Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (April 25, 2022)

The Stats:

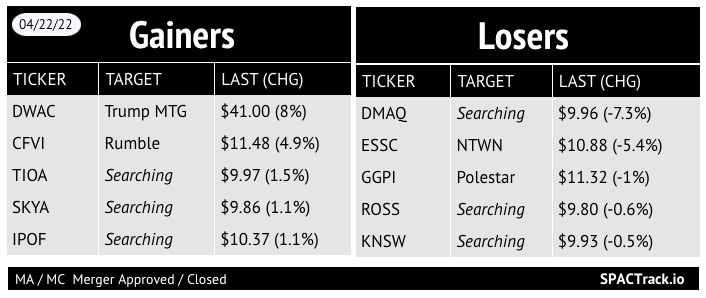

Pre-Market Movers

DWAC -6%, SV -4.1%, TUGC -2%, GGPI -1.4%, CFVI -1.2%, THCA -1%, ITHX +1.5%

Previous Session Movers & Volume Leaders:

The Deals (2):

1) Data Knights Acquisition Corp. (DKDCA) & OneMedNet (warrants +13% pre-market)

Founded in 2009, OneMedNet provides innovative solutions that unlock the significant value contained within the clinical image archives of healthcare providers. Employing its proven OneMedNet iRWD™ solution, OneMedNet securely de-identifies, searches, and curates a data archive locally, bringing a wealth of internal and third-party research opportunities to providers. By leveraging this extensive federated provider network, together with industry leading technology and in-house clinical expertise, OneMedNet successfully meets the most rigorous RWD Life Science requirements.

Valuation: $317M pro-forma EV

PIPE: No PIPE

2) XPAC Acquisition Corp. (XPAX) & SuperBac

SuperBac is a leading player in the biotech revolution, disrupting traditional industries with more sustainable and efficient solutions, with a track-record of over 25 years of R&D and operations. SuperBac believes it is well positioned for further expansion as a national leader in crop nutrition and diversification to crop protection and other sectors such as oil & gas, sanitation, home care and animal nutrition.

Valuation: $500M pro-forma EV

PIPE: No PIPE

Late Friday morning:

3) LMF Acquisition Opportunities, Inc. (LMAO) & SeaStar Medical

Denver-based SeaStar Medical is a privately-held medical technology company that is focusing on redefining how extracorporeal therapies may reduce the consequences of excessive inflammation on vital organs. SeaStar Medical’s novel technologies rely on science and innovation to provide life-saving solutions to critically-ill patients. It is developing and commercializing extracorporeal therapies that target the effector cells that drive systemic inflammation, causing direct tissue damage and secreting a range of pro-inflammatory cytokines that initiate and propagate imbalanced immune responses.

Valuation: $85M EV

PIPE: Expected PIPE from existing investors, The Dow Chemical Company Pension Plans

News:

Bed Bath & Beyond's Buybuy Baby Draws Buyer Interest (WSJ)

Bed Bath & Beyond Inc. is fielding interest from potential acquirers of its Buybuy Baby business after the retailer came under pressure from an activist investor to unload the unit.

Suitors for the baby-gear chain include private-equity firm Cerberus Capital Management LP and Tailwind Acquisition Corp. (TWND) a special-purpose acquisition company chaired by former Casper Sleep Inc. Chief Executive Philip Krim, according to people familiar with the matter. There is no guarantee the expressions of interest will result in a deal.

Union, N.J.-based Bed Bath & Beyond has been exploring alternatives for Buybuy Baby. The company added three new directors to its board as a part of a settlement agreement with activist investor Ryan Cohen in March, with two of them joining the committee overseeing the Buybuy Baby review.

Mr. Cohen, who co-founded pet-products retailer Chewy Inc. and is chairman at GameStop Corp., has a roughly 9.8% Bed Bath & Beyond stake. He has said he believes Buybuy Baby could be worth as much as the entire company, which had a market value of roughly $1.3 billion Friday afternoon. He also called on the company to consider a full sale, which is another possibility.

More News:

Elliott Management Backs SPAC Deal for Travel-Tech Company Mondee (PYMNTS.com)

Updates:

Alberton Acquisition Corp. (ALAC) will liquidate on 4/26/22 after the merger with SolarMax was terminated on 4/20

ALAC was previously notified by NASDAQ that the exchange would delist ALAC’s shares if the SPAC did not complete the merger by 4/26

TradeUP Global Corporation (TUGC) shareholders approved the merger with SAITECH with 2.07M shares redeemed or an estimated ~46% of the public SPAC shares

Spring Valley Acquisition Corp. (SV) announces that it expects to close its merger on 5/2 and begin trading on NYSE as SMR on 5/3

Selina announces $147.5 Million Convertible Note Financing in Connection with its Planned Business Combination with BOA Acquisition Corp. (BOAS)

Mondee and ITHAX Acquisition Corp. (ITHX) announce an additional $20M PIPE investment at $10 per share from two “leading financial investors” bringing the total PIPE proceeds to $70M

New SPACs (S-1s):

1) Monterey Capital Acquisition Corp (MCAC)

$100M, 1 Warrant, 1 Right (1/10th of a share)

Focus: Clean transition

2) Zi Toprun Acquisition Corp. (ZTOP)

$110M, 1 Warrant

Focus: Transportation/ auto: including autonomous, charging, microchip

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

Terran Orbital (LLAP)

S-1/A:

Gelesis (GLS)

Sky Harbour (SKYH)

S-4 Activity:

S-4/A:

Benessere Capital Acquisition Corp. (BENE) & Ecombustible (1st amendment)

Bright Lights Acquisition Corp. (BLTS) & MANSCAPED (2nd amendment)

Lionheart Acquisition Corp. II (LCAP) & MSP Recovery (5th amendment)

Dynamics Special Purpose Corp. (DYNS) & Senti Bio (2nd amendment)

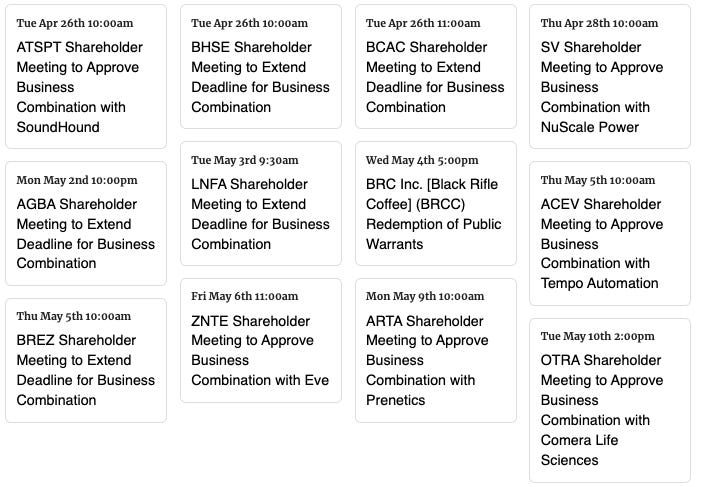

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points, Filters, and a new table view have been added to the Pro Screener as of 4/14:

Votes / Actions View: A downloadable table view to quickly access upcoming vote details, trust per share details, disc/prem to trust, & other relevant data points

New Data Points: Disc/prem to trust (Votes/Action View) and Merger Partner Geography (Deal Details View)

New Filters: Warrant Coverage, Upcoming Vote (definitive merger or extension vote scheduled), Merger Partner Geography

**Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,