Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (Feb 14, 2022)

Happy Super Bowl Monday!

Here’s a list of which SPAC / De-SPAC merger partners spent the big bucks on a Super Bowl spot:

Wallbox (WBX)

DraftKings (DKNG)

EToro (Merging with FTCV)

Polestar (Merging with GGPI)

Honorable mention (Lordstown RIDE connection) — GM’s Dr. EV

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

The Stats:

Pre-Market Movers:

CFVI -1.5%, ASAX +2%, NLIT +4.1%

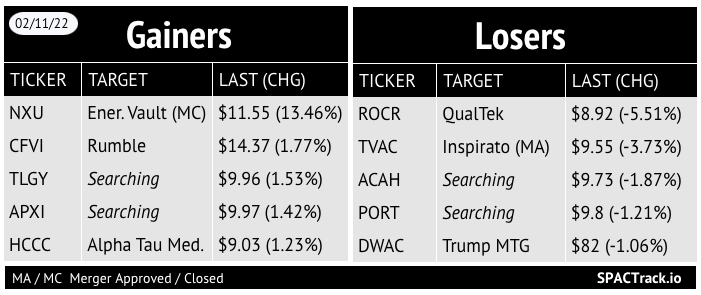

Friday’s Movers and Volume Leaders:

The Deals (2):

1) Northern Lights Acquisition Corp. (NLIT) & Safe Harbor Financial

Merger Partner Description:

Safe Harbor is one of the first financial services providers to offer reliable access to banking solutions for cannabis, hemp, CBD, and ancillary operators, making communities safer, driving growth in local economies, and fostering long-term partnerships. Safe Harbor, through its partners, serves the regulated cannabis industry and implements the highest standard of accountability, transparency, monitoring, reporting, and risk mitigation measures while meeting BSA obligations in line with FinCEN guidance on CRBs. Over the past seven years, Safe Harbor has processed over $11 billion in transactions with operations spanning 20 states with regulated cannabis markets.

Valuation: $227.1M EV

Additional Financing: $60M PIPE

2) SPK Acquisition Corp. (SPK) & Varian Biopharmaceuticals

Merger Partner Description:

Varian Biopharmaceuticals, Inc. is private precision oncology company developing novel therapeutics for the treatment of cancer. Precision oncology, whereby physicians use DNA testing to look for genetic mutations of the unique tumors, holds the promise of more targeted treatment recommendations with therapies designed to fight specific tumor types. A recently published global Precision Oncology Market analysis by Reports and Data found the global precision oncology market size amounted to US$49.9 billion in 2019 and is expected to grow at a CAGR of 99% over the next eight years to reach US$99.7 billion in 2027. Varian Bio is developing what has the potential to be a best-in-class high-potency, specific atypical protein kinase C iota (“aPKCi”) inhibitor for the treatment of various tumor types in multiple formulations. Recent scientific publications have characterized aPKCi as an oncogene whose activity may play a fundamental role in the regulation of cancer-associated transcription factors including GLI-1 and K-RAS. Varian Bio’s lead drug candidate, VAR-101, is being developed in a topical formulation for the treatment of basal cell carcinoma. VAR-102, an oral formulation, is being developed for the treatment of a wide variety of solid tumors where studies have shown potent aPKCi inhibition would be impactful, including non-small cell lung cancer (NSCLC), pancreatic cancer and colorectal cancer. Additionally, Varian Bio is seeking additional precision oncology therapeutic candidates for its pipeline and exploring development collaborations.

Valuation: $116M pro-forma equity value

Additional Financing: None listed in press release

Pending Investor Presentation

Merger Votes/ Completions:

Novus Capital Corporation II (NXU) completed its merger with Energy Vault, raising $235M of gross proceeds including a $195M PIPE

Ticker change to NRGV set for today

Quanergy released redemption information from its merger with CITIC Capital Acquisition Corp. (CCAC)

26.9M shares were redeemed (an estimated ~97% of the public shares)

Other Updates:

Tottenham reject £3bn takeover bid from LAMF Global Ventures (LGVC)

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1 Filings:

Satellogic (SATL)

S-1 Effective:

The Oncology Institute (TOI)

*When applicable

S-4 Activity:

S-4 filings:

Benessere Capital Acquisition Corp. (BENE) & Ecombustible

Gores Holdings VIII, Inc. (GIIX) & Footprint

Abri SPAC I, Inc. (ASPA) & Apifiny Group

Cartesian Growth Corp (GLBL) & Tiedemann Group and Alvarium Investments

Waldencast Acquisition Corp. (WALD) & Obagi & Milk Makeup

S-4/A filings:

Venus Acquisition Corporation (VENA) & VIYI Algorithm (5th amendment)

Aurora Acquisition Corp. (AURC) & Better (4th amendment)

Motive Capital Corp (MOTV) & Forge Global (5th amendment)

Crown PropTech Acquisitions (CPTK) & Brivo (1st amendment)

Spring Valley Acquisition Corp. (SV) & NuScale Power (1st amendment)

Bright Lights Acquisition Corp. (BLTS) & Manscaped (1st amendment)

Effective:

MedTech Acquisition Corporation (MTAC) & Memic Innovative Surgery

Highland Transcend Partners I Corp. (HTPA) & Packable

FirstMark Horizon Acquisition Corp. (FMAC) & Starry

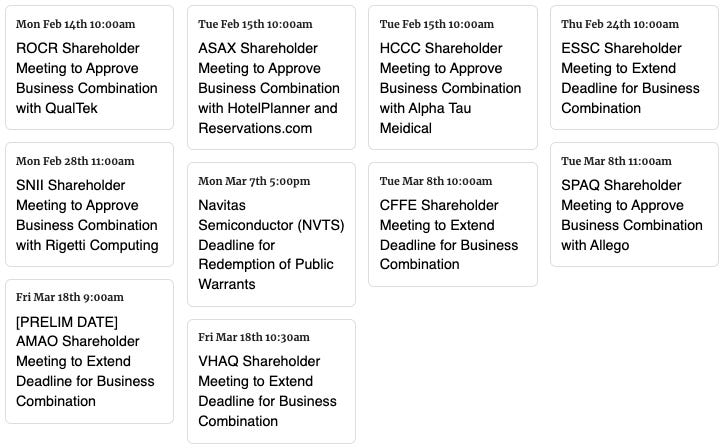

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Thanks for reading,