Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 18, 2022)

The Stats:

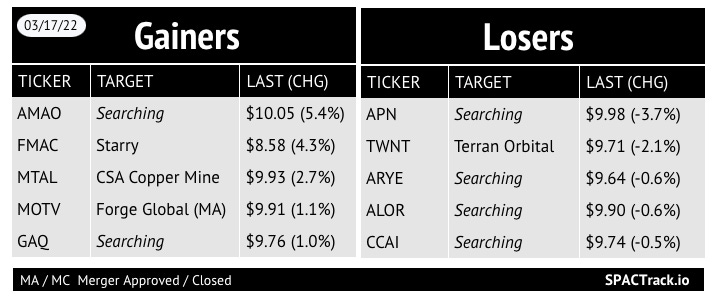

Pre-Market Movers:

PONO +5%, CFVI -1.3%, DWAC -1%

Yesterday’s Movers and Volume Leaders:

Volume Leaders

GDST-U 6M, MTAL 4.4M, GMBT 2.4M, GGPI 1.4M, IPOF 1.3M, DWAC 1M, SV 0.8M, PSTH 0.8M, FRSG 0.7M, TWNT 0.6M

The Deals (3):

Afternoon deal yesterday:

1) Vickers Vantage Corp. I (VCKA) & Scilex Holding Company (a subsidiary of Sorrento Therapeutics)

Merger Partner Description:

Scilex Holding Company, a majority-owned subsidiary of Sorrento Therapeutics, Inc., is dedicated to the development and commercialization of non-opioid pain management products for treatment of acute and chronic pain. Scilex is uncompromising in its focus to become the global pain management leader committed to social, environmental, economic, and ethical principles to responsibly develop pharmaceutical products to maximize quality of life. Scilex targets indications with high unmet needs and large market opportunities with non-opioid therapies for the treatment of patients with moderate to severe pain.

Valuation: $1.64B equity value

PIPE: No PIPE

2) Pono Capital Corp (PONO) & Benuvia

Merger Partner Description:

Benuvia, Inc. is a leading drug developer and manufacturer of active pharmaceutical ingredients focused on cannabinoids, with a growing portfolio of drug products and intellectual property. Benuvia owns the FDA approved cannabinoid drug SYNDROS® (dronabinol oral solution CII). SYNDROS® is FDA approved as a prescription drug for the treatment of chemotherapy-induced nausea and vomiting in cancer patients and loss of appetite in AIDS patients who have lost weight. Benuvia is pursuing 505(b)(2) fast-track approval with the FDA for Investigational New Drugs (“INDs”) for its dronabinol oral solution, with a focus on large opportunities that have significant unmet needs with industry research and studies supporting targeted efficacy endpoints. Benuvia manufactures active pharmaceutical ingredients in its 83,000 square foot cannabinoid manufacturing facility that is permitted by the US DEA for Schedule I to III Controlled Substances, is FDA registered and a cGMP facility. Benuvia has a robust portfolio of patents and patents pending and is pursuing new intellectual properties for its drug products.

Valuation: $440M EV

PIPE: No PIPE

3) Brookline Capital Acquisition Corp. (BCAC) & Apexigen

Merger Partner Description:

Apexigen is a clinical-stage biopharmaceutical company focused on discovering and developing a new generation of antibody therapeutics for oncology, with an emphasis on new immuno-oncology agents that may harness the patient’s immune system to combat and eradicate cancer. Sotigalimab and Apexigen’s other programs were discovered using Apexigen’s proprietary APXiMAB™ discovery platform. This platform has enabled Apexigen and its collaboration partners to discover and develop high-quality therapeutic antibodies against a variety of molecular targets, including targets that are difficult to drug with conventional antibody technologies. Multiple product candidates have been discovered using the APXiMAB platform, one of which is commercially available and the others are in clinical development, either internally by Apexigen or by its licensees.

Valuation: $205M pre-money equity

PIPE: $15M

Updates:

Bridgetown 2 Holdings Limited (BTNB) and PropertyGuru announce the completion of the business combination. Will begin trading as PGRU today

The transaction raised $254M in gross proceeds

Tempo Automation announces $100M in equity financing after the closing of the merger with ACE Convergence Acquisition Corp. (ACEV) by an affiliate of Cantor Fitzgerald “from time to time at the request of post-merger Temp”

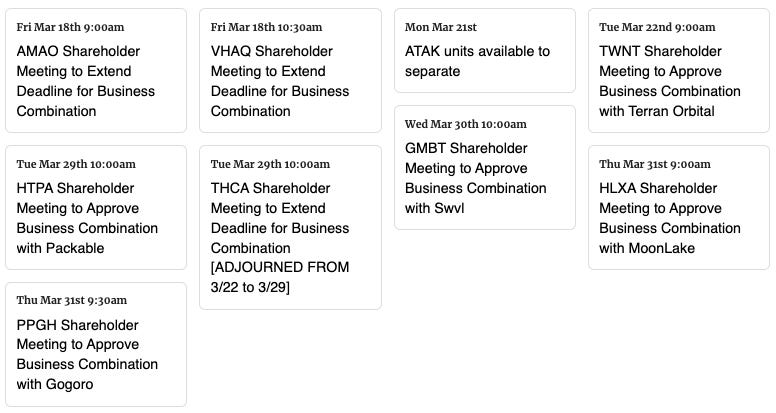

Merger Vote Set: Poema Global Holdings Corp. (PPGH) & Gogoro: 3/31

New SPACs (S-1s):

1) Israel Acquisitions Corp (ISRL)

$200M, 1/2 Warrant, 1 Right (1/10th of a share)

Focus: High-growth tech in Israel or Israeli connection

Registration Withdrawals

Venice Brands Acquisition Corp. I (VBAQ)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4/A:

Tuatara Capital Acquisition Corporation (TCAC) & SpringBig (1st amendment)

Effective:

Poema Global Holdings Corp. (PPGH) & Gogoro

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Updates:

New Data Points and Filters have been added to the Pro Screener as of 3/16:

Data Points in the Default View and SPAC Details View:

NAV (Trust per share) from proxy filing, Date of filing used for Trust per Share, Link to relevant filing

Data Points in the SPAC Details View:

Upcoming extension vote date, extension vote link, extension vote redemption date, extension vote ex. redemption date

New De-SPAC Filters:

Completed in 2022, Redemption Levels (<50%, 50%+, 75%+, 90%+), Post-closing S-1 effective

**Please note that all of the Pro data points on the Pro Screener along with which table “view” and download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,