Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (May 24, 2022)

The Stats:

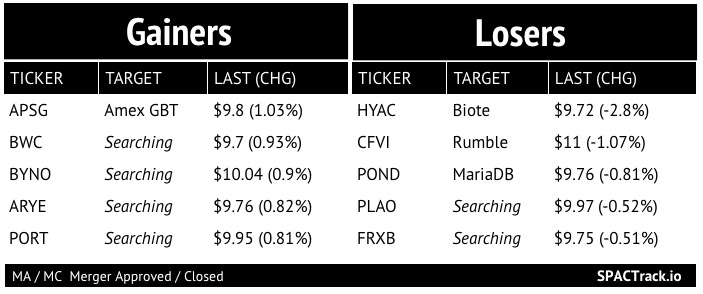

Pre-Market Movers:

DWAC -1.3%, MSRP -55%

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Parent of Social Platform Uplive Is Discussing Deal With E.Merge SPAC (Bloomberg)

Asia Innovations Group Ltd., the startup that operates social platform Uplive, is in talks to go public through a merger with E.Merge Technology Acquisition Corp. (ETAC), according to people with knowledge of the matter.

Any transaction is set to value the combined company at more than $2 billion, said one of the people, requesting anonymity discussing private negotiations. E.Merge is poised to begin formally canvassing private investment in public equity, or PIPE, investors, for capital to support the transaction, some of the people said. Its company’s revenue more than doubled in 2021 to about $300 million, some of the people said. Terms aren’t finalized and it’s possible a deal is not consummated.

An E.Merge representative declined to comment. An Asia Innovations Group representative didn’t immediately respond to a request for comment.

Asia Innovations Group is led by co-founders Xingzhi “Andy” Tian, Ouyang Yun and Mingling Liu. “Our widespread growth in the first quarter of 2022 shows we are meeting our users’ needs for accessible digital products that foster authentic human connection,” Tian, who is chief executive officer, said in a statement last month.

Founded in 2013, Asia Innovations Group says it serves more than 500 million registered users in over 150 countries and regions. In addition to Uplive, it operates dating apps CuteU and Lamour, online marketplace Hekka and voice-based social app Haya, as well as gaming and payments offerings. The company has received investment from firms including Kleiner Perkins, Yorkville Capital Management, Nicoya Capital Group, White Star Capital and Instagram co-founder Mike Krieger, according to PitchBook data.

Updates:

Cascade Acquisition Corp. (CAS) provided an update that the liquidation/ redemption of all outstanding shares will take place on 6/8 with the redemption price being $10.10 per share

Lionheart Acquisition Corporation III (LCAP) completes its merger with MSP Recovery and will trade as MSPR starting today

OceanTech Acquisitions I Corp. (OTEC) extended its deadline by 6 months from 6/2 to 12/2 by adding $0.15 per public share into the trust

Kingswood Acquisition Corp. (KWAC) extended its deadline to 11/24 by depositing $60,969 into the trust

New SPACs (S-1s):

1) Noble Education Acquisition Corp. (NEAT)

$100M, 1 Warrant, 1 Right (1/10th of a share)

Focus: EdTech

Registration Withdrawals:

Aurvandil Acquisition Corp. (AURV) — registration abandoned

Tiga Acquisition Corp. III (TTRE)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

Effective:

BigBear.AI (BBAI)

S-4 Activity:

S-4/A:

Duddell Street Acquisition Corp. (DSAC) & FiscalNote (5th amendment)

Cleantech Acquisition Corp. (CLAQ) & Nauticus (3rd amendment)

Brookline Capital Acquisition Corp. (BCAC) & Apexigen (1st amendment)

Upcoming Dates:

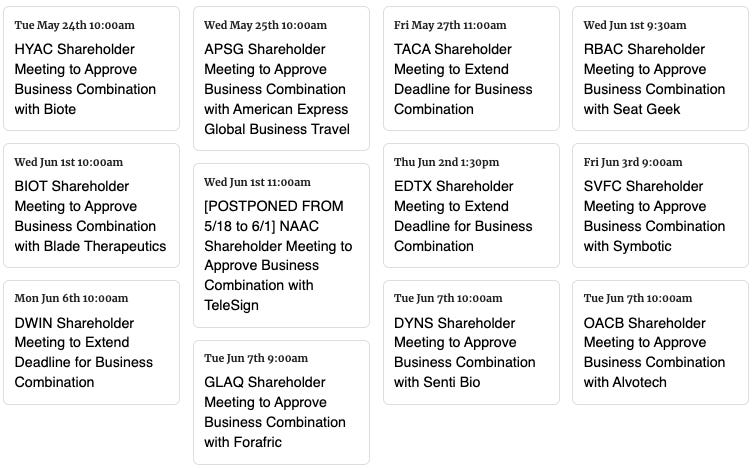

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

SPAC Track Pro Notes:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,