Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 19, 2022)

The Stats:

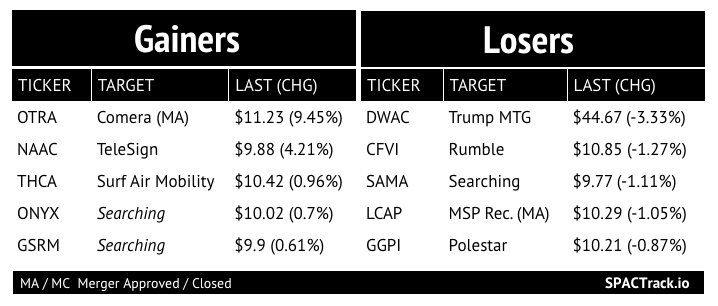

Pre-Market Movers:

OTRA -3%

Previous Session Movers & Volume Leaders:

The Deals (2):

1) KludeIn I Acquisition Corp. (INKA) & Near (warrants +86% pre-market)

Near, a global SaaS leader in privacy-led data intelligence, curates one of the world's largest sources of intelligence on people, places, and products. Near processes data from over 1.6 billion unique user IDs, in over 70 million places across 44 countries to empower marketing and operational data leaders to confidently reach, understand, and market to consumers and optimize their business results. With offices in Los Angeles, Silicon Valley, Paris, Bangalore, Singapore, Sydney and Tokyo, Near serves major enterprises in retail, real estate, restaurants, tourism, technology, marketing, and other industries.

Valuation: $754M Pro-forma Enterprise Value

Additional Financing: $100M committed equity financing facility from Cantor Fitzgerald

2) Alpine Acquisition Corporation (REVE) & Two Bit Circus, Inc. and Two Convention Hotels (warrants +63% pre-market)

Based in Los Angeles, Two Bit Circus is an award-winning community of entertainment and engineering enthusiasts who combine a love of technology with [mad] invention in pursuit of the future of fun. Named by Fast Company as one of the most innovative game companies of 2020, and recipient of TripAdvisors’ Traveler’s Choice Award, rated in the top 10% of attractions worldwide, Two Bit Circus is opening the world’s first network of Micro-Amusement Parks. These one-acre entertainment complexes fuse the latest interactive technology with the wonder and spectacle of a classic circus and carnival. The parks are a platform to showcase best-in-class interactive entertainment from all over the world and are filled with unexpected social experiences that bring people together elbow-to-elbow to play, eat, drink, and generally experience life at the highest resolution.

Valuation: $153.1M Pro-forma Enterprise Value

Additional Financing: $25M PIPE and $75M mortgage loan funding

Updates:

OTR Acquisition Corp. (OTRA) announces final redemption of 9,769,363 shares or an estimated ~92% of the public SPAC shares

Global SPAC Partners Co. (GLSPT) and Gorilla Technology Group amend the merger agreement to, among other things, extend the outside date to 7/13

Omnichannel Acquisition Corp. (OCA) announces it will liquidate and redeem all shares at appx. $10 per share on 6/1

Cascade Acquisition Corp. (CAS) announces it will liquidate and redeem all shares at appx. $10.10 per share on 5/24

Artisan Acquisition Corp. (ARTA) completed its merger with Prenetics and the combined company began trading as PRE yesterday

Lionheart Acquisition Corporation II (LCAP) Shareholders Approved the merger with MSP Recovery

New SPACs (S-1s):

No new S-1s

Registration Withdrawals:

Alexandria Agtech/Climate Innovation Corp. (AACE)

Tiga Acquisition Corp. III (TTRE)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

Anghami (ANGH)

S-4 Activity:

S-4/A:

EJF Acquisition Corp. (EJFA) & Pagaya Technologies (2nd amendment)

Gores Guggenheim, Inc. (GGPI) & Polestar (7th amendment)

Upcoming Dates:

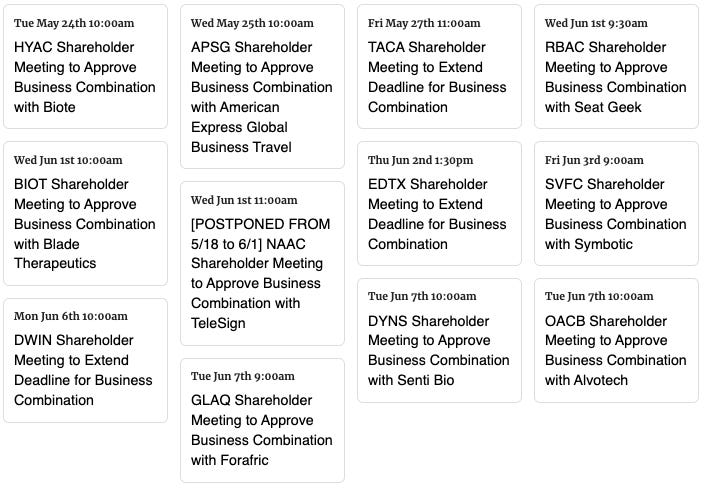

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,