Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 11, 2022)

The Stats:

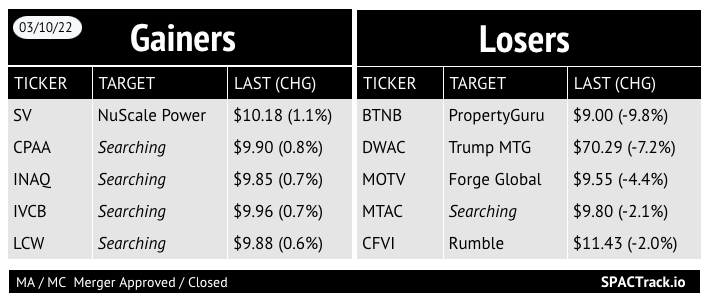

Pre-Market Movers:

FMAC -5.9%, SPAQ +4.8%, DWAC +1.5%

Yesterday’s Movers and Volume Leaders:

The Deals:

No new deals

Updates:

Rosecliff Acquisition Corp (RCLF) and Gett mutually agree to terminate their merger due to current market conditions

Gett also announced that it will be withdrawing from the Russian market (press release stated Russia business was less than 14% in Direct Gross Profit in Q4)

B. Riley Principal 150 Merger Corp. (BRPM) and FaZe Clan, among other things, agree to remove the minimum cash condition to close the merger and enter into a $10M bridge loan agreement

IPOs*:

1) Nubia Brand International Corp. Announces Pricing of Upsized $110,000,000 Initial Public Offering (NUBI-U)

New SPACs (S-1s):

1) Yotta Acquisition Corporation (Ticker n/a)

$60M, 1 Warrant

Focus: “High technology, blockchain, software and hardware, ecommerce, social media, and other general business industries globally”

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

S-4 filings:

CHW Acquisition Corp (CHWA) & Wag Labs

S-4/A filings:

Virgin Group Acquisition Corp. II (VGII) & Grove Collaborative (1st amendment)

Lionheart Acquisition Corp. II (LCAP) & MSP Recovery (3rd amendment)

Queen’s Gambit Growth Capital (GMBT) & Swvl (7th amendment)

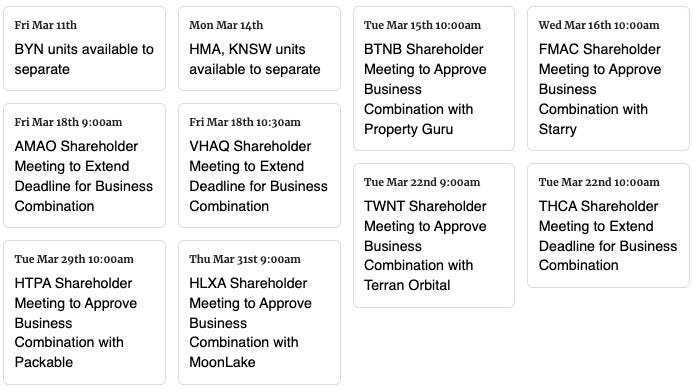

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

All the Pro data points on the Pro Screener along with which table “view” and export eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,