Precap from SPAC Track

The Precap newsletter: SPAC Track’s morning recap of the action in the SPAC world for premium subscribers. (April 13, 2022)

The Stats:

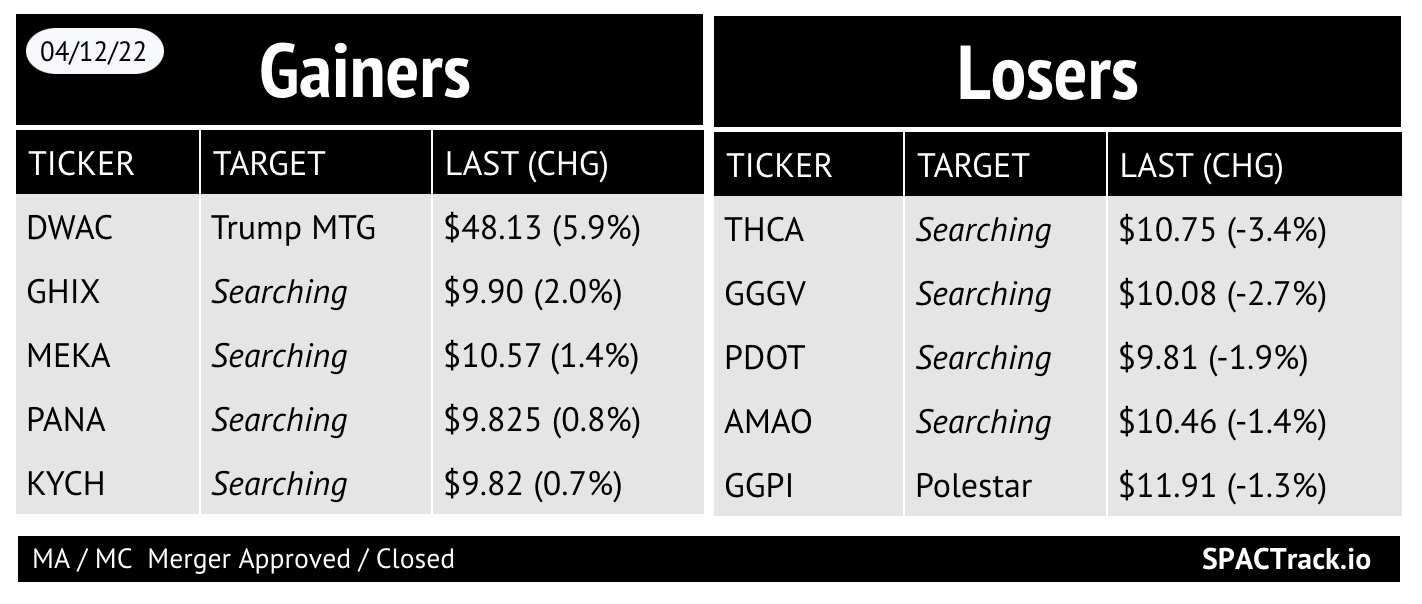

Pre-Market Movers:

PDOT -2%, AMAO -1.3%, THCA -%

Previous Session Movers & Volume Leaders:

The Deals:

No new deals

News:

Circle raises $400M at a $7.7 billion valuation (Axios)

What they’re saying: “With the $400 million, it's not just the capital that's going to allow us to grow — it's also the strategic partnership with BlackRock,” Circle CEO Jeremy Allaire said on CNBC shortly after the deal was announced.

“This is a strategic investment aimed at increasing their role in this ecosystem with a trusted [partner] and trying to advance what's possible with stablecoins and digital currency on the internet,” he said.

Context: In a rare piece of good news for the SPAC market, Circle announced in February that it struck a revised agreement with Concord Acquisition Corp. (CND) that doubled its valuation to $9 billion.

As part of that agreement, the PIPE announced during the previous summer was canceled, but Circle had the option to raise up to $750 million.

Yes, but: This financing is not replacing the PIPE and is independent of the upcoming SPAC merger.

According to a source with knowledge of the deal, BlackRock's financing agreement values Circle at $7.65 billion — or a 15% discount.

Circle's overall valuation remains $9 billion, under the terms of its revised SPAC agreement.

Credit Suisse Committee to Review SPAC Deals as SEC Rules Loom (Bloomberg)

Meesho plans to launch live commerce biz by year-end. “The company is currently exploring either a domestic listing or a SPAC-listing in the US” (Mint)

Updates:

8i Acquisition 2 Corp. (LAX) files the investor presentation for its merger with EUDA Health Limited that was announced yesterday

IPOs*:

1) Aura FAT Projects Acquisition Corp. Announces Pricing of $100,000,000 Initial Public Offering (AFAR-U)

New SPACs (S-1s):

No new S-1s

If you find this newsletter useful, feel free to share it with a friend (the free version of the newsletter) and suggest they subscribe:

De-SPAC S-1s (including PIPE resale registrations*):

S-1/A:

SES AI (SES)

S-4 Activity:

S-4/A:

Ackrell SPAC Partners I Co (ACKIT) & Blackstone Products (1st amendment)

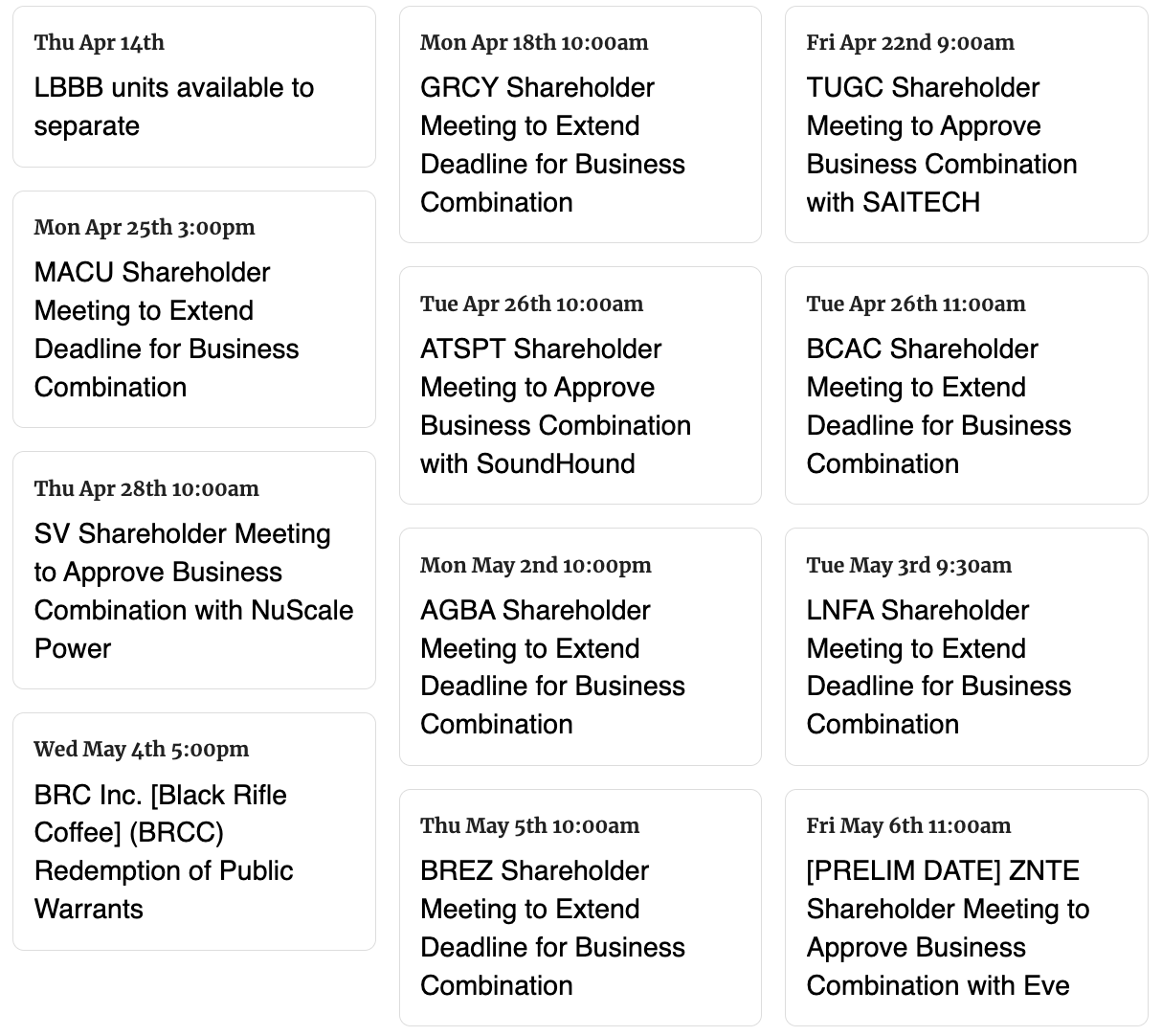

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

See the full calendar here.

Notes:

A list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/screener-instructions

Thanks for reading,