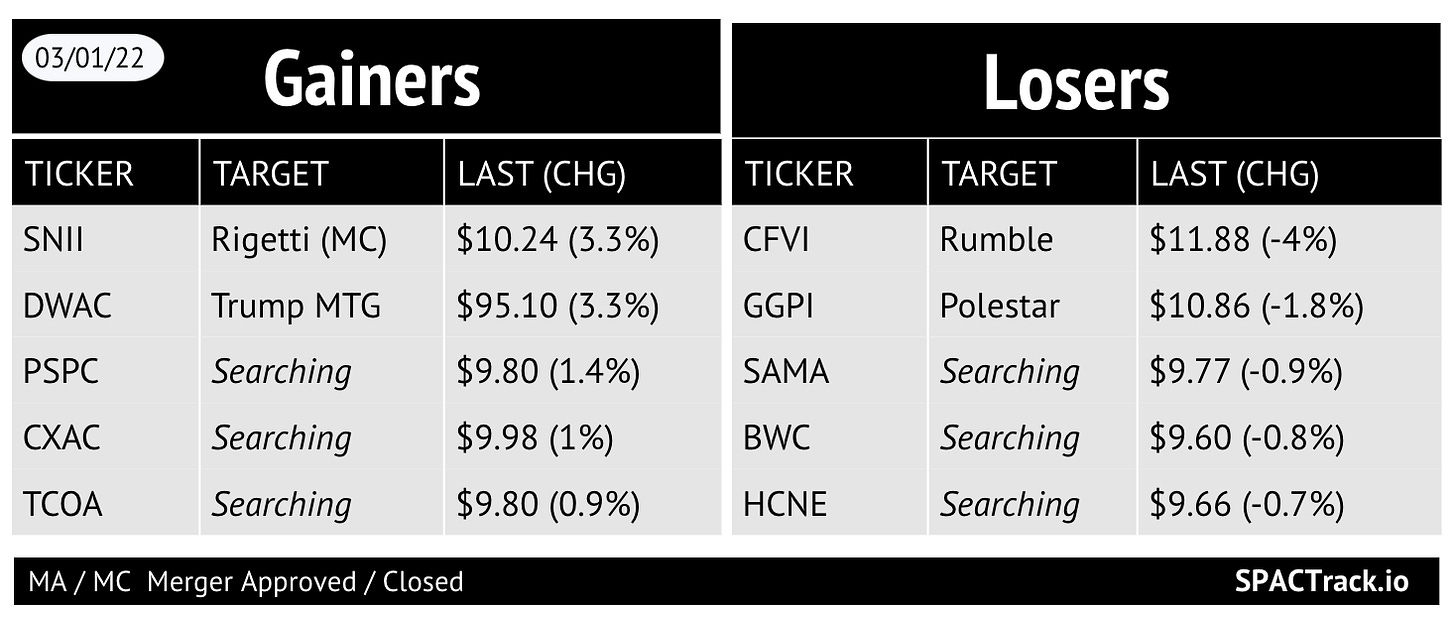

Pre-Market Movers:

DWAC +1.5%

Yesterday’s Movers and Volume Leaders:

The Deals:

No new deals today.

Roadside-Assistance Firm Urgently Said in Graf SPAC Merger Talks

Roadside-assistance startup Urgently has held talks to go public through a merger with Graf Acquisition Corp. IV (GFOR), a blank-check firm, according to people with knowledge of the matter.

A transaction features a potential private investment in public equity, or PIPE, and could value the combined entity at more than $700 million, said one of the people, who asked not to be identified discussing private talks. Terms may change and, as with all deals that aren’t finalized, talks could fall apart and Graf could pursue another target.

Vienna, Virginia-based Urgently, led by Chief Executive Officer Chris Spanos, said in December it had secured as much as $75 million in debt financing from funds managed by Highbridge Capital Management LLC, Onex Credit and Whitebox Advisors LLC, and separately refinanced and increased a debt facility from Structural Capital.

Urgently’s investors include BMW i Ventures, Jaguar Land Rover Automotive Plc’s InMotion Ventures, Porsche Ventures and Iron Gate Capital, according to PitchBook.

Merger Votes/ Completions:

Supernova Partners Acquisition Company II, Ltd. completed its merger with Rigetti Computing and will start trading as RGTI today

The transaction raised gross proceeds of appx. $261.75M

Other Updates:

East Stone Acquisition Corporation shareholder approved its extension to 8/24/22 with 361 shareholders redeeming

These SPACs Were Highfliers. Now They Can’t Hit Their 2022 Targets. (Barrons)

Kin [merger with Omnichannel Acquisition Corp. (OCA) terminated in January] Announces $82M First Close in Series D Financing

Geely-Backed Ecarx Weighs SPAC Merger at $4 Billion Value

Bill Foley steps down as Chairman of Paysafe (PSFE)

IPOs*:

1) Sound Point Acquisition Corp I, Ltd Announces Pricing of Upsized $225 Million Initial Public Offering (SPCM-U)

2) SHUAA Partners Acquisition Corp I Announces Pricing of $100 Million Initial Public Offering (SHUA-U)

3) Kensington Capital Acquisition Corp. IV

*Announced pricing as of this writing

New SPACs (S-1s):

No new S-1s

Registration Withdrawals:

Jeneration Acquisition Corp

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4 filings:

SPK Acquisition Corp. (SPK) & Varian Biopharmaceuticals

Upcoming Dates:

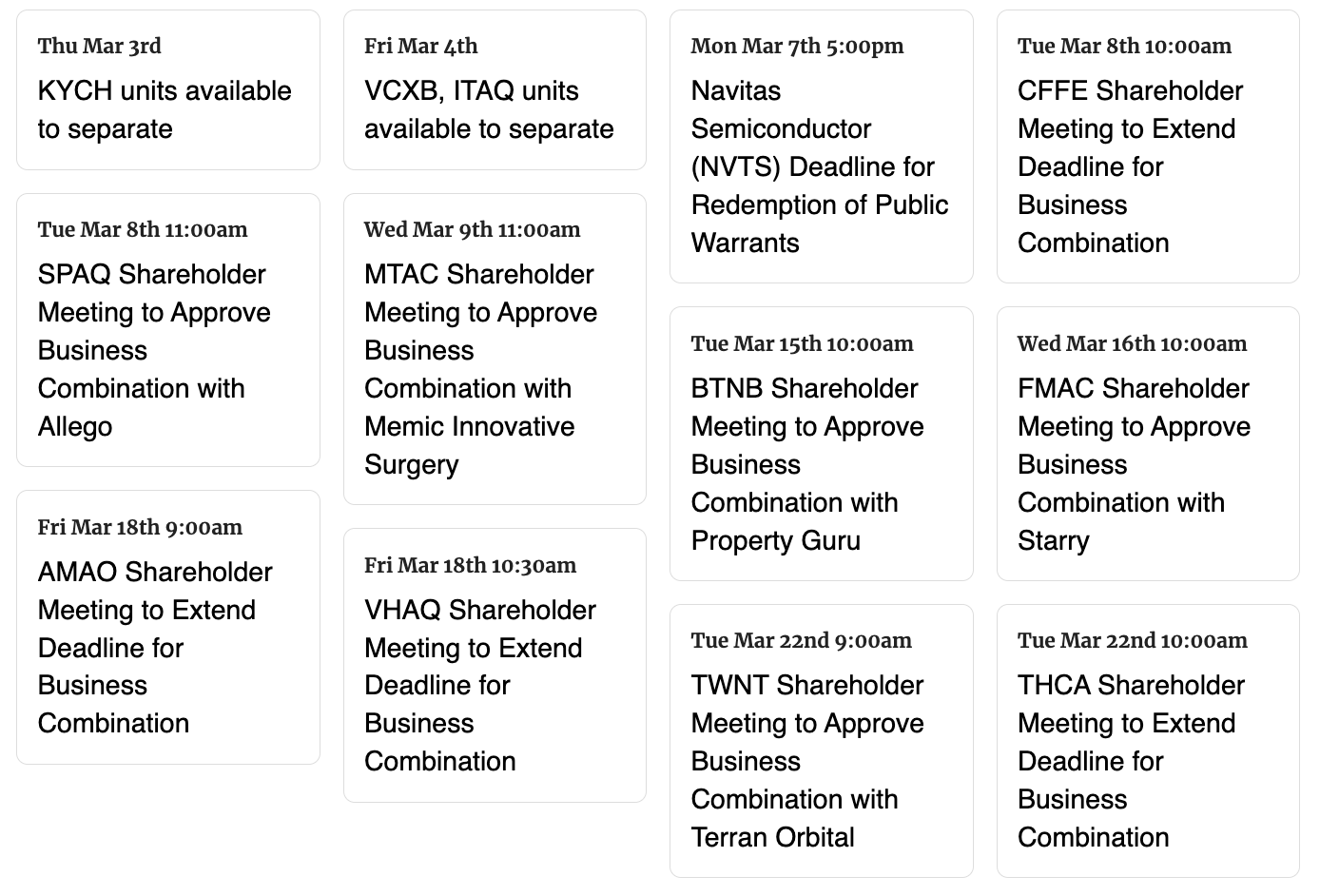

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,