Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 17, 2022)

The Stats:

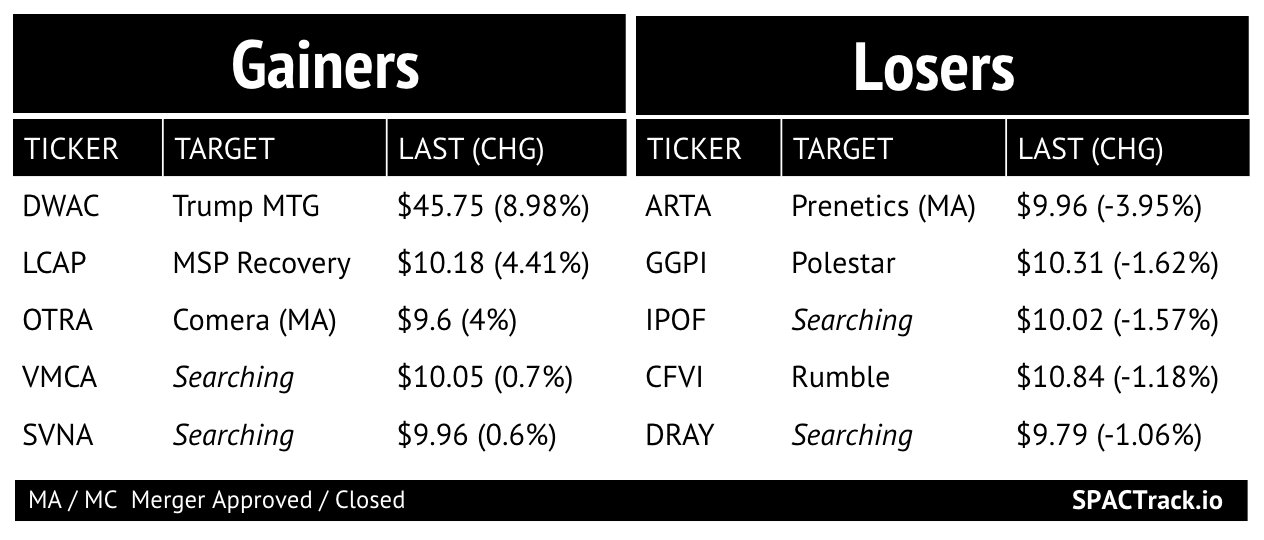

Pre-Market Movers:

DWAC -1.1%, BACA +2.2%

Previous Session Movers & Volume Leaders:

Earnings*:

This Morning:

*De-SPACs completed 2019- per Earnings Whispers

The Deals (2):

1) EdtechX Holdings Acquisition Corp. II (EDTX) & zSpace (warrants +150% pre-market)

zSpace is a leading evidence-based augmented/virtual reality (AR/VR) platform providing innovative hands-on, experiential learning to improve achievement in science, math, and career and technical education credentialing. Over U.S. 2,400 school customers, technical centers, community colleges, and universities use zSpace to provide equitable access to instruction for millions of learners preparing for success in college and careers. A privately held, venture-backed company located in San Jose, California, it has more than 70 patents. zSpace was named "Cool Vendor" by Gartner, Inc., "Best in Show at ISTE" by Tech & Learning Magazine for three consecutive years and ranked two years in a row on the Inc. 500 list of fastest-growing companies.

Valuation: $195M Pro-forma Enterprise Value

Additional Financing: $25M PIPE at $10.15 from existing securityholders, bSpace Investments Limited and Kuwait Investment Authority “in exchange for the retirement of an equal amount of indebtedness owed by the Company to bSpace and Kuwait Investment Authority”

2) PropTech Investment Corporation II (PTIC) & Appreciate (warrants +114% pre-market)

Appreciate, the parent holding company of Renters Warehouse, is a leading end-to-end Single Family Rental marketplace and management platform. The company offers a full-service platform for investing in and owning SFR properties, including a proprietary online marketplace and full-service brokerage teams in over 40 markets.

Valuation: $416M Pro-forma Enterprise Value

Additional Financing: $100M committed equity from an affiliate of Cantor Fitzgerald

News:

Byju’s in talks to acquire listed US edtech firm Chegg valued at $2 billion (Economic Times)

In an exclusive interview with ETtech, Byju Raveendran, the company's founder and chief executive, did not confirm discussions to buy Chegg, which was founded by Osman Rashid and Aayush Phumbhra in 2005 and has a current market capitalisation of $2.2 billion.

…Byju has also been pursuing a public listing in the US through a special purpose acquisition company (SPAC), which is a company founded for the purpose of acquiring or merging with another company. According to people familiar with the matter, if it buys Chegg, a publicly traded company in the US, it may also help the edtech firm go public.

“This (listing through a reverse merger with Chegg) is not the route to go public in the US,” Raveendran said, without confirming any acquisition talks.

“We will close the acquisition and if we are still doing an IPO in the US, we will do a SPAC. We are still thinking of an IPO in around 9-12 months and if it’s in the US, then it would be through a SPAC,” he said. But there have been doubts raised on its SPAC plan, amid a wider market crash and SPACs going out of favour.

Trump’s deal with Truth Social [Digital World Acquisition Corp. (DWAC)] makes returning to Twitter complicated (TechCrunch)

A rocket-builder’s [Astra (ASTR)] SPAC cash is rehabbing a defunct Navy base (Quartz)

Updates:

OTR Acquisition Corp. (OTRA) holders of 395k es reversed their redemption election bringing the redemption figure to 9,994,363 shares

OTRA has extended the deadline for redemption withdrawal to 5/17 at 4pm EST. The merger is expected to close on 5/18

Merger vote set:

Aries I Acquisition Corporation (RAM) announced that it extended its deadline from 5/21 to 8/21 by depositing $1,078,125 into the trust

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1:

SoundHound.AI (SOUN)

Effective:

Leafly (LFLY)

S-4 Activity:

S-4:

Executive Network Partnering Corp. (ENPC) & Granite Ridge Resources (Grey Rock oil and gas assets)

LMF Acquisition Opportunities, Inc. (LMAO) & SeaStar Medical

S-4/A:

Adit EdTech Acquisition Corp. (ADEX) & Griid Infrastructure (1st amendment)

Effective:

Tuatara Capital Acquisition Corporation (TCAC) & SpringBig

Virgin Group Acquisition Corp. II (VGII) & Grove Collaborative

Upcoming Dates:

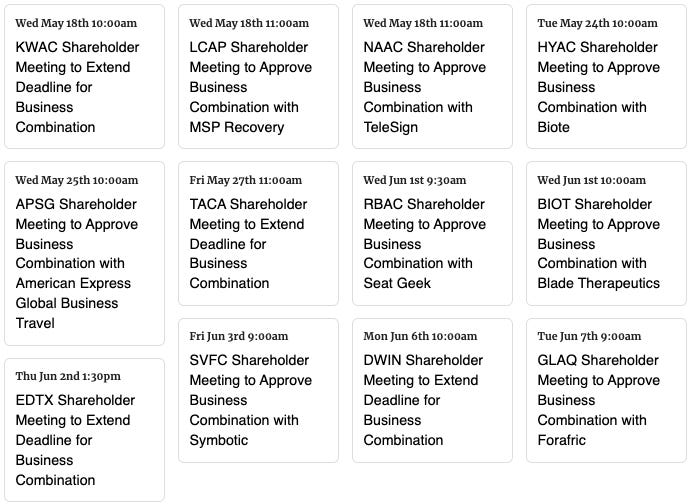

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,