Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (March 30, 2022)

The Stats:

Pre-Market Movers:

CFVI -1%

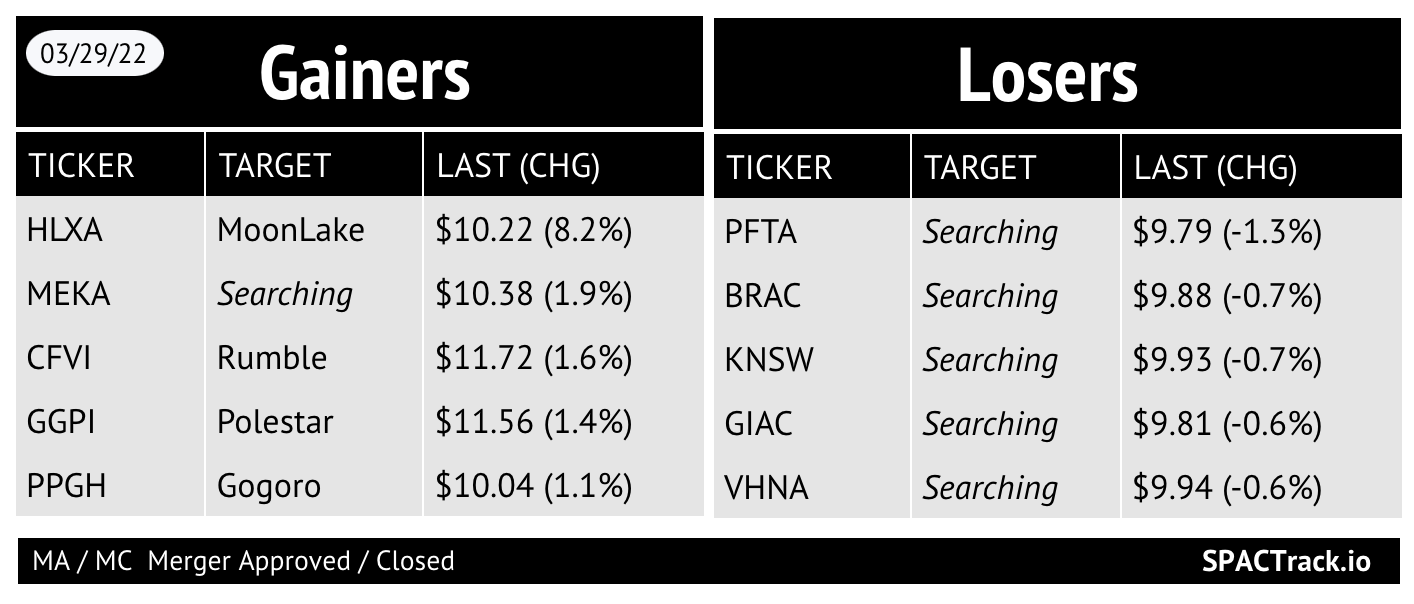

Previous Session’s Movers and Volume Leaders:

The Deals:

No new deals

News:

OnlyFans wants to go public (Axios)

OnlyFans has held talks with multiple blank check companies, or SPACs, about a merger to take it public, sources tell Axios.

OnlyFans is a massive social media platform, with millions of monthly users who've cumulatively paid out billions of dollars to creators. But its adult content has spooked some potential investors and SPAC partners.

The company may also face labor issues, as many of its employees are based in Ukraine. OnlyFans' majority owner is Leo Radvinsky, a controversial American of Ukrainian descent, and the company has donated digital currency to provide money and relocation services to those in the region.

OnlyFans tried raising private capital last year, to partially cash out Radvinsky, but that effort didn't gain traction because of the platform's adult content, Axios previously reported.

It subsequently announced plans to ban "explicit" material, hoping that would help it secure investors, but it reversed course after creators complained.

OnlyFans later replaced its CEO and founder Tim Stokely with chief marketing and communications officer Amrapali "Ami" Gan.

Among the SPACs contacted by OnlyFans was Forest Road Acquisition Corp. II (FRXB), co-led by former Disney execs Kevin Mayer and Tom Staggs, but the two sides are no longer in talks.

The SPAC, whose team includes Shaquille O'Neal as an adviser, ultimately couldn't get past the porn, per sources.

More News:

SPACs Face Fresh SEC Legal Threat for Overly Bullish Forecasts (Bloomberg)

SPACs Trip Up on Accounting Requirements, Reporting Deadlines (Bloomberg Tax)

Updates

Queen’s Gambit Growth Capital (GMBT) shareholders redeemed 29.2M shares or an estimated ~85% of the public SPAC shares in connection with its merger with Swvl

GMBT announced that redeeming shareholders can withdraw redemption until today and that the minimum cash condition is expected to be waived by Swvl

Poema Global Holdings Corp. (PPGH) and Gogoro announce that the merger is expected to close on 4/4 with at least $335M in gross proceeds

PPGH is extending the deadline for withdrawals of redemptions to 4/1

RedBall Acquisition Corp. (RBAC) and SeatGeek amend their merger agreement to change the agreement end date from 4/13 to 6/27

Registration Withdrawals

Osprey Technology Acquisition Corp. II (OTII)

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

No activity

S-4 Activity:

No activity

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

New Data Points and Filters have been added to the Pro Screener as of 3/16. A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,